Markets | NGI All News Access | NGI The Weekly Gas Market Report

Blackstone Tries to Make Tallgrass a ‘Take Private’ Offer It Can’t Refuse

Tallgrass Energy LP (TGE) has received a “take private” proposal from private equity firm Blackstone offering to buy up the master limited partnership’s stock at a premium, management revealed late Tuesday.

The proposal, submitted by Blackstone Infrastructure Advisors LLC, offers $19.50/share in cash for all outstanding Class A shares representing limited partner interest in TGE. That’s a roughly 35.9% premium over Tuesday’s TGE closing price and a roughly 12% premium to the volume weighted average price over the last 30 days, management said.

Blackstone, along with its partners and affiliates, already holds around 44.2% interest in TGE.

TGE’s board plans to form a conflicts committee to evaluate Blackstone’s proposal. “The proposal constitutes only a preliminary indication of interest” and isn’t binding, management said.

The Leawood, KS-based TGE operates a portfolio of integrated midstream assets, including crude oil and natural gas transportation out of major producing regions in the Rockies, the Upper Midwest and Appalachia. The company owns and operates more than 8,300 miles of natural gas pipeline and more than 800 miles of crude pipeline, including key assets such as the 1,700-mile Rockies Express Pipeline (REX) and the 760-mile Pony Express crude oil line.

TGE’s stock price jumped higher on the news of Blackstone’s proposal, up more than 35% as of around 2 p.m. ET Wednesday. TGE’s stock has fallen in recent months, dropping from over $25/share as recently as April to just under $15/share earlier this week.

Analysts with Tudor, Pickering, Holt & Co. (TPH) viewed the timing of Blackstone’s proposal as surprising.

“While market expectations were that an eventual acquisition by Blackstone was arguably the most likely outcome, transaction timing comes as a surprise to us and we suspect a majority of midstream investors,” the TPH analysts said. “Consensus view was that Blackstone’s incentive to step in (and at a material premium to boot) was limited ahead of a 4Q2019/1Q2020 recontracting cycle on franchise assets Pony and Rockies Express.”

Given a slate of competing crude takeaway proposals out of the Rockies, “Pony Express tariff rates were likely to see material degradation risk to throughput as well given the sheer magnitude (TPH estimates an incremental 1.2 million b/d at full capacity) of infrastructure buildout,” the analysts said.

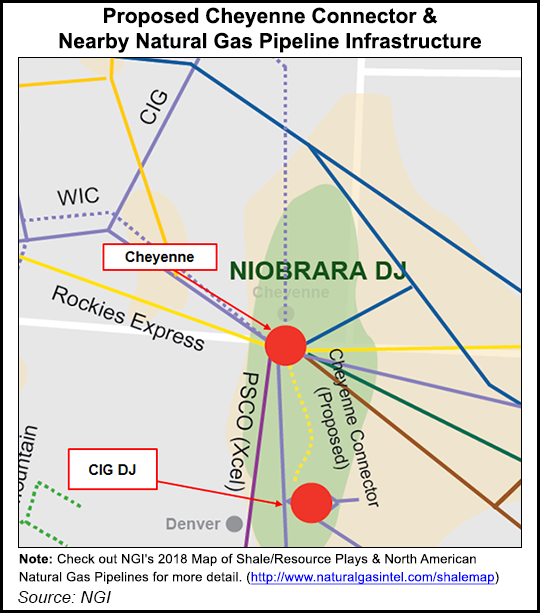

On the gas side, start-up for TGE’s proposed Cheyenne Connector and Cheyenne Hub expansions, aimed at tapping an additional 600,000 Dth/d from Weld County, CO, to move west-to-east on REX, has been pushed back to early next year on regulatory delays at FERC.

TGE management said during a recent 2Q2019 conference call that the delay to Cheyenne Connector and Cheyenne Hub does not affect ongoing efforts to re-contract west-to-east capacity on REX.

East Daley Capital Advisors has projected that the Cheyenne projects will enter service in 2Q2020, based on a September approval from the Federal Energy Regulatory Commission. This is on the expectation that the imminent departure of Democratic Commissioner Cheryl LaFleur will break a 2-2 deadlock at the agency, a deadlock that could explain recent inaction on ripe certificate decisions.

Cheyenne Connector and Cheyenne Hub would “provide much needed egress to DCP and Western Gas facilities as well as supply diversity to REX” by opening up access to volumes from the Denver Julesburg Basin, East Daley analyst Matt Lewis said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |