E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Blackstone Paying $2B For Permian Basin Gathering, Processing System

Midland, TX-based EagleClaw Midstream Ventures LLC and its sponsor, EnCap Flatrock Midstream, are selling the company to funds managed by Blackstone Energy Partners and Blackstone Capital Partners for $2 billion in cash.

Closing is expected by the end of July and includes $1.25 billion of financing provided by Jefferies LLC.

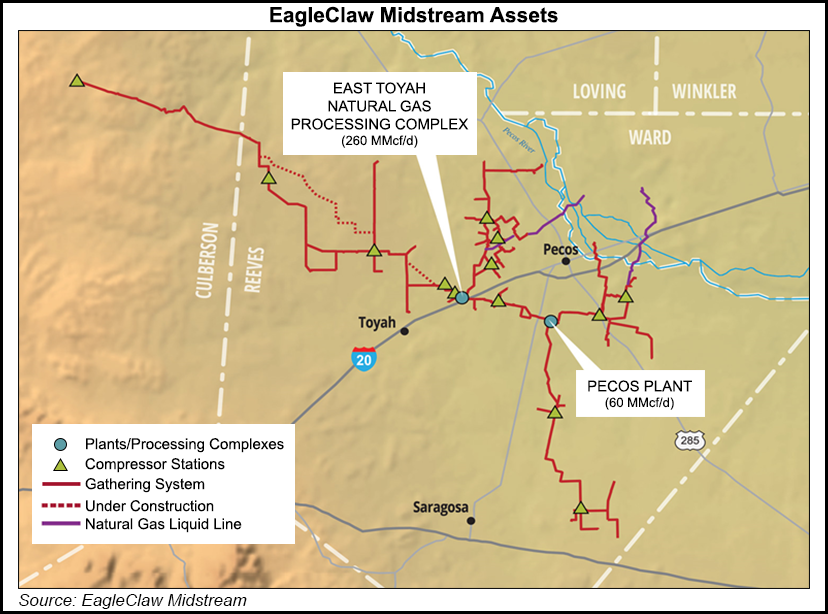

EagleClaw is the largest privately held midstream operator in the Permian Basin’s Delaware sub-basin in West Texas. Its assets are in Reeves, Ward and Culberson counties and include more than 375 miles of natural gas gathering pipelines and 320 MMcf/d of processing capacity with an additional 400 MMcf/d under construction. EagleClaw has long-term natural gas volume dedications from more than 220,000 acres.

EagleClaw said it will retain its name and operate as a Blackstone portfolio company. Management and most employees are expected to remain in their current roles.

“As we begin a new chapter, we will continue to deliver the same outstanding level of service our customers expect while we work with Blackstone to deploy additional capital and to expand our footprint in the Delaware Basin,” said EagleClaw CEO Bob Milam.

Last August, EagleClaw agreed to acquire PennTex Permian LLC from PennTex Midstream Partners LLC. Back in 2012, EnCap put up $100 million to fund the EagleRock venture.

Separately earlier this month, San Antonio-based Stakeholder Midstream LLC acquired the Lovington Gas Gathering System in the Northwest Shelf of the Permian from Lucid Energy Group.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |