Regulatory | NGI All News Access

Ballot Initiative to Raise Oil, Gas Taxes Moves Ahead in Alaska

Alaska Lt. Gov. Kevin Meyer certified a ballot initiative last week that would end certain tax credits for oil and natural gas production in the state’s most prolific regions, and effectively increase tax rates.

The “Fair Share Act” would raise the alternative minimum gross tax on crude production to 10% at the point of production when the average Alaska North Slope (ANS) crude price is $50.00/bbl or less. If ANS crude prices exceed $50.00/bbl, the tax would increase by 1% for every $5 increase in the ANS crude price, but not exceed 15% in additional tax.

It would also eliminate the current $8.00/bbl tax credit and add an additional tax when a producer’s average monthly production tax value is $50.00/bbl or more.

The referendum only applies to production fields where output is 40,000 b/d or more during the previous calendar year, and where cumulative production is 400 million bbl or greater.

At those levels, the measure restricts the proposed tax changes to Alaska’s largest and most profitable legacy fields, proponents have said. That aspect of the initiative would also give smaller independent producers and newer developments an advantage and even the playing field, according to the bill’s sponsors.

A group of Alaskans — 163 certified signatories — led by attorney Robin Brena are behind the ballot initiative.

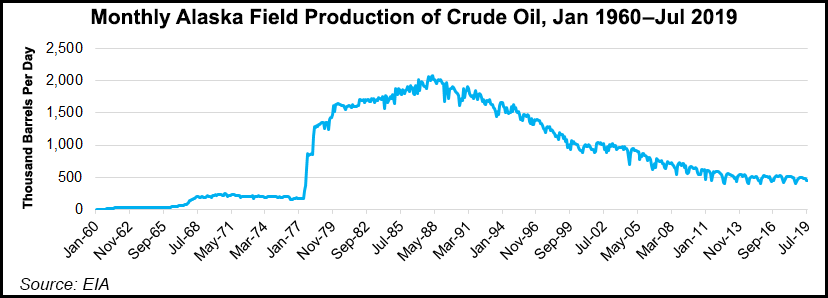

Some experts suggested last year that Alaska’s North Slope was poised to re-emerge as a major U.S. producing area.

“This proposed ballot measure is yet another flawed attempt to adopt complicated tax policy through the initiative process,” said Kara Moriarty, CEO of the Alaska Oil and Gas Association. “While the sponsors say it will not have any impact, make no mistake, no industry in Alaska can sustain a $1 billion plus tax hike without negatively impacting investment decisions for their business, which creates less opportunity for jobs for Alaskans.”

Since fiscal year 2015, the state’s oil and gas tax rate has been 35% of the value of production, but the legislation that established that rate — Senate Bill 21 — also offered several credits, according to the Alaska Department of Revenue’s Tax Division.

Now that it’s been certified, the initiative will need to gather 28,501 signatures to be voted on to appear on the next ballot. Signatures must be turned in before the 31st Legislature begins its second regular session on Jan. 21, 2020.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |