Shale Daily | E&P | NGI All News Access

BLM Utah Lease Sale Proceeds Plunge

The Bureau of Land Management’s (BLM) Utah office in Salt Lake City said the results of its latest quarterly oil and natural gas lease sale showed significantly lower proceeds and activity than a year earlier.Separately, a previously scheduled auction in August has been canceled to combine with one planned in November.

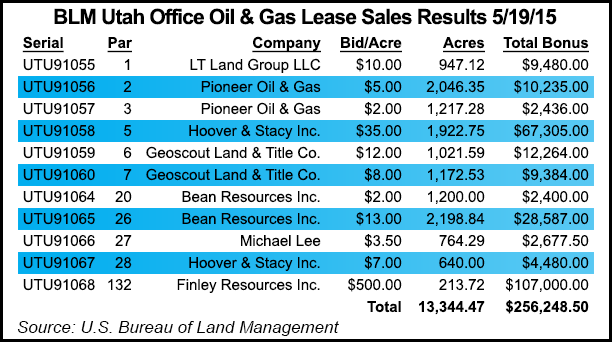

Bonus bids totaled $256,000 for 11 parcels covering 13,344 acres; 14 parcels had been offered.

In comparison, an auction held a year ago, before the global oil price crash, drew $2.84 million in bonus bids on 62 parcels covering 50,072 acres. In the November 2014 sale, bonus bids totaled $4.8 million for 64 of 65 parcels offered and 64,701 acres.

Results for the most recent sale, announced on Tuesday, grossed $20,023 in rental fees and $1,705 in administrative fees, which combined with bonus bids resulted in total receipts of more than $277,000. Proceeds are shared with the state and the county where the leased lands are located.

Fort Worth, TX-based Finley Resources Inc. submitted the highest total bid-per-acre ($500) and the highest bid-per-parcel ($107,000). Finley picked up Parcel 132, which is in the service area of BLM’s Vernal, UT, field office.

BLM said 79% of the parcels offered were sold and 13,344 of the 15,265 acres offered, or 87% of the acreage available. The average bid/acre sold was $19, and the average bid/parcel sold was $23,295.

In comparison, in the BLM quarterly sale last November, the highest bid/acre was $13,000, and the highest bid for a parcel was $1.99 million. The average acre sold last November was a little more than $75, and the average bid/parcel sold was $76,200.

The BLM West Desert District Office (WDDO) in Utah also announced that the competitive oil and gas lease sale that was scheduled for Aug. 18 has been postponed and combined with the Green River District Office (GRDO) auction that is scheduled for Nov. 17.

“In light of the relatively small number of potential lease parcels under consideration for the WDDO oil and gas lease sale that was scheduled for Aug. 18, 2015, combining that lease sale with the GRDO oil and gas lease sale scheduled for Nov. 17, 2015, is anticipated to improve efficiency by allowing for certain aspects of the workloads for the two lease sales to be consolidated,” the BLM said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |