Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

BCE-Mach Partners Stack Up More Oklahoma Opportunities in $320M Deal with Alta Mesa

Oklahoma City-based BCE-Mach III LLC has snapped up substantially all of the upstream oil and natural gas assets of bankrupt Alta Mesa Resources Inc. for $320 million, giving it a bevy of assets in the Midcontinent.

BCE-Mach III, the third partnership between Bayou City Energy Management LLC (BCE) and Mach Resources LLC, agreed to acquire the assets of Houston-based Alta Mesa, which filed for Chapter 11 protection last September.

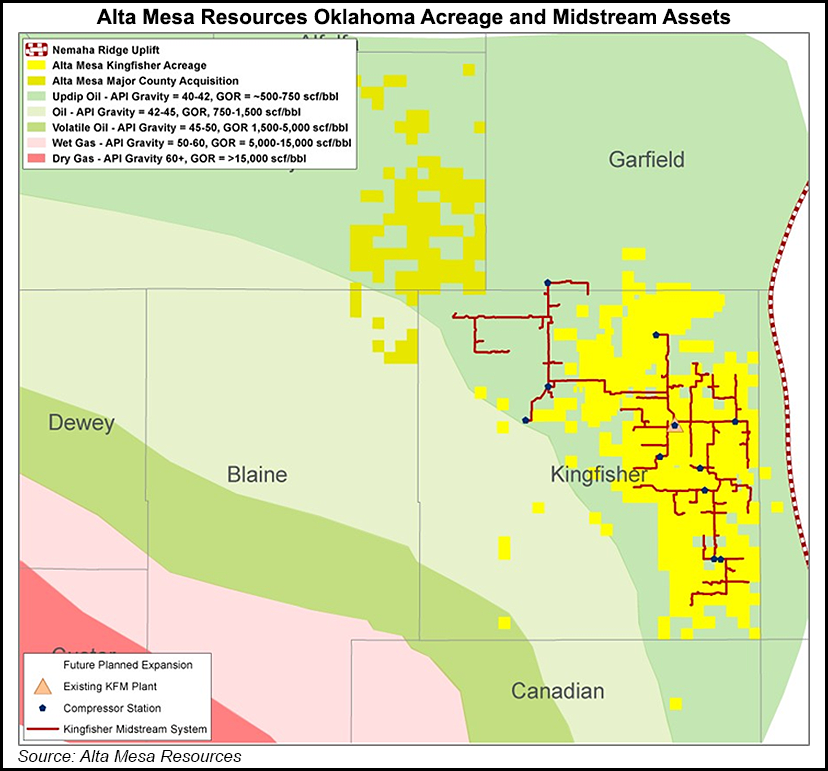

Alta Mesa, led by former Anadarko Petroleum Corp. CEO Jim Hackett, trained its talents on Oklahoma’s STACK, aka the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties.

“This was a unique opportunity to acquire a sizable cash-flowing asset with the supporting midstream infrastructure, through a bankruptcy process, in an area of our team’s expertise and still have an extensive inventory for future development,” said Mach CEO Tom L. Ward, the legendary wildcatter who founded the company. Ward also was one of the founders of Chesapeake Energy Corp. and SandRidge Energy Inc.

“Our strategic aim in partnership with BCE has been to aggressively consolidate and maximize underdeveloped, undercapitalized or otherwise distressed areas in the Midcontinent. We have been successful in buying assets at a discount, increasing production in a cost-effective manner and avoiding overspending. In a lot of ways, we have gone back to the fundamentals that were true when I began my career.”

The transaction, set to be completed in February, includes 30,000 boe/d of production, 900-plus operated wells and 130,000 net acres. The deal also includes around 72 million boe of proved reserves, natural gas processing capacity of 350 MMcf/d and 453 miles of gas gathering pipeline.

Also to be acquired from Alta Mesa are 157,000 barrels/day of produced water system capacity, 224 miles of water disposal pipeline, 108 miles of oil gathering pipeline and 50,000 bbl oil storage capacity.

“BCE is thrilled to be making another attractive acquisition in the Midcontinent in conjunction with Mach Resources,” said BCE founder Will McMullen. BCE has had drilling partnerships with Alta Mesa and Oklahoma City’s Chaparral Energy Inc.

“We know these particular assets well and are confident that the Mach team will be able to operate them in a manner suitable to the current macro environment, focused on maximizing free cash flow generation and delivering a sustainable, conservatively leveraged return to our investors,” McMullen said.

“We continue to be encouraged by the opportunities we see to further consolidate assets in the Midcontinent under the BCE-Mach banner.”

The acquisition represents the sixth by partnerships between BCE and Mach. To date, the BCE-Mach partnerships have made three acquisitions in the Mississippian Lime and two in the Anadarko Basin.

Once the latest transaction is completed, the BCE-Mach partnerships would have net production of 58,000 boe/d, interests in 5,700-plus wells and 500,000 net acres across the Midcontinent.

BCE-Mach III’s legal adviser is Kirkland & Ellis LLP, while UBS Securities LLC is financial adviser.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |