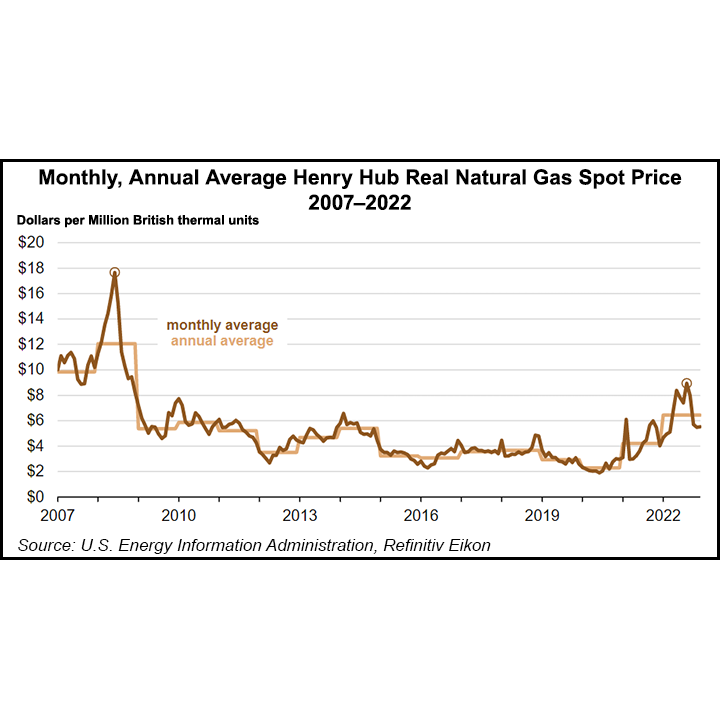

U.S. natural gas prices have had a remarkably soft winter so far, but the whole of 2022 tells a completely different story.

In 2022, the wholesale U.S. natural gas spot price at Henry Hub averaged $6.45/MMBtu, the highest level since 2008, according to the Energy Information Administration (EIA) based on data from Refinitiv Eikon.

This was up 53% from 2021, the fourth-largest year/year increase in natural gas prices on record, behind only 2000, 2003 and 2021. Volatility was also off the charts. On a daily basis, the Henry Hub spot natural gas price ranged from $3.46 to $9.85/MMBtu, EIA said.

Prices varied from quarter to quarter, with Covid-related issues and then Russia’s invasion of Ukraine heavily influencing pricing.

During the first quarter of 2022, declining U.S....