Kevin Dobbs joined the staff of NGI in April 2020. Prior to that, he worked as a financial reporter and editor for S&P Global Market Intelligence, covering financial companies and markets. Earlier in his career, he served as an enterprise reporter for the Des Moines Register. He has a bachelor's degree in English from South Dakota State University.

Archive / Author

SubscribeKevin Dobbs

Articles from Kevin Dobbs

February Inflation Data Choppy, but Costs Contained Overall Amid Sagging Natural Gas Prices

Slumping natural gas prices offset festering high prices in other corners of the economy and helped to keep overall inflation mostly in check last month. The U.S. Department of Labor said Tuesday its Consumer Price Index (CPI) increased at a rate of 3.2% in the 12-month period through February. That was up from 3.1% the…

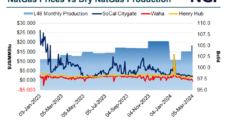

Canadian Natural Gas Supply Glut Hampers Prices – Yet Production Cuts Uncertain

Canadian natural gas production and storage are both elevated heading toward shoulder season – much like in the United States – and bearish pressure on prices persists. There are hints that exploration and production (E&P) companies may pull back, following the lead of their Lower 48 brethren and creating the potential for supply/demand balance this…

OPEC Cuts, Global Oil Demand Fuel Potential for Ongoing U.S. Associated Natural Gas Production

Steady global demand for crude and ongoing OPEC production reticence could motivate U.S. oil producers to keep output near record levels this year. In doing so, they could also continue to deliver robust amounts of associated natural gas from the Permian Basin, countering efforts elsewhere to curb supply in the face of low prices. The…

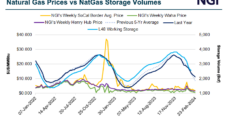

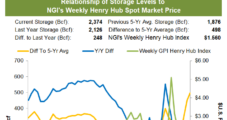

Lofty Natural Gas Storage Levels Keeping Ceiling on U.S. Prices – For Now

Natural gas in U.S. storage remains swollen, reflecting an exceptionally mild winter and record levels of production. The one-two punch weighed on prices through most of the heating season and raised concerns about an enduring bear market. Yet elevated supplies in storage may ultimately lose much of the current bearish bite. Prices see-sawed over the…

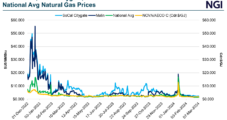

March Bidweek Natural Gas Prices Drop as Weak Weather Overshadows Production Cuts

Natural gas prices retreated in March bidweek trading as signs of declining production were eclipsed by paltry weather-driven demand and lofty levels of supply in storage. NGI’s March Bidweek National Avg. fell $1.710 month/month to $1.505/MMBtu. That was down from $2.870 a year earlier. Trading for the latest bidweek period spanned Feb. 23, 26 and…

April Natural Gas Futures Snap Win Streak Amid Swelling Storage Surpluses

Natural gas futures treaded lightly throughout Thursday’s session as traders weighed a seasonally weak storage result against continued signs of a pullback among producers. Following a three-day rally, the April Nymex gas futures contract ultimately settled at $1.860/MMBtu on Thursday, down 2.5 cents day/day. NGI’s Spot Gas National Avg. fell 9.0 cents to $1.480. Wood…

Natural Gas Futures Fail to Sustain Momentum After EIA Prints Lean Storage Result; Cash Called Lower

Natural gas futures treaded lightly throughout Thursday’s session as traders weighed a seasonally weak storage result against continued signs of a pullback among producers. At A Glance: EIA reports 96 Bcf withdrawal Output slips below 102 Bcf/d Weather demand set to fade Following a three-day rally, the April Nymex gas futures contract ultimately settled at…

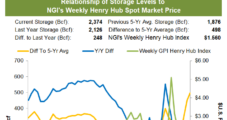

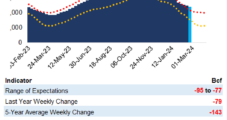

April Natural Gas Futures See-Saw Following Steeper-Than-Expected Storage Draw

The U.S. Energy Information Administration (EIA) on Thursday reported a withdrawal of 96 Bcf natural gas from storage for the week ended Feb. 23. The result exceeded market expectations for a pull in the high 80s Bcf and briefly boosted Nymex natural gas futures. Ahead of the 10:30 a.m. ET government print, the April futures…

With Production Lighter, April Natural Gas Futures Advance in Front Month Debut; Spot Prices Strengthen

Natural gas for delivery in April ramped up a third straight day, supported on Wednesday by lower production estimates and a late winter blast of frigid air across the nation’s midsection. At A Glance: 80s Bcf withdrawal expected Output holds near 102 Bcf/d Colder near-term conditions In its first session as the prompt month, the…

Weaker Output Not Enough to Send Off March Natural Gas Futures in Style

Natural gas futures were mixed on Tuesday, with the March contract off slightly amid light volume. But the April contract was boosted by bargain buying and a continued slide in production that could, if sustained, address supply/demand imbalance and bolster prices in the medium term. At A Glance: Output slips below 102 Bcf/d Solid but…