NGI The Weekly Gas Market Report | Markets | NGI All News Access

Canada Natural Gas Said Economic, Possible Avenue for Shortages in U.S. Northeast

Canadian natural gas is becoming more economic to bring into New England and New York, and more of it could be needed as efforts to ship Appalachian supplies into the region have fallen short in the face of political resistance, according to an Iroquois Gas Transmission System LP executive.

The prolific increase of supplies from the Appalachian Basin has challenged the role of Canadian gas in the Northeast in recent years, but Todd White, who directs business development for Iroquois Pipeline Operating Co., recently told a crowd at LDC Gas Forums Northeast in Boston that “we’re starting to see another shift back.”

Established in 1991 to move gas from Western Canada to New York City, Long Island and Connecticut via an interconnect with the TC Energy Corp. (formerly TransCanada) Mainline, the 416-mile Iroquois system had long functioned well until supply dynamics shifted with the renaissance of gas production in Appalachia. A variety of factors, however, are making Canadian gas more attractive, White said.

“One of the issues is that TransCanada has done a lot of great work. They have been very successful in negotiating long-term fixed-price deals,” he said.

Tolls have fallen as a result, with “a couple Bcf/d under fixed prices approved” by Canada’s National Energy Board (NEB) for 10-20 years terms, he said, adding that “people know what it’s going to cost to move gas across their system.” That’s important to Iroquois, as 1.2 Bcf/d of the system’s total 1.7 Bcf/d physical receipt capacity comes from TC.

Appalachian basis also has increased in recent years as more pipelines have come online to take gas out of the region. Projects such as Nexus Gas Transmission and the Rover Pipeline have pushed more gas into the Midwest, putting downward pricing pressure on the Dawn Hub, where lower-cost gas can move into the Iroquois system, White said.

“It’s made it a lot more economic to get gas through the Canadian route than it used to be,” he added.

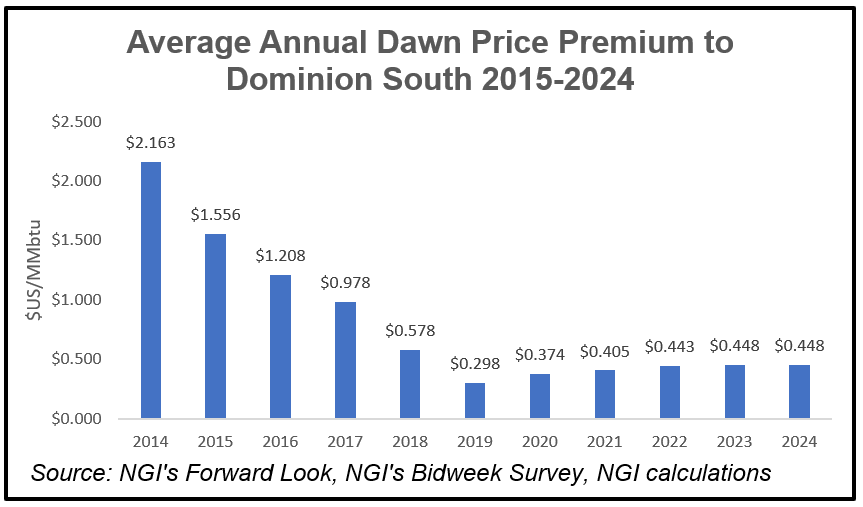

While Dawn prices continue to be more expensive than Dominion South, “that premium has come down significantly over time,” according to NGI’s Patrick Rau, director of strategy and research. “Dawn averaged more than $2.00/MMbtu than Dominion in 2014, fell below $1.00 in 2017 and is expected to be less than 30 cents in 2019. That’s quite a progression.”

Rau agreed that shifting gas from Appalachia to Dawn via Rover and Nexus “is a big part of this, as it has lowered Dawn prices and created excess Appalachian takeaway capacity, which in turn has improved pricing into Dominion. So the irony is Appalachian gas could be helping to make Appalachian gas a little less competitive than supply that is routed through Canada.”

Looking at NGI’s Forward Look data, which offers fixed and basis forward natural gas prices out 10 years, Rau said that increased Marcellus and Utica shale production is expected to push the Dawn-to-Dominion premium back above 40 cents after 2020, but even that figure is still below more recent historical norms.

While year/year Canadian pipeline deliveries to the United States dropped by 5% to 7.8 Bcf/d in 2018, they remained stronger than their volumes of 7.3 Bcf/d in 2014 and 7.4 Bcf/d in 2015, according to trade records compiled by the NEB.

Furthermore, Rau estimated that a combined 752 MMcf/d of gross volumes flowed into the U.S. Northeast via Waddington, NY, and Pittsburg, NH, in 2018, up from 558 MMcf/d in 2017, and the highest yearly total since 2013.

The shift comes as demand in the Northeast remains strong, White said. Enbridge Inc.’s Erin Petrovich, director of business development, said the same. She noted that Algonquin, another major pipeline in the region that transports 3.12 Bcf/d of gas to New York, New Jersey and New England remains fully subscribed and highly utilized.

“We think there’s going to need to be a number of expansions going forward to bring more gas into the Northeast. It remains to be seen how that’s going to happen,” White said of the political resistance the industry has faced in New England and particularly in New York, where state regulators have repeatedly denied permits for gas pipelines.

Utilities in the region, including in New York and Massachusetts, have imposed moratoriums on new gas service because of a lack of supply. Consolidated Edison Co. (Con Ed) last month inked a deal with Iroquois to increase gas supply into its New York service territory. Iroquois would upgrade compression facilities to move supply into the Bronx and parts of Manhattan and Queens. Pending regulatory approval, Con Ed said the new supplies could become available by November 2023.

The last major expansion that Iroquois undertook came 10 years ago. Similarly small projects have went into service across the Northeast in recent years, such as Algonquin’s AIM and Atlantic Bridge projects, along with the Dominion New Market Project and the Millennium Eastern System Upgrade, as greenfield pipes have faced strong opposition.

“We’re not going to build a pipeline project on speculation,” White said of what might come next for Iroquois. The system has periodically been overscheduled at Waddington, where it extends from the border, in part because of the lower TC tolls. “We tend to look for 15-20 year contracts and increasingly these days, we’re looking for parties who are going to be customers on that project and share some of the permitting risk as well, as we see that as more challenging.”

The notion of permitting risk echoed the event’s bearish sentiment on gas, as the broader market remains oversupplied, liquefied natural gas exports appear poised to slow and a hostile environment remains for the industry in parts of the Northeast. Many speakers spent time addressing how to address anti-fossil fuel policies and nascent renewable development in the region — particularly offshore wind — which could have a strong role to play in the regional power markets in the coming years, threatening some gas demand.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |