Infrastructure | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Cameron LNG Requests FERC OK to Begin Service by Friday

Another wave of liquefied natural gas (LNG) supply is preparing to hit the open seas as developers of the Cameron LNG project on Monday asked federal regulators for authorization to place its first production unit and related facilities into service by Friday (July 26).

In its request, sponsor Sempra Energy told FERC that it has completed commissioning Train 1, the outside battery limit facilities and the associated regasification facility equipment.

“Cameron has completed all necessary functional and performance tests for these facilities demonstrating that the facilities can operate safely as designed,” management said in a letter to the Federal Energy Regulatory Commission.

Cameron achieved first production at Train 1 in May, while the second and third trains, delayed to 1Q2020 and 2Q2020, respectively, round out Phase 1. Total export capacity from the Hackberry, LA, facility is to be 12 million metric tons/year (mmty).

Cameron LNG’s pending startup comes on the heels of an announcement by the Freeport LNG developers that the project on the Texas coast at Quintana Island has reached the final commissioning stage, including introducing feed gas into Train 1. Once fully operational, Freeport Train 1 would be capable of producing more than 5 mmty.

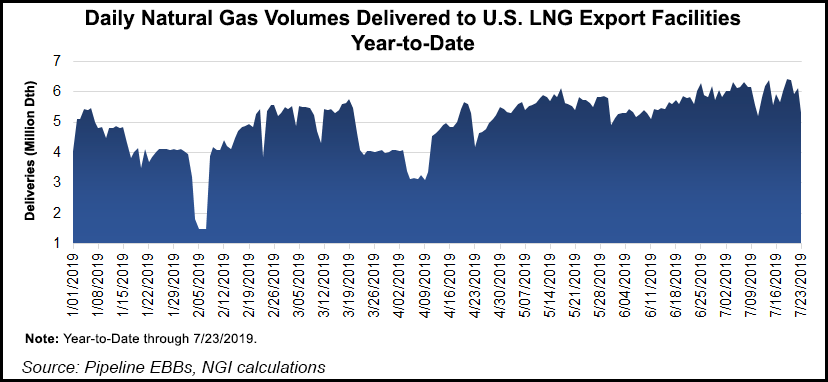

LNG feedstock demand has surged in recent weeks, hitting new highs above 6 Bcf/d, with the looming increase in exports from Cameron and Freeport expected to catapult demand even further. However, the delays in getting the facilities online could portend what’s to come as the so-called second wave of proposed LNG export facilities move toward in-service, according to BTU Analytics.

When looking at announced in-service dates from 2018, the U.S. gas market should have had an additional 3 Bcf/d of capacity online this summer, but Cameron, Freeport and Kinder Morgan Inc.’s Elba Island and others have been delayed multiple times. If not for the delays, LNG deliveries from the Lower 48 would be nearing 8 Bcf/d, “however, that conversation will have to wait till 2020 now,” said BTU’s Matthew Hoza, manager of energy analysis.

A number of facilities have proposed in-service dates for 2023 and 2024, according to BTU. Tellurian Inc. is expected to reach a final investment decision (FID) this year for Driftwood LNG, with first production expected in 2023. NextDecade Corp. has indicated that, once sanctioned, Rio Grande LNG could also begin commercial operations in 2023. Venture Global LNG Inc.’s third proposed export terminal — Delta LNG — is also targeting a 2023 startup, which if sanctioned, could begin operating in November 2024.

“Having new facilities come online within the next five years would go a long way toward closing the LNG gap between first- and second-wave facilities,” Hoza said. “However, taking history as our guide, those in-service dates are likely to be pushed back by as much as two years.”

Recognizing the United States’ growing role in the global LNG market, an Australian-based developer with projects on the drawing board for the Gulf Coast and in Canada is seeking to move its stock listing to Nasdaq from Sydney.

The LNG Ltd. (LNGL) board said the proposed redomicile transaction would align with the company’s 100% North American LNG project development and operational management focus. It would also increase awareness in LNGL with North American investors that want to deploy capital to the industry.

Furthermore, the move would improve valuation and enhance trading liquidity given the current valuations for LNGL’s peers, all of which are U.S.-listed companies, the board said. Redomiciling to the U.S. stock exchange would also increase the attractiveness of LNGL to potential future business partners, enable demand from investors not able to invest in equities listed outside of the United States and retain and attract talent, according to the company.

“After continued evaluation by the board and management team and given the company’s confidence in raising new capital to fund our business and marketing efforts, we believe a U.S. redomiciling is in the company’s best interest,” Chairman Paul J. Cavicchi said. “This listing change is expected to benefit LNGL and its shareholders by properly positioning and valuing the company for future success.”

LNGL is developing the Magnolia LNG export facility, which is still awaiting an FID pending additional offtaker commitments. As proposed, the project calls for constructing four liquefaction trains each with 2.2 mmty of capacity. The Port of Lake Charles, LA, facility is fully permitted, including an order from FERC and worldwide export approval from the Department of Energy.

In June, LNGL executed an updated engineering, procurement and construction (EPC) contract for Magnolia with KSJV, a joint venture of Houston-based KBR Inc. and South Korean firm SK Engineering & Construction. The updated contract is valid until Dec. 31 and accounts for an additional 0.8 mmty of capacity, growing Magnolia’s total installed capacity to 8.8 mmty.

The Magnolia LNG project has also earned Louisiana’s Industrial Tax Exemption Program incentive, which provides tax relief for manufacturers that make a commitment to jobs and payroll in the state. The project is expected to generate 1,500 construction jobs and 200 permanent direct positions for Louisiana.

LNGL Canadian subsidiary Bear Head LNG is proposing an 8-12 mmty LNG export terminal in Richmond County, Nova Scotia, with potential for further expansion. The spinoff is also proposing a 1,600-kilometer (1,000-mile) 42-inch diameter pipeline to provide feedgas to the Bear Head facility.

The board needs shareholder approval and has to clear regulatory and judicial hurdles before proceeding with the transaction. The company expects to use a share sale facility (SSF) providing eligible existing shareholders an election to either sell or retain their shareholding. Eligible existing shareholders that do not want to invest would be allowed to sell their shares through the proposed SSF.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |