Markets | NGI All News Access | NGI The Weekly Gas Market Report

Canada’s Oil, Gas Job Losses Expected to Worsen in 2019

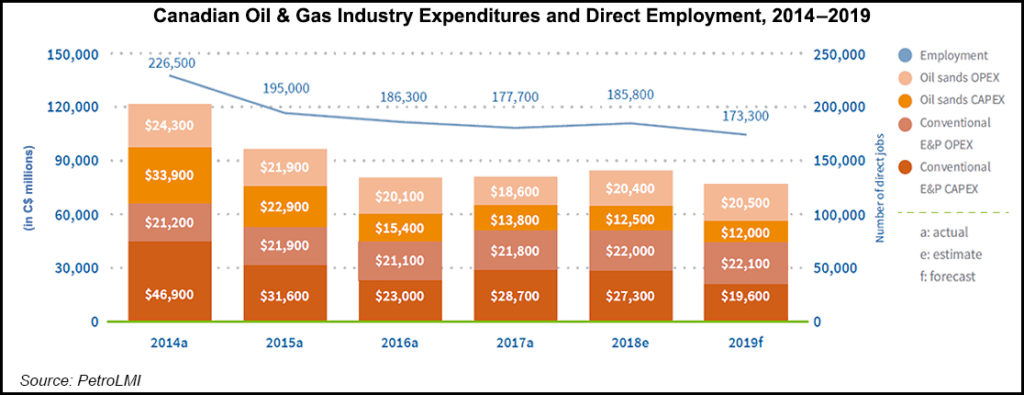

Canadian oil and gas job losses since the 2014 global price fall from US$100/bbl-plus will worsen to a five-year total 53,200 as of 2019, according to Petroleum Labor Market Information (PetroLMI).

The number of “at risk” workers this year is 12,500, the Calgary-based industry agency said Monday in an annual employment review. If all of the potential job losses were to happen as foreshadowed by the industry survey, the Canadian oil and gas labor force would drop to 173,300.

From the 2014 peak of 226,500, the Canadian oil and gas labor force already had shrunk in 2018 to 185,800.

The five-year employment contraction by 23% has resulted from an even steeper decline in Canadian oil and gas investment by 60%, down to a forecast C$32 billion ($24 billion) this year from C$80 billion ($60 billion) in 2014, PetroLMI noted.

Employment and investment deterioration began when the 2014 oil price drop set off waves of cost cutting, mergers and production technology changes. Regulatory, legal and political conflicts prevented a Canadian counterpart to the recovery in the United States.

“Stalled progress on the development of pipeline and liquefied natural gas (LNG) infrastructure projects in Canada is driving lower capital spending and lower employment levels,” PetroLMI said.

British Columbia is a lone hiring bright spot, where 200 jobs are expected to emerge as work continues on the sanctioned LNG Canada export project, the group said. However, significant gains from supply development for the terminal and associated pipeline remain years in the future.

As Canada’s primary oil and gas producer, Alberta is expected to account for 9,600 or nearly 80% of the industry job losses that PetroLMI is anticipating this year. Casualties are expected in all sectors, from natural gas drilling to oilsands development.

“Natural gas prices, which fell into negative territory in the summer of 2018, will continue to be discounted until pipeline bottlenecks are addressed and LNG export infrastructure is constructed and operational,” said PetroLMI.

On the oil side of the Canadian industry, where thermal bitumen extraction is the nation’s top gas consumer, “market access issues continue to weigh heavily on investors and capital investment, which in turn impacts employment growth.”

Conflicts with environmental, native and political opponents hold back an estimated 1.2 million b/d of Canadian export pipeline capacity additions.

Construction permit delays postponed for a year completion of a 370,000 b/d Enbridge Inc. pipe replacement program until 2020. TransCanada Corp. remains mired in a legal battle to set aside a U.S. court injunction stalling the 830,000 b/d Keystone XL project. Political, environmental and native campaigns in Michigan also aim to shut down a 540,000 b/d Enbridge pipeline.

In Alberta, oil and gas jobs dominate a spring provincial election. Ahead of voting day next Tuesday (April 16), the ruling New Democratic Party and opposition United Conservative Party are promoting rival plans to revive pipeline projects and adapt to the industry contraction.

The prolonged slump affects morale throughout the Alberta economy. PetroLMI found that 40% of wage earners who have hung onto oil and gas jobs constantly wonder how long their spots on industry payrolls will last.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |