Blizzard-Backed Eastern NatGas Gains Tackle Broader Losses; Futures Inch Higher

Next-day natural gas at most points was off about a nickel on Wednesday, but healthy gains in the Northeast ahead of Friday’s forecasted blizzard resulted in a miniscule national gain. The NGI National Spot Gas Average added 3 cents to $2.31, and the Northeast managed a gain of 23 cents.

Midwest quotes were lower as power prices proved unsupportive, and weather forecasts called for temperatures just slightly below normal. Futures trading was lackluster, but prices did manage to avoid the carnage in the crude oil pits and equity markets. At the close February was higher by 2.7 cents to $2.118, and March had risen 1.5 cents to $2.123. The expired February crude oil finished at $26.55, down $1.91, and the Dow Jones Industrial Average reversed steep early losses but still slumped 249 points to 15,767.

Next-day gas prices in the Midwest couldn’t find much help from either next-day power prices or the weather outlooks. AccuWeather.com forecast that Wednesday’s high in Minneapolis of 20 would rise to 24 Thursday before dropping to 19 on Friday, 5 degrees below normal. Chicago’s high of 23 was expected to reach 27 Thursday and climb to 31 Friday, the seasonal norm. Detroit’s high of 22 was seen reaching 26 Thursday and 29 by Friday, 2 degrees below normal.

Gas on Alliance came in 9 cents lower at $2.20, and deliveries to the Chicago Citygate fell 7 cents to $2.21. Gas on Michigan Consolidated was quoted 3 cents lower at $2.22, and packages on Consumers were seen down by 6 cents to $2.22.

Intercontinental Exchange reported that on-peak power Thursday for delivery to the Indiana Hub fell $2.72 to $25.75/MWh.

Forecasters are expending the big eastern snowstorm to bypass the area. “It will remain chilly around Chicagoland but it won’t be as brutally cold as it was to start the week,” AccuWeather.com reported. The early week’s arctic blast helped drop the month’s temperature to about 2 degrees below average through Tuesday.

“Temperatures will rise into the low 30s Fahrenheit by the weekend, with [wind chill] temperatures staying in the mid-20s,” AccuWeather meteorologist Dan Pydynowski said. “The potential major Northeast and Mid-Atlantic snowstorm will bypass Chicago allowing temperatures to moderate a little bit over the weekend across Chicagoland. A lake-effect band may bring a quick burst of snow across the city on Friday before a dry weekend.”

Marcellus points mostly held steady, but downstream deliveries on REX Zone 3 slipped. Gas on Tennessee Zn 4 Marcellus rose a penny to $1.36, and packages on Transco-Leidy Line were quoted unchanged at $1.40.

According to NGI‘s Rockies Express Zone 3 Tracker, next-day gas on REX Zone 3 in Illinois was quoted at $2.13 at several points, and that represented a drop of 4 cents into Midwestern Pipeline at Edgar County, IL, a slide of 5 cents for gas at the Moultrie County, IL junction with NGPL and a decline of 5 cents for gas on Trunkline at Douglas County, IL.

Mid-Atlantic prices got a shove lower from soft power prices as well. Intercontinental Exchange reported next-day peak power at the PJM West terminal retreated $4.55 to $34.68/MWh.

Gas bound for New York City on Transco Zone 6 fell 45 cents to $3.58, and farther south gas on Transco Zone 6 non-NY North fell 9 cents to $3.14.

Surveying the weather landscape a New York floor trader told NGI, “We could get a little pop off the weather up to $2.15 to $2.16, but I look for the market to trade sub $2 in the next seven to nine days. I’m looking near term for $1.95 to $2.00, but by April and May I expect $1.75 to $1.80.”

Once a major winter storm hits the East over the weekend, weather models then calculate a moderating pattern for next week, although the models are not in total agreement. In its Wednesday report, Commodity Weather Group (CWG) said “the models continue to converge on a significant winter storm for the Mid-Atlantic late on Friday into the weekend that could trigger some demand destruction associated with snow/wind-related power outages. Extra snow cover (maybe one-two feet in the Washington, DC, area) could enhance cold in the short-range for the East Coast cities, but we still see a broader moderating pattern for the six- to 10-day that focuses the warmest anomalies over the Midwest area and starting to get toward the Northeast too.”

In the 11- to 15-day period, CWG is showing a warmer pattern than Tuesday with a broad ridge of above normal temperatures centered over Illinois, Indiana, Ohio and Michigan. “The models are still mixed for next week with debates on some transient weather systems and a faster-moving, weaker cool to cold trough. The European ensemble then shows a fairly warm pattern dominating the 11-15 day.”

Analysts at Tudor, Pickering, Holt & Co. (TPH) see continued contraction in drilling activity and subsequent falling production. “Dry gas production declines in the U.S. are set to accelerate as a cash flow crunch combined with ever expanding leverage has all but shutdown activity. Over the last few weeks, our rig data shows that activity in the Haynesville, Fayetteville, Barnett, Pinedale and Piceance is down to around 25-30 rigs from a peak in 2015 of 95.

“Further, recent conversations with larger operators in these basins suggest activity may fall closer to 20 rigs in aggregate versus TPH macro model of 36. These basins represent approximately 17.5 Bcfe/d of aggregate supply with an estimated proved developed producing decline of 2-3 Bcfe/d. If assuming rigs are high-graded, we may only see a supply wedge of 1-1.5 Bcfe/d (50-75 MMcfe/d per rig per year), creating a supply decline of 1-2 Bcfe/d.” The current macro model assumes 1Bcfe/d.

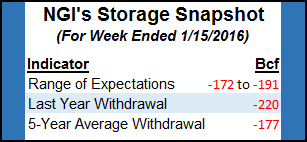

Production declines aren’t expected to have much impact on Thursday’s release of storage figures by the Energy Information Administration. Forecast withdrawals can’t hold a candle to last year’s 220 Bcf pull, but they are close to the five-year average of 177 Bcf. ICAP Energy is looking for a decline of 182 Bcf, and IAF Advisors predicts a withdrawal of 191 Bcf. A Reuters poll of 21 industry players revealed an average drop of 184 Bcf with a range from -172 Bcf to -191 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |