Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Cabot to Unlock More Natural Gas for Power Plants, Atlantic Sunrise

It was about two years ago that Cabot Oil & Gas Corp. CEO Dan Dinges said 2018 could be the “inflection year” for the company, which operates in just one county in the bottlenecked region of northeast Pennsylvania, as management anticipated more than 1 Bcf/d of demand outlets coming online.

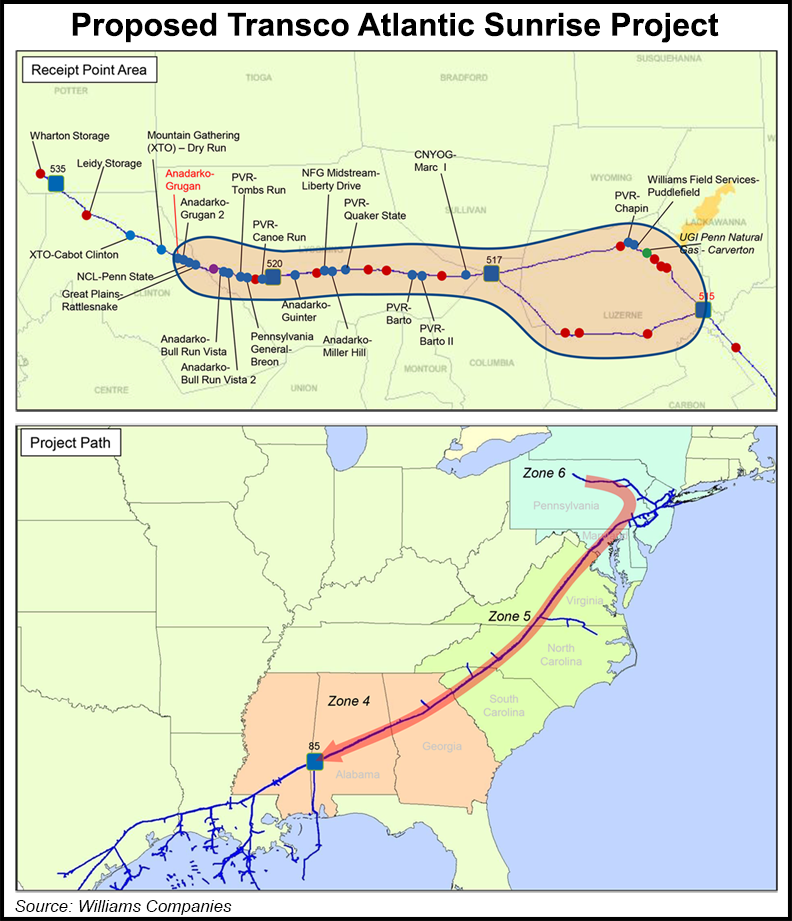

That point has arrived, as the company edges closer to the 2 Bcfe/d that management has long said it could produce with more outlets for its gas. Cabot expects about 1.5 Bcf/d of demand to kick in over the coming months. Two gas-fired power plants Cabot is exclusively supplying are near in-service, while construction of the Atlantic Sunrise expansion is more than 50% complete and on track for a mid-2018 start up, Dinges said.

“Cumulatively, these three projects will drive a significant improvement in differentials going forward, resulting from access to premium markets post Atlantic Sunrise in-service and seasonally high power prices once the Moxie Freedom and Lackawanna Energy Center plants are up and running,” he added.

Both the Moxie and Lackawanna power plants, located south of Cabot’s operations in Susquehanna County, are accepting test gas and making final preparations for commissioning in June, when their power generation contracts are set to begin. Cabot has agreed to supply Moxie with 165 MMcf/d and another 240 MMcf/d to Lackawanna, as its three generation trains are phased-in between June and December.

As it awaits those projects, Cabot also recently received notice that its 20-year supply agreement with Sumitomo Corp. affiliate Pacific Summit Energy is now in effect as commercial operations have started at the Cove Point liquefied natural gas export facility in Maryland.

The company also has about 1 Bcf/d contracted on the 1.7 Bcf/d Atlantic Sunrise project. Cabot produced 169.6 Bcfe in the first quarter, up slightly from the 170.1 Bcfe it produced in the year-ago period and down a bit from the 172.6 Bcfe reported in 4Q2017.

The company brought no new wells online in the first quarter. Its production schedule is weighted toward the second half of the year to help meet its commitment on Atlantic Sunrise, which management said would be filled by the end of the year.

The company is guiding for 10-15% year/year production growth in 2018, and it plans to place 20 wells to sales in the second quarter and bring another 60 wells online by the end of the year. Management said Atlantic Sunrise would be filled with new production and volumes from other pipelines.

Cabot had nothing to say during a first quarter earnings call on Friday about the beleaguered Constitution Pipeline, which it is partly sponsoring. Constitution’s backers have petitioned the U.S. Supreme Court to review an appeals court ruling in August against the project. A decision in that proceeding is near, as the petition was distributed for conference, or discussion among the justices, on Friday. Constitution has been battling for authorization since 2016, when New York state denied the project’s water quality certificate.

The company also had little to say about its oil exploration efforts in two unspecified areas. Cabot has allocated $75 million for the wildcatting this year.

“We do continue to make progress on gathering the data on both projects,” Dinges said. “Our objectives have been clear that we’re trying to secure enough data points to be able to give some very good color in our third quarter call. We’ve also mentioned that both projects are designed to evaluate oil prospects.”

While the company’s oil and natural gas liquids prices increased, natural gas prices — including hedges — were down 8% year/year in the first quarter to $2.44/Mcf. Revenue declined from $517.8 million to $473.2 million over the same time.

Cabot reported first quarter net income of $117.2 million (26 cents/share), compared to net income of $105.7 million (23 cents) in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |