E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Callon Tightens Up in Permian, While Laredo Reduces Workforce

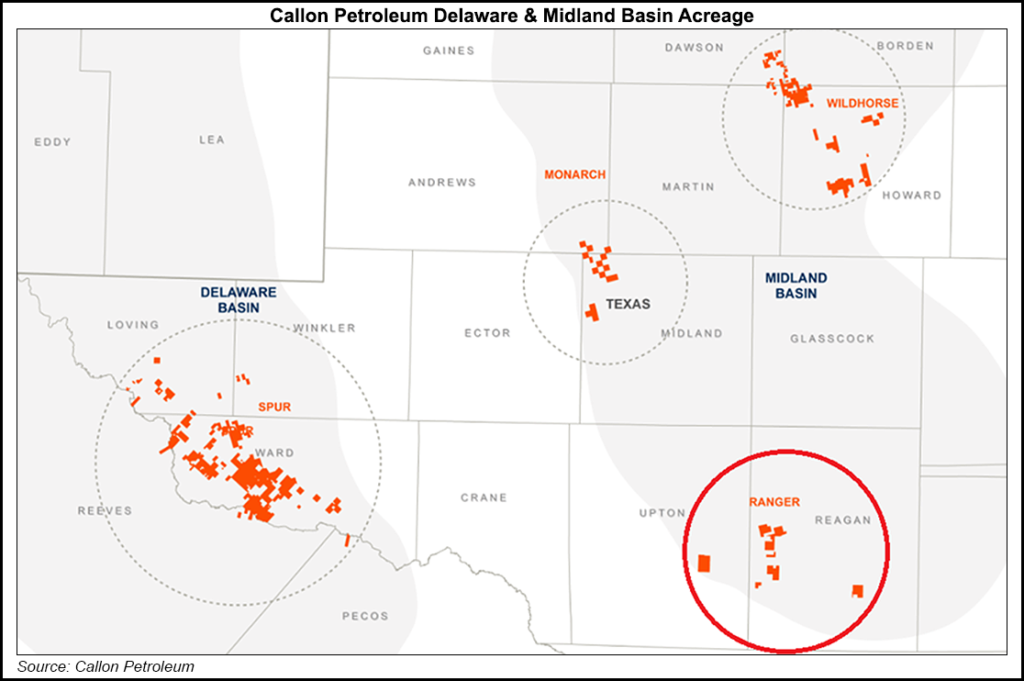

Two big West Texas explorers have shuffled their Permian Basin operations, with Callon Petroleum Co. selling some acreage and Laredo Petroleum Inc. sharply reducing the executive ranks.

The sale of Midland sub-basin assets by Callon to an undisclosed buyer provides for an initial cash payment of $260 million. Potential incremental cash payments of up to $60 million also could be made based on future commodity prices, with “upside participation” starting at $60/bbl West Texas Intermediate oil.

“We are delivering on our commitment to drive enhanced capital efficiency by monetizing lower margin, noncore properties that have not competed for capital on a sustained basis,” CEO Joe Gatto said. “The proceeds from this divestiture will accelerate our debt reduction initiatives and also provide the opportunity to retire our preferred stock, reducing our cash financing costs.

“In addition, the transaction streamlines our business with a resulting focus on three core operating areas. We are actively optimizing our operations, which we believe will reduce capital intensity and increase returns on capital for our shareholders.”

The divestiture by the Houston-based independent encompasses the Ranger operating area, which includes about 9,850 net acres in the Wolfcamp formation (66% working interest), as well as 80-plus producing horizontal wells drilled since 2012.

Daily production from the Ranger averaged around 4,000 boe/d during February. Capital plans for the year are unchanged, as Callon planned no activity in the Ranger this year.

In addition to the pending divestiture, Callon said it also completed a strategic trade in 1Q2019 that expanded its contiguous position in northwestern Howard County by adding two incremental long-lateral drilling spacing units in exchange for properties in Midland County.

The trade resulted in a net increase of about 167 net acres to Callon’s Midland leasehold, and it generated $14 million in cash proceeds.

Meanwhile, Tulsa-based Laredo Petroleum Inc., another West Texas-focused independent, has aligned its cost structure with operational activity by reducing general/administrative expenses and capitalizing employee costs by around 25% on an annualized basis.

“We have reduced our total employee count by approximately 20%, including a greater than 40% reduction at the vice president and above level, resulting in annualized savings of approximately $30 million,” CEO Randy A. Foutch said. “While these actions are always difficult, they are necessary as we focus on increasing corporate-level returns and growing within cash flow from operations.”

In addition, Michael T. Beyer was promoted to CFO, replacing Richard C. Buterbaugh. Since 4Q2018 Laredo has named a new COO and general counsel too.

Beyer’s promotion “is the latest action in the company’s senior leadership succession planning process,” Foutch said.

Beyer joined Laredo in 2007 and most recently served as chief accounting officer. He also was controller. He holds a bachelor’s degree in business administration from The University of Oklahoma and has been a certified public accountant since 2002.

Laredo’s decision to trim the workforce “remains a key focus for upstream investors, and we expect more announcements over the coming quarters as companies address right-sizing the corporate cost structure,” Tudor, Pickering, Holt & Co. said Tuesday. “For those companies who do not proactively do so (and need to), we foresee increasing pressure from shareholders.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |