Alex Steis joined the staff of NGI in June of 2000. He received his bachelor's degree in Business Management from Syracuse University in New York in May of 2000.

Archive / Author

SubscribeAlex Steis

Articles from Alex Steis

Penn Virginia Closes Devon Eagle Ford Deal, Eyes Extended Reach Laterals

Penn Virginia Corp. reported Tuesday that it has completed its acquisition of Eagle Ford Shale assets located primarily in Lavaca County, TX from Devon Energy Corp. for $205 million in cash.

Physical NatGas Trading A Mixed Bag While September Futures Jump 20 Cents

Physical natural gas trading for the week ended Aug. 11 was a tale of two stories, as Northeastern, Appalachian and Californian price points were predominantly in the red on moderating temperatures and pipe constraints, while the rest of the country’s locations inched higher from a couple of pennies to nearly a dime.

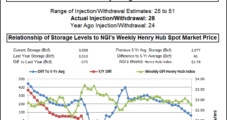

Bullish Storage Build Puts Pressure on $3 Natural Gas

Natural gas futures bulls received a dose of supportive fundamentals Thursday morning as the Energy Information Administration reported that a less-than-expected 28 Bcf was injected into underground storage for the week ended Aug. 4.

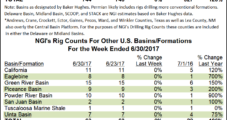

Rigs Finish June at a Steady Clip; All Eyes on Permian

U.S. oil and gas rig activity remained pretty steady during the last week of June as those in search of oil declined by two to 756, while those drilling for natural gas added one to 184, according to data from Baker Hughes Inc.

U.S. Oil & Gas Rig Count 118% Higher Than a Year Ago

U.S. oil and gas rig activity remained pretty steady during the last week of June as those in search of oil declined by two to 756, while those drilling for natural gas added one to 184, according to data from Baker Hughes Inc.

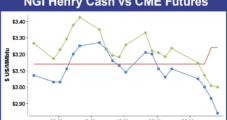

Down Again? Physical, Financial NatGas Suffer Heavy Weekly Losses

Natural gas price bulls might like to forget the short trading week ending June 2 as moderate temperatures combined with bearish storage data to produce a sea of red in terms of price losses in both the physical and futures natural gas arenas.

Lack of Heat Results in Across-the-Board Natural Gas Price Drops

Natural gas cash and futures traders were seeing a lot of red during the short week as moderate temperatures combined with bearish storage data to produce double-digit losses across the physical market and the financial screen.

Bears Double Up on Storage Injection, Reclassification; Futures Break Below $3

Natural gas futures bears were large and in charge Thursday morning after digesting a larger-than-expected storage injection report, which appeared even larger thanks to a reclassification from working gas to base gas.

Natural Gas Growth in Power Generation Stack Expected to Continue, NGSA Study Finds

Natural gas has played and will continue to play a critical role in power generation within the United States, regardless of what the Trump administration does with the Clean Power Plan (CPP), according to a new study conducted by Pace Global and commissioned by the Natural Gas Supply Association (NGSA).

CPP or Not, NatGas Seen as Critical in Power Generation Future, Study Finds

Natural gas has played and will continue to play a critical role in power generation within the United States, regardless of what the Trump administration does with the Clean Power Plan (CPP), according to a new study conducted by Pace Global and commissioned by the Natural Gas Supply Association (NGSA).