Bakken Shale | E&P | NGI All News Access

Bakken Rail Transport to Pick Up, State Official Says

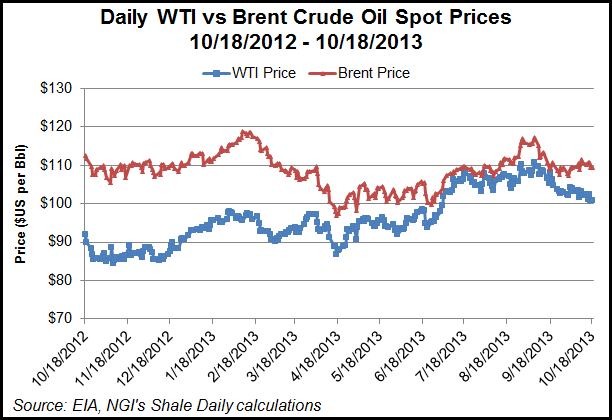

After several months of decline, rail transport of crude oil is likely to pick up during the rest of the year, according to North Dakota Pipeline Authority Director Justin Kringstad, who said the widening spread in global Brent and U.S. WTI oil prices will drive more shipments back to rail.

After converging in recent months, the Brent and WTI prices are “starting to go their own way again,” said Sandy Fielden, a senior analyst with RBN Energy LLC. “The Brent premium to West Texas Intermediate (WTI) last Friday was $9.14/bbl, indicating a new disconnect between U.S. crude prices and international levels.”

On a webinar earlier this month reporting the latest production statistics in North Dakota, Kringstad said there was a decline in rail transport of crude this summer as the Brent-WTI pricing spread tightened, particularly in July.

“[Brent-WTI difference] is really the driver when it comes to making a decision whether to put my barrel in a pipeline system or on a rail car,” Kringstad said. “The spread between the Brent and WTI has continued to widen since July [citing $8.69/bbl as of Oct. 14], so we may see some barrels start to move back toward the rail again.

“The spread is starting to widen again to the extent we are likely to see a move back to rail transport.” He said rail accounted for 61% of the Bakken shipments in August, or about 620,000-630,000 b/d.

Three years ago, Brent and WTI traded within $1 of each other, Fielden said, and then WTI began to trade at a discount to Brent, widening out to as much as a $28/bbl difference in November 2011. The spread averaged $18/bbl in 2012, and early this year the spread widened again to $23 and then came all the way back as the stockpile of crude at the Cushing, OK, hub fell steadily.

“During 2012 and early 2013 [with the wide Brent-to-WTI spreads] there was a boom in crude-by-rail movements to bypass Cushing, particularly from North Dakota to the Gulf, East and West coasts,” Fielden said.

The current “theme,” as Fielden calls it, has Brent prices “taking off on their own” while WTI prices are more in retreat with a U.S. domestic crude surplus. That surplus is likely to continue, particularly after the first of the year when the Cushing-to-Gulf Coast southern portion of the Keystone XL pipeline comes online, bringing another 700,000 b/d to the Texas Gulf Coast, Fielden said in Monday’s analysis on the Brent-WTI widening.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |