NGI The Weekly Gas Market Report | E&P | LNG | NGI All News Access

Cameron LNG Close to Ramping Up but Two Trains Delayed, Says Sempra

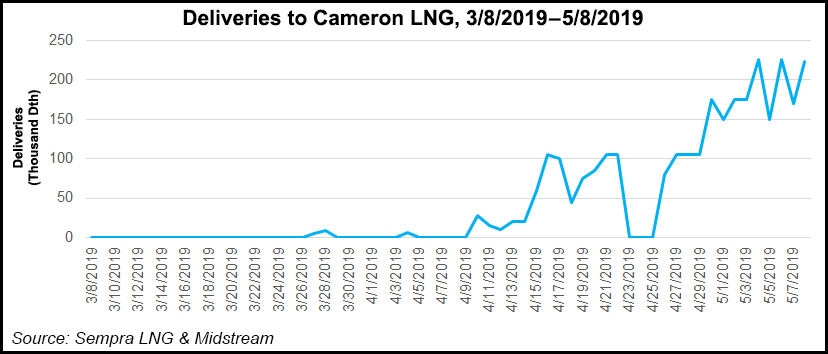

The first of three production trains at Sempra Energy’s natural gas export project is on the verge of beginning commercial operations, but completion of the other two trains has been pushed to the first half of 2020, executives said Tuesday during a 1Q2019 earnings conference call.

Even with the liquefied natural gas (LNG) train delays at Cameron LNG, Sempra reported that the full run-rate of earnings from the Hackberry, LA-based project would be realized in 2021, with an estimated $400-$450 million of annual earnings for the San Diego-based utility holding company.

During the conference call, CEO Jeff Martin said the first profits from the Cameron LNG exports would four to six weeks after first gas is produced by Train 1. Martin noted that the other two trains would be subjected to longer construction and commissioning schedules.

“Train 1 continues to achieve key milestones, and we expect to be producing LNG shortly this spring and begin generating earnings in mid-2019,” said President Joe Householder. As far as the overall project, “we’re ready right now, and we’re starting up right now.”

Sempra’s existing gas import facility on the Baja California coast in Mexico and a greenfield LNG export project east ofHouston in Port Arthur, as well as trains 4-5 at Cameron each are moving forward as planned.

Final investment decisions (FID) are expected later this year for the Mexico facility, with the FID on Port Arthur set for early next year, Householder said.

In response to an analyst’s concern about current “weaknesses” in global LNG trade, Martin said from conversations that Sempra executives have had, they see a robust future business based on long-term contracts and high quality customers with strong balance sheets.

Aside from the LNG projects, Sempra’s substantial U.S. utilities in California and Texas are facing milestone regulatory decisions on rates and earnings at the state and federal level. In California there are pending actions related to wildfires that directly impact utility San Diego Gas and Electric Co. (SDG&E).

Regarding the fire mitigation efforts, SDG&E is in a “materially different position” than its gas utility peers in California, Martin said.

“All the right conversations are taking place and all the right stakeholders are at the table,” Martin said. He is watching the July 1 due date for a report from Gov. Gavin Newsom’s Catastrophic Wildfires Commission, and said there is a commitment to have a bill for the state legislature by mid-July.

Both Martin and Householder said utilities need assurances for recovery of prudent costs for wildfires. Without that assurance, the utilities would be weakened financially, they said.

Sempra reported net income of $441 million ($1.50/share) in 1Q2019 versus $347 million ($1.33) for the same period last year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |