Bears Yawning Following EIA Storage Data

Natural gas futures worked lower after the release of government inventory figures showing an increase in working gas storage about in line with market expectations.

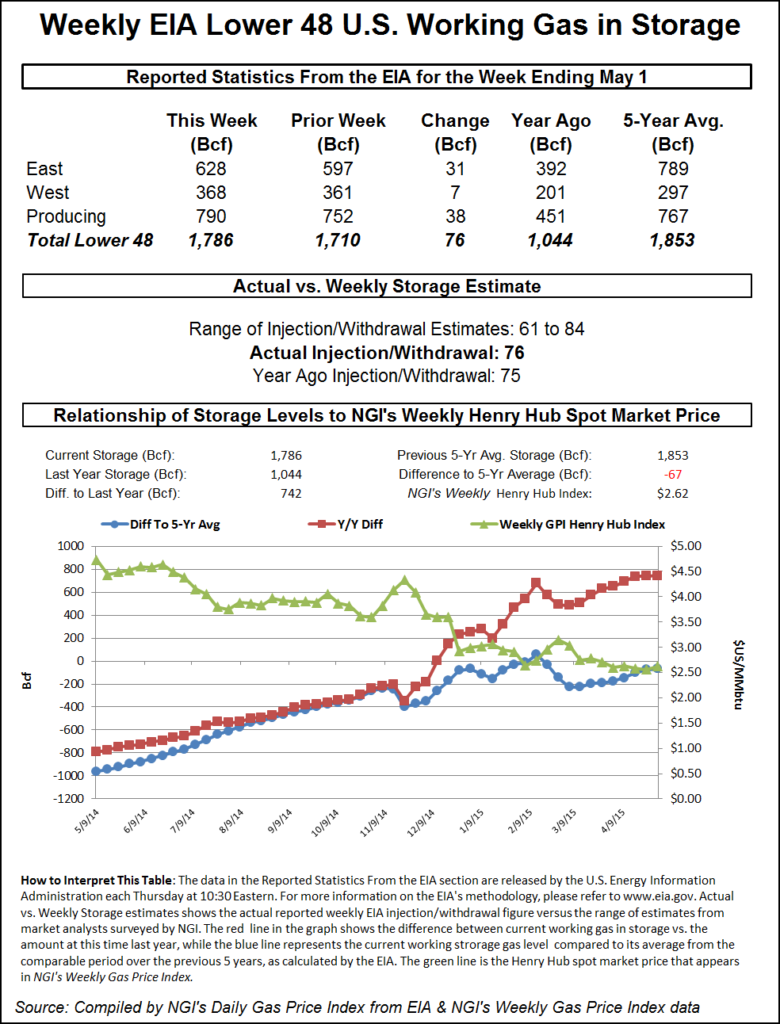

For the week ending May 1 the Energy Information Administration (EIA) reported an injection of 76 Bcf in its 10:30 a.m. EDT release. June futures fell to a low of $2.741 after the number was released and by 10:45 EDT June was trading at $2.754, down 2.2 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase close to, if not right at 76 Bcf. ICAP Energy calculated a 76 Bcf increase, and Citi Futures Perspective was looking for a build of 70 Bcf. IAF Advisors figured on a 75 Bcf injection.

“I had heard 75 Bcf as an average, and the range was 68 Bcf to 84 Bcf. The initial knee-jerk reaction was lower,” said a New York floor trader. “I think it was about in line with expectations and we are not seeing [prices] out of any of the ranges. We are literally right in the middle of the $2.50 to $3 trading range.”

The injection pace is expected to pick up considerably with next week’s inventory report. Tim Evans of Citi Futures Perspective forecasts builds of 131, 121, and 139 Bcf for the next three weeks.

Inventories now stand at 1,786 Bcf and are 742 Bcf greater than last year and 67 Bcf less than the five-year average. In the East Region 31 Bcf were injected and the West Region saw inventories increase by 7 Bcf. Stocks in the Producing Region rose by 38 Bcf.

The Producing region salt cavern storage figure was up by 14 Bcf to 223 Bcf, while the non-salt cavern figure increased 24 Bcf to 567 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |