Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Canada Oil, Natural Gas Drilling Seen Plunging to 49-year Low Amid Pandemic, Demand Rout

Canadian oil and natural gas drilling is plummeting to the slowest pace in half a century, report the industry’s field contractors.

An updated forecast by the Petroleum Services Association of Canada (PSAC) predicts only 3,100 wells in 2020 – the fewest since activity slid to 2,934 in 1971, show records of the Canadian Association of Petroleum Producers (CAPP).

The projected 2020 well count would be 88% less than the 2005 Canadian peak of 25,068, 31% below the 4,499 drilled after the 1980s oil and gas price slump, and 63% lower than the 8,137 bottom in the 2008-2009 global financial crisis.

“Punishing blows continue to batter the health of this vital industry,” said PSAC acting president Elizabeth Aquin.

Canadian setbacks began before the Covid-19 virus pandemic with pipeline protests that erupted into a national railway blockade, an oilsands project cancellation, and loss of investor support by a Quebec liquefied natural gas export project, recalled Aquin.

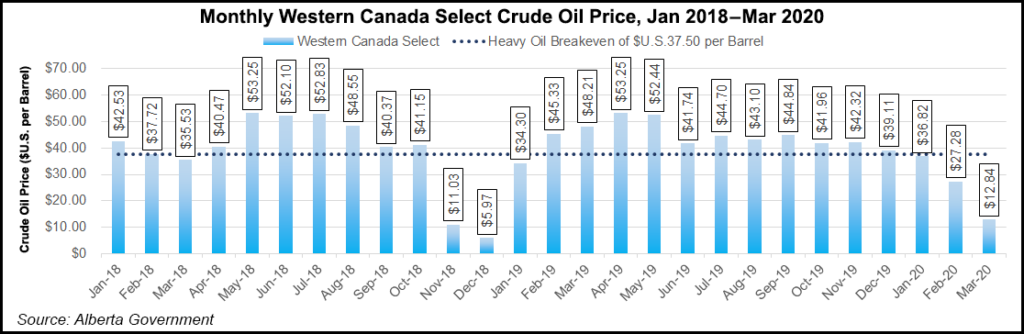

“What followed with the demand destruction from measures to combat Covid-19 compounded by a collapse in prices from a poorly timed Russia-Saudi price war, quickly dashed any optimism for the rest of the year,” said the PSAC leader.

“The result is over C$7 billion ($5.2 billion) of capital investment cancelled from budgets to date, foretelling activity levels not seen in decades.”

As the PSAC recorded the 2020 slump the federal and provincial governments began accepting applications May 1 for C$1.7 billion ($1.3 billion) in grants and loans to support oilfield employment with cleanups of discarded, depleted wells.

The governments predict the aid will save 5,200 Canadian oilfield jobs. The PSAC sought the environmental cleanup program. The help is “very welcome” as “some relief,” said PSAC chairman Mark O’Byrne.

“But much more is needed given the severity of the [economic] headwinds to keep this vital industry alive,” added O’Byrne. “Additional measures to support the sector through this crisis are crucial.”

Targeted aid for Canadian oil and gas enterprises, on top of loans and staff pay subsidies provided to date for all industrial sectors, is under discussion with the provincial and national governments. No commitments have been made.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |