Jeremiah Shelor joined NGI in 2015 after covering business and politics for The Exponent Telegram in Clarksburg, WV. He holds a Master of Fine Arts in Literary Nonfiction from West Virginia University and a Bachelor of Arts in English from Virginia Tech.

Archive / Author

SubscribeJeremiah Shelor

Articles from Jeremiah Shelor

Strong Natural Gas Production Growth Continuing Not a Given, Says BP Analyst

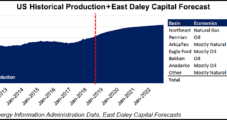

Innovation in the exploration and production (E&P) sector has helped drive rapid natural gas supply growth since last year, but the market shouldn’t assume this pace of growth will continue, according to BP North America Gas & Power’s Josh McCall, who directs fundamental analytics.

Capping Off Big Week for Bulls, Natural Gas Futures Steady; Appalachian Cash Falls

The natural gas futures market paused to reflect Friday after a furious run higher earlier in the week helped by strong physical prices, signs of early heating demand and lean stockpiles. In the spot market, shoulder season maintenance helped put the squeeze on producers in Appalachia heading into the weekend; the NGI National Spot Gas Average shed 2 cents to $2.58/MMBtu.

Southeast Sees Weekly NatGas Gains as West Texas Basis Collapses

Strong shoulder season prices in the Southeast and collapsing basis differentials in West Texas headlined the physical natural gas market during the week ended Sept. 21; the NGI Weekly National Spot Gas Average picked up 7 cents to $2.67/MMBtu.

Natural Gas Cash, Futures Mixed Friday Following Week of the Bulls

The natural gas futures market paused to reflect Friday after a furious run higher earlier in the week helped by strong physical prices, signs of early heating demand and lean stockpiles. In the spot market, shoulder season maintenance helped put the squeeze on producers in Appalachia heading into the weekend; the NGI National Spot Gas Average shed 2 cents to $2.58/MMBtu.

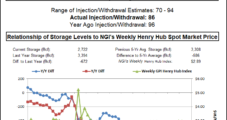

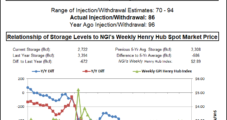

Market Awaits EIA Storage Number as October Natural Gas Steady

October natural gas futures were trading about 1.1 cents higher Thursday morning at around $2.919/MMBtu, hanging onto recent gains as the market turns its attention to the upcoming release of government storage data.

Equity Market Factors Driving ‘Relentless’ Natural Gas Supply Growth Expected to Continue

Going back to last year, natural gas production forecasts based on drilling fundamentals missed key signals from equity markets that had predicted the recent surge in Lower 48 supply, according to East Daley Capital’s Matthew Lewis, who directs financial analysis for the firm.

Permian NatGas Prices Plunge to New Lows as Pipes ‘Jam-Packed Like Southern California Traffic’

Constraints to the north and to the west have combined to clobber West Texas spot prices this week, including a new all-time low at the Waha hub, and analysts see more volatility on the way as Permian Basin producers wait on additional takeaway capacity.

Natural Gas Futures Rally Further as Storage Deficits Persist; West Texas Woes Continue

Natural gas futures showed some follow-through Thursday after rallying earlier in the week, with recent demand giving the market something to think about as the end of injection season nears. Constrained West Texas points continued to suffer in the physical market Thursday, while prices moderated in the Midwest and East; the NGI National Spot Gas Average fell 8 cents to $2.60/MMBtu.

West Texas Spot Woes Continue as Natural Gas Futures Rally Further

Natural gas futures showed some follow-through Thursday after rallying earlier in the week, with recent demand giving the market something to think about as the end of injection season nears. Constrained West Texas points continued to suffer in the physical market Thursday, while prices moderated in the Southeast; the NGI National Spot Gas Average fell 8 cents to $2.60/MMBtu.

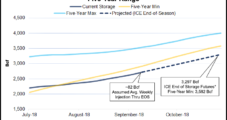

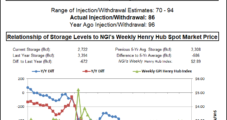

Natural Gas Futures Not Rattled as EIA’s Storage Number Surpasses Consensus

The Energy Information Administration reported an 86 Bcf weekly injection into working U.S. natural gas stocks Thursday that was…