Christopher joined NGI as a Senior Editor for Mexico and Latin America in November, 2018. Prior to that, he was a Senior Editorial Manager at BNamericas in Santiago, Chile. Based out of Santiago, he has covered Latin American energy markets since 2009 as a reporter, editor and analyst. He has an MA in International Economic Policy from Columbia University and a BA in International Studies from Trinity College.

Archive / Author

SubscribeChristopher Lenton

Articles from Christopher Lenton

North American Natural Gas Prices Look for Support Amid U.S. LNG Permit Freeze – Mexico Spotlight

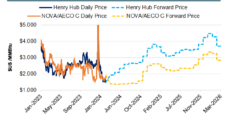

North American natural gas prices were subdued this week despite a boost from lower production and some lingering cold weather. On Thursday, the New York Mercantile Exchange contract for April settled at $1.683/MMBtu, down 1.6 cents on the day. As a comparison, NGI’s next-day Henry Hub traded Wednesday for Thursday delivery at $1.565, down a…

Mexico Presidential Hopeful Gálvez Looking to Transform Nation’s Energy Sector

Opposition candidate Xóchitl Gálvez promises to shake up Mexico’s energy sector if she wins the elections in June. Gálvez would respect the laws of competition as enshrined in the constitution, promote the domestic production of natural gas and renewable energy and work to develop a regional energy strategy, Rosanety Barrios, the head of her energy…

Chevron’s Guyana Mega-Deal Facing Hurdles as Oil, Natural Gas Industry Consolidates

ExxonMobil is trying to put a stop to Chevron Corp. and its bid to enter the lucrative Guyanese offshore oil and natural gas patch. The company has filed for arbitration, claiming Chevron’s bid to snap up Hess Corp.’s Guyana assets goes against a contract clause that grants ExxonMobil a right of first refusal. Last October,…

North American Natural Gas Prices in Doldrums After Warm Winter – Mexico Spotlight

North American natural gas futures gained some ground on Thursday but overall, prices continued to languish. After six straight sessions of losses, the New York Mercantile Exchange contract for April rose on Thursday by 8.3 cents/MMBtu day/day to settle at $1.741. There was little room for optimism, though, for natural gas bulls. AccuWeather said the…

Amid Oil and Natural Gas Consolidation Frenzy, Chevron’s Guyana Mega-Deal Facing Hurdles

ExxonMobil is trying to put a stop to Chevron Corp. and its bid to enter the lucrative Guyanese offshore oil and natural gas patch. The company has filed for arbitration, claiming Chevron’s bid to snap up Hess Corp.’s Guyana assets goes against a contract clause that grants ExxonMobil a right of first refusal. Last October,…

Mexico Natural Gas Market Undergoing Restructure Amid Sub-$2 Prices – Spotlight

North American natural gas prices got a bump earlier in the week when top U.S. producer EQT Corp. announced it was curtailing output, but the rally was short-lived. On Thursday, the New York Mercantile Exchange contract for April settled at $1.818/MMBtu, down 11.1 cents day/day. Mexico pipeline imports of natural gas for the 10-day period…

Paramount Resources Shuttering Some Montney Dry Natural Gas, Reducing ‘24 Forecast

Western Canada independent Paramount Resources Ltd. has curtailed some of its natural gas production in Western Canada amid the low price environment. The independent, whose development is focused in the Montney Shale region, has shut in dry gas production and reduced its forecast 2024 average sales volumes by about 2,250 boe/d. The “company continues to…

Crescent Point Limiting AECO Exposure, Hedging Natural Gas Volumes Amid Portfolio Retool

Canadian independent Crescent Point Energy Corp. is moving its natural gas exposure away from the AECO price point. The company has reduced its AECO exposure to about 20% of production, management said in its fourth quarter earnings call. AECO often trades at a discount to more lucrative markets such as the U.S. Midwest and Gulf…

CFE Looking to Develop Texas Natural Gas Storage as Mexico Import Needs Mount — Spotlight

Mexico’s Comisión Federal de Electricidad (CFE) wants to develop natural gas storage in South Texas in time for new industrial projects in Mexico that would require stable and increased shipments from the United States. CFE’s international marketing arm, CFE International, has issued a request for proposals (RFP) from interested parties. The RFP is seeking proposals…

Natural Gas Price Volatility? For Ovintiv, Efficiencies and Hedging Poised as Shield

Denver-based Ovintiv Inc. has set up its year to avoid natural gas price swings through a hedging program that covers about 50% of volumes. The independent, which operates across the Anadarko, Permian and Uinta basins, as well as the Montney Shale in Western Canada, has a base Nymex price assumption of $2.50/Mcf for 2024. “More…