Calgary production giant Canadian Natural Resources Ltd. (CNRL) scored a comeback in the first three months of 2021, reversing losses inflicted a year earlier by Covid-19 and the slump in oil and gas prices.

“As the global vaccine distribution increases and crude oil demand recovers, especially in the United States, we are seeing improved commodity pricing,” said President Tim McKay. “We are well positioned to generate significant free cash flow in 2021.”

Natural gas production grew to 1.59 Bcf/d from 1.4 Bcf/d in 1Q2020. Oil and natural gas liquids output increased to 979,352 b/d from 938,676. Alberta oilsands mining and underground extraction, cornerstones of the firm, gained 10% year/year to 736,333 b/d.

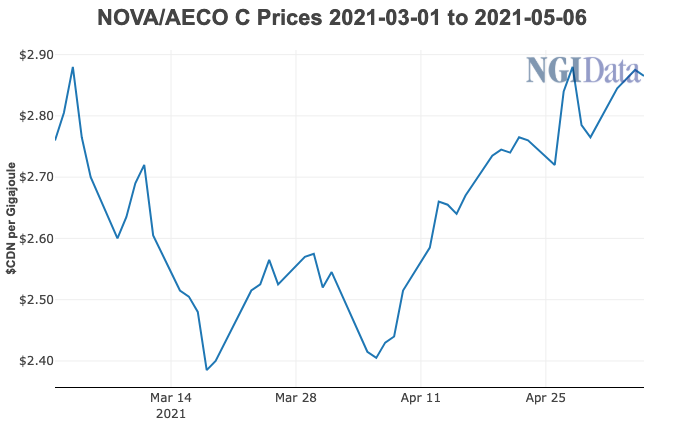

Prices fetched for natural gas jumped by 54% from a year...