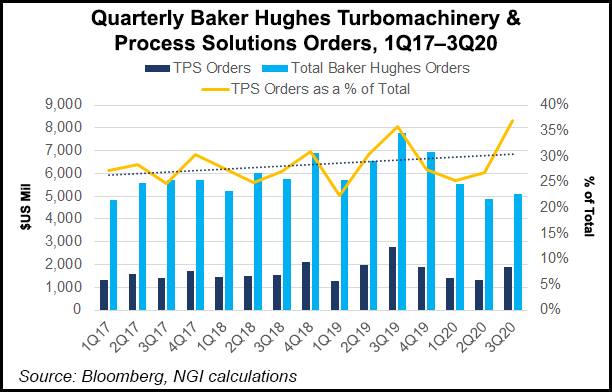

Lifted by a major natural gas order from longtime partner Qatar Petroleum, Baker Hughes Co. saw its revenue climb and equipment orders increase during the third quarter by 4% sequentially.

CEO Lorenzo Simonelli said he sees positives for natural gas, pointing to the major liquefied natural gas (LNG) order in Qatar. However, like his fellow oilfield services executives at Schlumberger Ltd. and Halliburton Co., energy demand has begun to flatten as Covid-19 snakes its way across the globe.

“After significant turmoil during the first half of the year, oil markets have somewhat stabilized,” Simonelli said. “However, demand recovery is beginning to level off and significant excess capacity remains, which could create volatility in the future.

“The outlook for natural gas...