NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

California, Northeast Partially Erode Broader Weekly Gains

For the week ended Aug. 26 there was only nominal movement in weekly gas prices, but the roles were reversed from the previous week. Solid gains of a dime or more were posted at interior basins and Midwest market points, but declines in the Northeast and California pulled the averages down.

TheNGI National Spot Gas Average rose 4 cents to $2.55, but regionally the Northeast plunged 41 cents to $2.42 and California fell 5 cents to $2.83. All other regions made gains.

The market point showing the largest advance was NOVA/AECO C with a $1.28 advance to $C2.38/Gj, and the week’s greatest loss was endured by Algonquin Citygate, which fell 77 cents to $2.91.

The weakest region was the Midcontinent, which staged a 5-cent gain to $2.57, followed by a 6-cent rise to $2.53 in the Rocky Mountains.

The Midwest was up by 9 cents to $2.72, and South Louisiana and Appalachia each advanced a dime, to $2.72 and $2.88, respectively.

South Texas rose 11 cents to $2.70 and East Texas was right on its tracks with a 12-cent gain to $2.72. The Southeast made the week’s greatest regional gain with a move of 13 cents to $2.88.

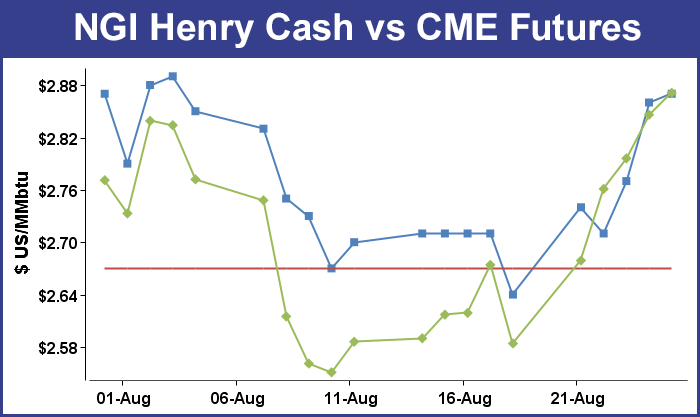

When the Thursday storage report rattled across trading desks, traders once again were treated to actual data far from industry surveys. The Energy Information Administration (EIA) reported an addition to storage of 11 Bcf, a stout 7 Bcf shy of expectations, and futures prices rose. At the end of trading the September contract had gained 5.0 cents to $2.846, and October added 5.0 cents as well to $2.885.

When the report hit, the initial response was somewhat subdued. September futures reached a high of $2.861 immediately after the figures were released, but by 10:45 a.m. EDT September was trading at $2.818, up 2.2 cents from Wednesday’s settlement.

“The ICE swap was 11 [Bcf] bid at 13, and I think everyone goes off that,” said a New York floor trader. “My number was 19 Bcf and that number should have been [more] bullish based on what traders were looking for. It seems the ICE swap is always right on target.”

“The 11-Bcf build for last week was the latest demonstration that with the natural gas market’s increased share of the power sector demand is quite sensitive to any extreme in summer heat,” said Tim Evans of Citi Futures Perspective. “While supportive, we also note this will mean a more pronounced drop in demand when temperatures cool in the weeks ahead.”

Inventories now stand at 3,350 Bcf and are 275 Bcf greater than last year and 350 Bcf more than the five-year average. In the East Region 12 Bcf was injected and the Midwest Region saw inventories increase by 14 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was lower by 3 Bcf. The South Central Region dropped 14 Bcf.

In Friday’s trading, physical gas for weekend and Monday delivery worked lower as buyers saw little reason to commit to three-day deals.

Modest gains in the Gulf Coast, Midcontinent and Texas were overrun by losses in the Southeast, California and the Northeast. The NGI National Spot Gas Average retreated 3 cents to $2.61. Futures were able to erase early losses and made it five straight gains for the week. At the close September had risen 2.5 cents to $2.871 and October rose 2.8 cents to $2.913.

Traders see the futures market having difficulty moving past the most recent high of $2.998. “I don’t think we will cross $2.97,” Alan Harry, director of trading at McNamara Options in New York, told NGI.

“There is a lot of bullish pressure in the market right now, but in the end there are enough producers and enough natural gas in the marketplace along with Canada and U.S. producers. It’s going to be difficult to keep the market up.

“We had a settlement in August of $2.672 and that’s when you have all the cooling going, and September comes off the board on Monday. Is September going to be warmer than August? Probably not. Are we going to have less natural gas flowing into the system? Probably not. It’s difficult to see the cash price supporting that.

“Let’s say that September settles Monday in the $2.80 to $2.90 range, so it sounds like anyone buying into that is going off some sort of damage from a hurricane or some outage, or something like that. If we don’t get that, and it seems likely based on the models, then it’s going to be difficult to support natural gas at much higher levels.

“Short term, I think we make a rally to $2.88 to $2.94, and after that we back off. We got to that range today so it looks like we are close to a top and have downside [risk] for natural gas.”

Other observers are looking for the recent price advance to run its course. “[W]e believe that the weather forecasts have been fully priced. Additionally, the market has moved into technically overbought territory, at least on a short-term basis,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning note to clients. “And while some tropical storm activity has forced some hurricane premium into the market, we look for the futures to demand clearer evidence of some production disruption before offering much additional support.

“While [Friday’s] option expiration could crank up volatility a notch, recent such expirations haven’t offered significant pricing clues. And looking ahead to Monday’s September futures expiration, a healthy supply surplus should preclude any independent strength unless weekend updates to the weather views offer some major shifts. In the background, we see production becoming a larger factor across the upcoming shoulder period, with output showing an appreciably stronger pace than previously expected as rig counts maintain a strong upward trend.”

In physical trading prices took a dive at points along the Eastern Seaboard for weekend and Monday delivery as temperatures were expected to decline although remain above seasonal norms. Wunderground.com reported that Boston’s uncomfortable 90 degree high Friday would drop to 80 by Saturday before rising back to 86 on Monday. The seasonal high in Boston is 78. New York City’s 93 high on Friday was forecast to fall to 89 Saturday and climb back to 90 on Monday. The normal high for the Big Apple this time of year is 81.

Gas for delivery to the Algonquin Citygate shed 24 cents to $2.95, and deliveries to Iroquois, Waddington were lower by a penny to $2.94. Gas on Tenn Zone 6 200L fell 21 cents to $2.87.

Gas bound for southeasternmost Pennsylvania, Trenton and southern New Jersey on Transco Zone 6 non-NY North tumbled 35 cents to $1.99 and gas on Transco Zone 6 NY was down 36 cents to $2.00.

California points also slipped. Gas at the PG&E Citygate fell 3 cents to $3.27, and deliveries to the SoCal Citygate dropped 11 cents to $2.69. Gas priced at the SoCal Border Avg. changed hands 9 cents lower at $2.66, and gas on Kern Delivery gave up 5 cents to $2.71.

Gas buyers for weekend and Monday power generation in ERCOT should have a relatively easy time. “Stormy and cooler than average temperatures expected,” said WSI Corp. in its Friday morning report. “A wet and cool period is expected through the remainder of the week into the weekend as a tongue of tropical moisture plumes into the region from the Gulf of Mexico.

“Temps only expected to rise into the 80s and lower 90s. Total precip 0.25 to one inch. Some areas over the coastal Southeast could see up to two inches. Modest wind gen [Friday] as output peaks near 6 GW. Flow is expected to reduce over the weekend, limiting wind gen.”

At 2 p.m EDT the National Hurricane Center (NHC) was following a disturbance in the north-central Gulf of Mexico. The feature was expected to move onshore Texas over the weekend and was given a 10% chance of tropical storm development in the succeeding 48 hours.

An area of weak low pressure over eastern Cuba north to Bermuda could be more problematic, as it has a 30% chance of tropical storm development over the weekend, NHC said.

Further out in the Atlantic, Tropical Storm Gaston on Friday was packing 65 mph winds 1,110 miles east southeast of Bermuda. It was headed north-northwest at 17 mph, and NHC continued to project its course heading east of Bermuda.

The storms have gotten the attention of Gulf operators. On Friday morning, BP said it was closely monitoring the tropical disturbance “to ensure the safety of our personnel and operations in the deepwater Gulf of Mexico.

“With forecasts indicating the system could enter the Gulf of Mexico, we are now taking additional steps to respond. BP has begun securing offshore facilities and evacuating nonessential personnel from our platforms and drilling rigs.”

Chevron, Shell and Anadarko all said they were closely monitoring the system.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |