Markets | NGI All News Access | NGI Data

Bulls Stirring on Heels of Lean Storage Data

Natural gas futures bounded higher Thursday following the release of government storage figures that were significantly less than what traders and analysts were expecting.

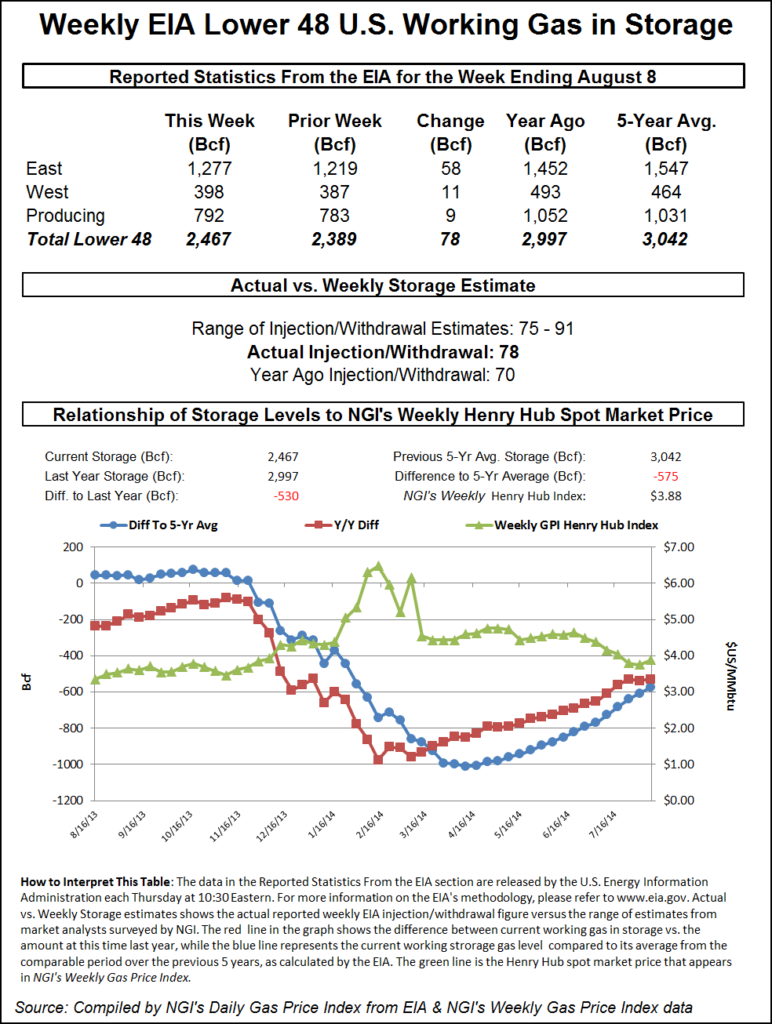

The injection of 78 Bcf was about 6 Bcf lower than market surveys and independent analyst projections, and for the week ended Aug. 8, the Energy Information Administration reported an increase of 78 Bcf in its 10:30 a.m. EDT release. September futures surged to a high of $3.947 soon after the number was released, and by 10:45 a.m. September was holding at $3.914, up 8.3 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a build of approximately 84 Bcf. A Reuters survey of 24 traders and analysts revealed an average increase of 83 Bcf with a range of 75-91 Bcf. IAF Advisors was looking for a build of 85 Bcf. and Bentek Energy anticipated an injection of 84 Bcf.

In a report Bentek hinted that “a modest uptick in power burn” might lead to a somewhat lower figure. “Sustained levels of heat for the previous few weeks in the Producing and East regions help provide some downside risk to this week’s forecast…The increase in power burn was centered in the East Region, which grew nearly 0.6 Bcf/d from the previous week and cut Bentek’s total sample injections within the region by 5 Bcf from the previous week, which was offset by stronger sample injections within the Producing and West regions.

“We had heard between 84 Bcf to 86 Bcf, and the market rallied about 11 cents,” said a New York floor trader. “We are not breaking the $4 level, and I don’t see that happening anytime soon.”

“This second miss on the bullish side of expectations does suggest that the background supply-demand balance may have firmed slightly, which may carry over into somewhat smaller refills going forward, although still likely to exceed five-year average rates,” said Tim Evans of Citi Futures Perspective.

Phillip Golden, director of Risk and Product Management at EMEX, said the storage report was “moderately bullish” versus market expectations of 83-84 Bcf. “As expected, the market has moved up in initial response to the news, erasing a little more than half of yesterday’s significant ($0.14 for Sept. 14) decline,” he said. “While this is the largest build for Week 19, the recent fall off in injection numbers and misses to the low side are likely to start supporting the market.” As a result, EMEX believes “there is a good buying window over the next couple of months.”

Inventories now stand at 2,467 Bcf and are 530 Bcf less than last year and 575 Bcf below the five-year average. In the East Region 58 Bcf was injected, and the West Region saw inventories up by 11 Bcf. Inventories in the Producing Region rose by 9 Bcf.

The Producing region salt cavern storage figure increased by 1 Bcf from the previous week to 213 Bcf, while the non-salt cavern figure rose by 10 Bcf to 580 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |