Richard Nemec began writing for NGI in 1995 and has 30 years experience in the energy industry. He holds BA from the University of Southern California, Los Angeles; and a MA in journalism from Northwestern University, Evanston, IL; and completed MBA courses at Northwestern's Evening Graduate School of Management.

Archive / Author

SubscribeRich Nemec

Articles from Rich Nemec

Henry Who? Mexico Still Searching For a Hub

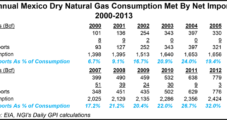

The prospect for substantial U.S. liquefied natural gas (LNG) exports and additional pipeline supplies being exported to Mexico raises questions about pricing mechanisms and the role of the Henry Hub, but it is still too early to determine what role, if any, Henry will have south of the border, an energy consultant with ICF International said Tuesday in Los Angeles.

Mexico Energy Reforms Offer Equal Amounts of Opportunity, Uncertainty, Say Experts

With its well-publicized national energy market reforms now in place, Mexico is going to offer big opportunities for the U.S. energy sector, but they are still wrapped in a bundle of uncertainties, a U.S. consultant and energy attorney told an industry audience Tuesday in Los Angeles.

California Drought Means Less Hydro, More Gas-Fired Power

With 58% of California now in exceptional drought conditions, the state’s source of hydroelectric power is down sharply, while reliance on natural gas-fired generation and renewables increased steadily during a dry period stretching back to 2011.

PG&E Finds More Email CPUC Violations; U.S. Attorney Investigates

Pacific Gas and Electric Co. (PG&E) on Monday told state regulators that more violations were uncovered in the company’s ongoing internal review of past email communications between former PG&E executives and the California Public Utilities Commission (CPUC). In addition, the U.S. Attorney’s San Francisco Office has begun an investigation of the ex parte communications violations.

Texas Boasts $174M in NGVs, Fueling Statewide

Like other areas of the country with plentiful supplies, Texas is cashing in on natural gas use in vehicles and the fueling infrastructure that goes with them. The Railroad Commission of Texas reported that to date there has been $174 million invested in natural gas vehicles (NGV) and fueling stations to support them in the state.

Second Joint Venture LNG Production Plant Set for Permian

With an initial plant slated to open early next year in the Eagle Ford Shale play, Stabilis Energy and Flint Hills Resources said Monday they plan to pursue a second joint venture (JV) by acquiring property in Odessa, TX, for development of another liquefied natural gas (LNG) production plant in Texas to service oil/gas field operations.

PG&E Urges Proposed $2B Penalty Aimed at Pipeline Safety, Not General Revenue

Undaunted by a series of public rebukes, Pacific Gas and Electric Co. (PG&E) late Thursday filed with the California Public Utilities Commission (CPUC), seeking to limit where the monies go from the upcoming penalties the utility will be ordered to pay for the 2010 natural gas transmission pipeline rupture in San Bruno, CA.

Mexico Establishes Oil, Gas Income Fund

Eyeing increased federal revenues from the opening of the nation’s energy plays to foreign investment, Mexico’s federal government recently established a special fund in the Bank of Mexico, the nation’s central bank.

Oxy Board Approves California Oil, Gas Spin-Off

Houston-based Occidental Petroleum Corp.’s (Oxy) board of directors on Thursday approved the spin-off of the company’s substantial California oil and natural gas business into an independent, separately traded unit, California Resources Corp. (CRC).

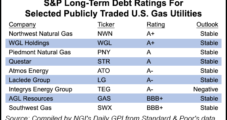

S&P Lowers Southwest Gas Ratings on Recent Purchase

Standard & Poor’s Ratings Services (S&P) gave a thumbs-down Thursday to Las Vegas, NV-based Southwest Gas Corp.’s ratings based on the natural gas-only utility’s purchase of some Canadian pipeline construction companies for more than $200 million.