Bakken Shale | E&P | NGI All News Access

Bakken Curtailments Hit Northern Oil Earnings; Midstream Relief Expected Soon

Minnetonka, MN-based independent Northern Oil and Gas Inc. reported second quarter crude production curtailments on its Bakken Shale assets, which pushed the lease operating expenses higher.

“At its worst, we’ve seen the curtailments of 2,500 to 2,800 b/d,” said CFO Nicholas O’Grady during the second quarter earnings call, noting that the company curtailed another 800 b/d in July. Those curtailments led to a rise in lease operating expenses (LOE) to $8.21/boe in the second quarter from $7.60/boe in the second quarter of 2018.

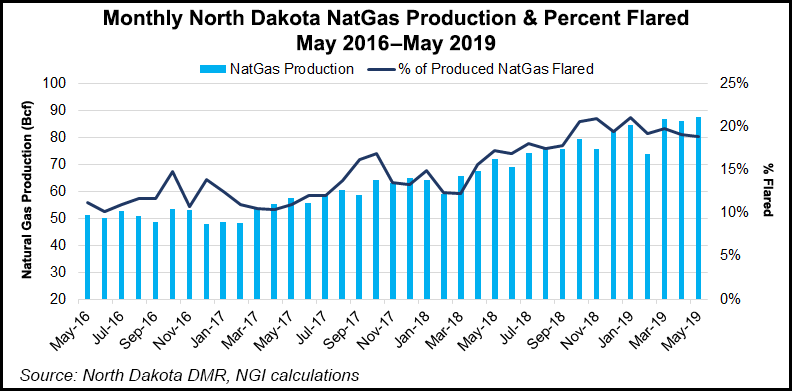

The company focuses on the Bakken and Three Forks formations in the Williston Basin in North Dakota and Montana, a production hotbed that has been dogged by infrastructure constraints and flaring challenges. The pipeline bottleneck and rise in flaring have led to voluntary production cuts by independent operators, as well as curtailments mandated by state regulators.

Natural gas liquids (NGL) pipeline expansion projects and gas processing plant expansions should alleviate the curtailments at the end of 2019 as they come online through the remainder of the year and into early 2020, management said.

The expansions should set the basin up for another three or four years of adequate processing and takeaway capacity, said CEO Brandon Elliott. “So, I would expect…when it’s all done that you’ll see NGL yields improve,” as well as gas pricing.

The increase in LOE is also in part because of the recently closed acquisition of Ven Bakken LLC for $165 million. The acquired properties include working interests in about 18,000 net acres consisting of 87.8 net producing wells, an additional 4.1 net wells in process, as well as 45.6 net undrilled locations.

Planned infrastructure expansions in the region combined with the Ven assets acquisition should lead to higher production in the third and fourth quarters of this year, management said.

The company’s 2Q2019 production was 34,965 boe/d, up by 66% from 2Q2018 production. Output is forecast to be 41,500-42,500 boe/d in the third quarter and 43,500-44,500 boe/d in the fourth quarter.

As the company touted a strong 2020 outlook backed by new infrastructure, it also announced that founder Michael Reger has stepped down as president. However, he is to remain chairman emeritus and assist in the transition under a consulting arrangement through next March.

“As Northern transitions to a primary focus of the return of free cash flow to shareholders, Mr. Reger’s entrepreneurial talents are best suited for a startup organization and we wish him the best of luck in his future endeavors,” said Chair Bahram Akradi.

NOG fired Reger as CEO position in 2016 following an investigation by the Securities and Exchange Commission for an alleged stock scheme, for which co-founder Ryan Gilbertson was later charged in 2017.

For 2Q2019, NOG reported net income of $44.4 million (12 cents/share), compared with a net loss of $96.5 million (minus 49 cents) a year ago.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |