NGI The Weekly Gas Market Report | Markets | NGI All News Access

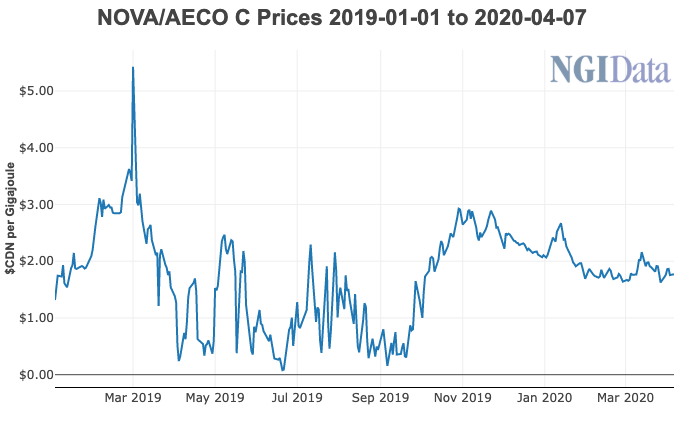

Canada Natural Gas Prices Predicted to Fade, with AECO Differential Close to $1 Under Henry Hub

Fading demand will erode Canadian natural gas prices that have held up so far against the global economic pause for the Covid-19 virus pandemic, Alberta’s senior petroleum engineering and geology consulting firm is predicting.

“Good times don’t last forever,” said Sproule Associates. The firm acknowledged price support by a late-2019 delivery rule change on TC Energy Corp.’s production collection grid in Alberta and British Columbia (BC), Nova Gas Transmission Ltd. (NGTL).

Sproule said current Western Canadian supply patterns only postpone loss of the favorable market balance created by the tariff amendment, which drained surpluses off the NGTL network by granting priority to shipments destined for storage.

The pipeline rule change falls short of immunizing the Western Canadian gas value yardstick, AECO, against the downward demand and price pressure on the Henry Hub benchmark in the United States, said the Alberta firm.

“Ultimately, AECO gas is still the marginal molecule flowing into a well supplied North American market, and we do not expect to see sustained narrowing of the differential,” said Sproule, until access to Asian markets is open via liquefied natural gas exports.

On the AECO market for Alberta and BC supplies “we expect to see differentials widen closer to US$1.00/MMBtu below Henry Hub.”

Demand losses liable to weaken Canadian prices include potential production cuts by the country’s top gas user, Alberta thermal oilsands plants. With 85% flowing out as exports, Canadian output is immediately affected by international market trends.

“In the second quarter of this year we expect to see upwards of 20 million b/d of crude demand disruption, with road and aviation fuel sectors experiencing the largest shocks,” said Sproule.

“A supply response from Canadian producers is imminent, especially considering that heavy oil,” which is always discount priced, “accounts for roughly 70% of Canadian production…

“Shut-ins will be necessary to ease pressure on [pipeline] egress systems as demand from U.S. refineries drops and Western Canadian storage capacity fills. Without shut-ins, we would expect to see prices received in Western Canada to fall close to zero in coming weeks.”

Canadian oil production has to be cut by 500,000-1 million b/d, or 11-22% off the national total of 4.6 million b/d, mostly from Alberta, to prevent a supply glut that would gut prices, estimated Sproule.

The firm forecasts a wide range of global oil scenarios driven by unpredictable supply responses to the pandemic and economic slump, with surpluses from 4-11 million b/d and prices stagnating below US$20/bbl or bouncing back above $30.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |