E&P | NGI All News Access | NGI The Weekly Gas Market Report

California Resources Reports $1.7B Impairment, Cites Doubt as Going Concern

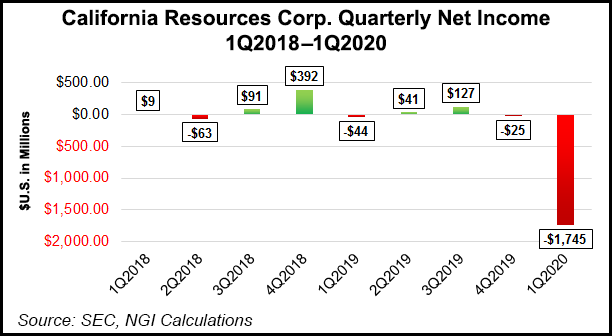

California Resources Corp. (CRC), the state’s largest producer, last week in its delayed Form 10-Q filing for 1Q2020 to the Securities and Exchange Commission (SEC) said it had taken a $1.7 billion impairment charge.

Net losses for the quarter totaled $1.79 billion, (minus $36.43/share), compared with a $67 million loss (minus $1.38) for the same period last year.

In the 10-Q report, CRC cited the impact on operations of oil and gas commodity prices, and the fact that the global oil price crash has been compounded by the Covid-19 pandemic, which has crushed global energy demand.

“The unprecedented dual impact of a severe global oil demand decline due to Covid-19, coupled with a substantial increase in supply from Saudi Arabia and Russia, results in a collapse of crude oil prices,” management said.

As it had earlier reported this year, CRC reiterated that the “challenging conditions in the credit and capital markets raise substantial doubt regarding our ability to continue as a going concern.” CRC continues to hold restructuring discussions with its major creditors and stakeholders, and it told the SEC it expects to have an agreement by Tuesday (June 30).

CRC, which was spun off by Houston-based Occidental Petroleum Corp. in 2014, began independent operations with $6.8 billion in debt. The debt has been reduced to $4.9 billion, according to the 10-Q.

CRC defaulted on several interest payments over the past six weeks. It has a forbearance agreement that ends on Tuesday, and a $72.3 million interest payment that has a 30-day grace period set to expire July 15.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |