Shale Daily | E&P | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report

Black Stone, XTO Look to Build Haynesville Output in East Texas

Houston-based Black Stone Minerals LP has clinched an incentive agreement with ExxonMobil’s XTO Energy Inc. to turn some wells online within a section of the Haynesville Shale in East Texas.

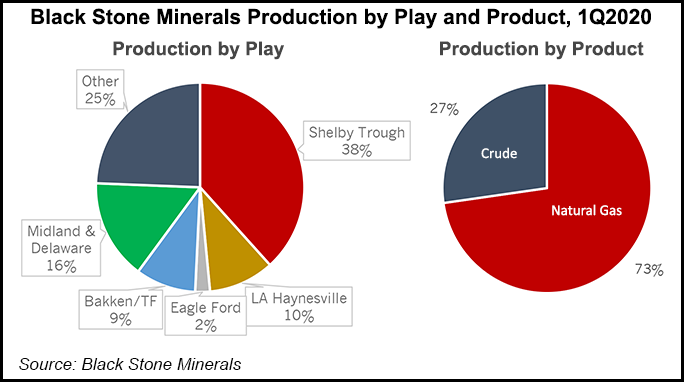

The agreement with XTO covers drilled but uncompleted wells, aka DUCs, in Black Stone’s Shelby Trough acreage in San Augustine County, which is part of the gassy Haynesville. The agreement would allow for royalty relief on 13 existing DUCs if XTO turns the wells online by the end of 1Q2021.

In addition to the agreement with XTO, Black Stone said it is “actively evaluating alternatives to encourage further development activity in the Shelby Trough in San Augustine, working with XTO and using its available acreage position and contractual rights to bring in a second operating partner.”

Black Stone recently completed a similar development agreement covering the Shelby Trough with Aethon Energy Management LLC in nearby Angelina County. Dallas-based Aethon, a private operator, was founded in 1990 and over the past few years it has become one of the Haynesville’s largest producers by making various deals to expand its acreage.

Black Stone owns mineral interests and royalty interests in 41 states. Earlier this month Black Stone secured two agreements to sell some Permian Basin mineral/royalty properties for $155 million.

Last month analysts with Raymond James & Associates Inc. said Black Stone’s production outlook continued “to improve with the market for natural gas (which we see reaching $4/MMBtu next year).” They also cited Black Stone’s low leverage and “enviable hedge book,” with more than 60% of 2020 oil and gas production hedged.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |