Andrew joined NGI in 2018 to support coverage of Mexico’s newly liberalized oil and gas sector, and his role has since expanded to include the rest of North America. Before joining NGI, Andrew covered Latin America’s hydrocarbon and electric power industries from 2014 to 2018 for Business News Americas in Santiago, Chile. He speaks fluent Spanish, and holds a B.A. in journalism and mass communications from the University of Minnesota.

Archive / Author

SubscribeAndrew Baker

Articles from Andrew Baker

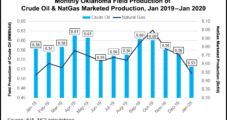

Oklahoma Approves Relief Measure to Protect E&Ps Amid Coronavirus, Low Oil Prices

The Oklahoma Corporation Commission (OCC), the state’s oil and gas regulator, on Wednesday approved a relief measure allowing operators to shut-in production without losing their lease rights.

Mexico’s AMLO Downplays Severity of Crude Collapse Despite Pemex Downgrade, Negative Prices

Despite a punishing sequence of events over the last few days for Mexico and state oil company Petróleos Mexicanos (Pemex), President Andrés Manuel López Obrador on Tuesday downplayed the potential impacts of current market turmoil.

NGI The Weekly Gas Market Report

May WTI Plunges Negative in Historic Intraday Rout as U.S. Crude Storage Nears Capacity

The May West Texas Intermediate (WTI) crude oil futures contract plunged into negative territory Monday, reflecting an unprecedented surplus of oil and lack of demand amid the Covid-19pandemic.

More Lower 48 Shut-Ins Appear Imminent as May WTI Settles Deep in Negative Territory

The May West Texas Intermediate (WTI) crude oil futures contract plunged into negative territory Monday, reflecting an unprecedented surplus of oil and lack of demand amid the Covid-19 pandemic.

Lower 48 Oil, Gas Permitting Expected to ‘Collapse in April’ Amid Pandemic

Having already plunged by 62% year/year (y/y) in the first three months of 2020, permitting for Lower 48 oil and natural gas drilling is expected to drop further in April, according to a team of Evercore ISI analysts led by James West.

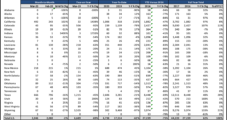

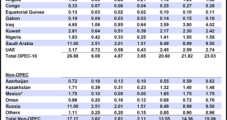

IEA Sees Record Decline in Global Oil Demand, but OPEC More Optimistic; U.S. Shale Patch in Crosshairs

Citing global Covid-19 containment measures that have brought mobility “almost to a halt,” the International Energy Agency (IEA) said Wednesday it expects year/year (y/y) global crude demand to fall by a record 9.3 million b/d in 2020 to 90.5 million b/d after nearly a decade of growth.

IEA Says Timing ‘Could Not Be Worse’ for Mexico Oil Production Push

Although oil production in Mexico has begun to inch upward after years of steady decline, “the timing could not be worse,” according to the International Energy Agency (IEA).

Ring Energy in Deal to Sell Permian Delaware Acreage

Ring Energy Inc. said Tuesday it has entered a deal to sell a portion of its Permian Basin acreage to an undisclosed party for $31.5 million.

Higher Mexico Natural Gas Prices Likely as U.S. Gas Seen Surpassing $3; Covid-19 Seen Impacting 0.5 Bcf/d of Mexico Demand

U.S. natural gas operators are beginning to regain control of the market and could see prices move “sustainably” above $3.00/Mcf as the U.S. oil supply declines, with Mexico prices poised to follow suit, according to analysts and historical price data.

May WTI Sheds 35 Cents Despite Historic OPEC Supply Agreement

U.S. oil prices reacted tepidly on Monday to an agreement by the Organization ofthe Petroleum Exporting Countries (OPEC) and its allies to slash output by an unprecedented 9.7 million b/d during May and June, illustrating the formidable challenge posed to the market by the Covid-19pandemic.