Jeremiah Shelor joined NGI in 2015 after covering business and politics for The Exponent Telegram in Clarksburg, WV. He holds a Master of Fine Arts in Literary Nonfiction from West Virginia University and a Bachelor of Arts in English from Virginia Tech.

Archive / Author

SubscribeJeremiah Shelor

Articles from Jeremiah Shelor

Natural Gas Futures Flop as Market Eyes LNG Weakness — MidDay Market Snapshot

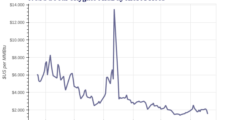

Amid signs of ongoing issues at a major U.S. LNG export terminal, and with physical market prices pointing to weak near-term fundamentals, natural gas futures were headed for heavy losses as of midday trading Wednesday. Here’s the latest: May Nymex futures down 13.2 cents to $1.680/MMBtu as of 2:11 p.m. ET Day-ahead Henry Hub prices…

Natural Gas Futures Pull Back Early as Market Continues to Mull Mild Temps, Weak Production

After advancing over the previous two sessions, natural gas futures pulled back in early trading Wednesday as mild shoulder season weather continued to dampen the outlook despite continued production restraint. The May Nymex contract, set to expire later this week, was down 5.3 cents to $1.759/MMBtu at around 8:45 a.m. ET. June was down to…

Mountain Valley Pipeline Submits In-Service Request as Project ‘Nearing Completion’

Nearly seven years after receiving federal certification to build its 303-mile, 2 million Dth/d natural gas conduit, Mountain Valley Pipeline LLC (MVP) has requested FERC authorization to place the project into service. MVP in a written request filed by its legal counsel Monday asked the Federal Energy Regulatory Commission to approve its in-service request by…

Natural Gas Futures Steady, Cash Mixed — MidDay Market Snapshot

Natural gas futures visited both sides of even through midday Tuesday as traders mulled less-than-inspiring forecasts and strengthening export volumes. Cash markets were mixed, with some chilly spring weather failing to have much impact on Midwest and Northeast prices. Here’s the latest: May Nymex futures up 0.7 cents to $1.798/MMBtu as of 2:08 p.m. ET…

May Natural Gas Futures Slightly Lower as Mild Forecast Pressures Prices

With the market continuing to balance near-term oversupply against longer term bullishness, natural gas futures moved slightly lower at the front of the curve in early trading Tuesday. The May Nymex contract was down 1.7 cents to $1.774/MMBtu at around 8:45 a.m. ET. June was off 1.7 cents to $2.048. A recently updated outlook from…

Natural Gas Futures Advancing as LNG Demand Picks Up — MidDay Market Snapshot

Rebounding export demand, including at the Freeport LNG terminal, helped natural gas futures carve out modest gains at the front of the curve through midday trading Monday. Here’s the latest: May Nymex futures up 2.3 cents to $1.775/MMBtu as of 2:15 p.m. ET; June up 5.9 cents to $2.047 “As we approach contract rollover later…

May Natural Gas Called Slightly Higher as Traders Eye Production, Cool Temps

Natural gas futures nudged higher early Monday as near-term heating demand and soft springtime production offered support for prices. The May Nymex contract was up 2.1 cents to $1.773/MMBtu at around 8:45 a.m. ET. June was up 2.5 cents to $2.013. Updated estimates Monday showed domestic production remaining steady at sub-100 Bcf/d levels. Bloomberg data…

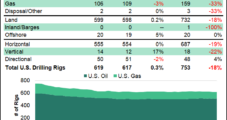

U.S. Down Three Natural Gas Rigs in BKR’s Latest Count

The U.S. natural gas rig count slid to 106 for the week ending Friday (April 19), down three rigs from the week prior and down 53 rigs year/year, according to the latest tally from oilfield services provider Baker Hughes Co. (BKR). The addition of five rigs in the oil patch lifted the combined U.S. rig…

Natural Gas Futures Treading Water to Close Out Week; Cash Mixed — MidDay Market Snapshot

Natural gas futures were essentially flat through midday trading Friday, with prices seemingly lacking direction amid the competing fundamental trends of sagging export demand and fading production. Here’s the latest: May Nymex futures off fractionally at $1.756/MMBtu at around 2:30 p.m. ET U.S. drops three natural gas rigs in latest Baker Hughes Co. count The…

Slight Pullback for Natural Gas Futures Early as Shoulder Season Balances in Focus

Natural gas futures eased lower at the front of the curve early Friday as the market continued to assess balances following updated storage data that landed in line with expectations. The May Nymex contract was down 2.6 cents to $1.731/MMBtu at around 8:30 a.m. ET. The U.S. Energy Information Administration (EIA) on Thursday reported a…