Eagle Ford Shale | E&P | NGI All News Access | Permian Basin

Carrizo Boosts 3Q Production, Adds Oil Hedges

Houston-based Carrizo Oil & Gas Inc., in the midst of a contentious takeover by cross-town operator Callon Petroleum Co., said its Texas-focused production during the third quarter climbed 6% sequentially and it also took advantage of a brief oil price rally during September to add to 2020 hedges.

In a preliminary report ahead of third quarter results, Carrizo said quarterly production volumes are forecast to be 69,500-69,600 boe/d, a 6% sequential increase. Carrizo’s primary operations are in the Eagle Ford Shale and Permian Basin.

Oil production is expected to account for around 66% of output, while natural gas should account for 18% and natural gas liquids production at about 16%.

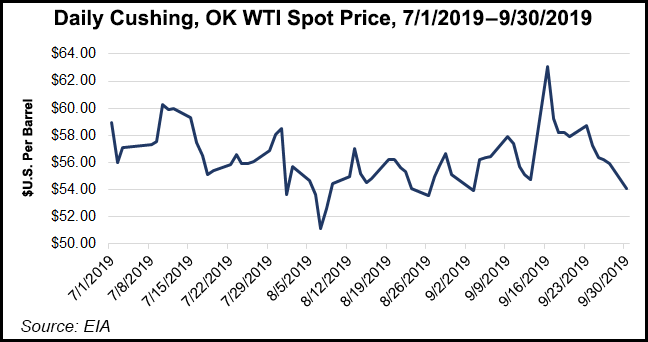

The independent, whose primary focus is the Permian Basin and Eagle Ford Shale, said it also took advantage of an uptick in oil prices during September to boost its 2020 hedge position.

Hedges were covering 10,000 b/d of oil for 2020, consisting of three-way collars with an average floor price of $55.00/bbl, ceiling price of $64.10/bbl and subfloor price of $45.00/bbl.

The total hedge position for 2020 now stands at 25,000 b/d, including swaps covering 3,000 b/d of crude oil at an average fixed price of $55.06 and three-way collars covering 22,000 b/d with an average floor price of $55.34, ceiling price of $65.16 and subfloor price of $45.34.

Carrizo in July agreed to tie-up with Permian pure-play Callon Petroleum Co. valued at $3.2 billion. However, some Callon shareholders are not enthused by the deal, questioning the value of acquiring Carrizo’s “inferior” Eagle Ford assets.

If approved, Callon shareholders would own 54% of the combined company, with Carrizo shareholders holding the remaining stakes.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |