Infrastructure | NGI All News Access | Permian Basin

Cactus II Ramp Heralds Start of More Permian Crude Takeaway Options

One of the first of the big Permian Basin-to-Gulf Coast crude pipelines has reached its destination in South Texas, according to Trafigura Trading LLC and Buckeye Partners LP.

Cactus II, a Plains All American system, recently delivered crude for the first time to the Buckeye Texas Partners terminal near Corpus Christi. Earlier this month, Plains CEO Willie Chiang had said Cactus II was mechanically complete from Wink in West Texas to Ingleside near Corpus.

Trafigura and Buckeye said they worked together to achieve early service commissioning and receipts through connected infrastructure in the Eagle Ford Shale. Further direct connections and interconnectivity are to be completed once the pipeline is fully operational.

This initial receipt “represents the first deliveries from more than 3 million b/d of new pipeline capacity being built into the broader Corpus Christi market,” the partners noted.

“Trafigura has a significant long-term volume commitment to move crude oil from the Permian Basin via Cactus II,” said Trafigura’s Corey Prologo, director of North America. The start up of Cactus “builds our position as the leading exporter of U.S. crude oil and refined products” around the globe.

Buckeye’s Khalid Muslih, president of Global Marine Terminals, said once the first phase of development is completed at the South Texas facilities, “we will be able to provide customers with access to broader domestic and international markets” with more than 1 million b/d of export services.

Cactus II is the first of three Corpus-bound pipelines set to ramp this year to provide 1.7 million b/d of Permian crude connectivity, according to Tudor, Pickering, Holt & Co. (TPH).

The Epic Crude Oil Pipeline, originating in Orla, TX, expects to begin interim service by the end of September with permanent service scheduled for January. Enbridge Inc.’s Gray Oak system also is on track for initial start up this year.

“While initial Cactus II flows will be constrained at 400,000 b/d, total capacity is expected to increase to nameplate 670,000 b/d following establishment of full export dock connectivity by late 1Q2020,” TPH analysts said.

“Ongoing line fill of Cactus II and Epic crude pipelines has driven additional demand for Midland barrels and contributed to the quarter-to-date narrowing of Midland — MEH and Midland — West Texas Intermediate (WTI) differentials to $2.60/bbl and $43 cents//bbl, respectively,” TPH noted. “We continue to expect further tightening of Permian crude oil differentials following in-service of Epic pipeline and beginning of Gray Oak line fill in coming months.”

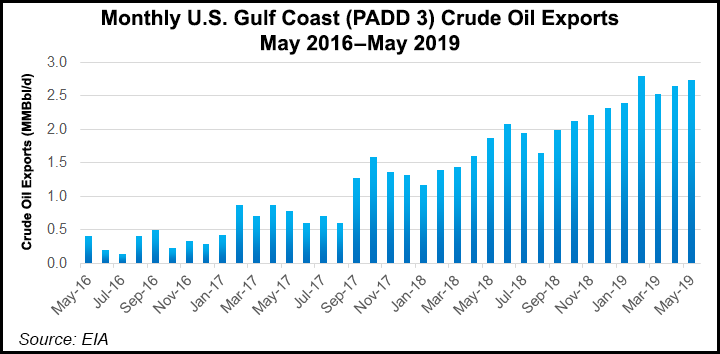

The Energy Information Administration (EIA) also expects to see the WTI-Brent spread tighten. In its August edition of the Short Term Energy Outlook (STEO), EIA said it expected WTI crude to average $5.50/bbl less than Brent during the fourth quarter and in 2020, narrowing from the $6.60 spread during July.

The narrowing spread reflects EIA’s assumption that crude pipeline transportation constraints from the Permian to Gulf Coast refineries and export terminals are going to ease in the coming months.

In the July STEO, EIA had forecast the Brent-WTI spread would average $4.00/bbl in 2020. The updated differential forecast this month reflects revised assumptions about the marginal cost of moving crude via pipeline from the Cushing hub in Oklahoma to the Gulf Coast.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |