NGI Archives | NGI All News Access

Australia’s Amadeus Acquiring Eagle Ford-Focused Lonestar Resources

Australia’s Amadeus Energy Ltd. plans to acquire Fort Worth, TX-based Lonestar Resources Inc. — a player in the Eagle Ford, Bakken and Barnett shales — via the purchase of Lonestar’s holding company, Ecofin Energy Resources Plc of the United Kingdom.

The deal, which requires the approval of Amadeus shareholders, “combines Amadeus’ low-risk conventional oil and gas portfolio and strong balance sheet, with Lonestar’s high-growth unconventional assets focused on the Eagle Ford Shale,” said Amadeus Chairman Craig Coleman. “Lonestar’s U.S.-based management team brings extensive technical, operational and financial experience in running successful U.S. oil and gas businesses in North America’s most established energy basin with a growth focus on the Eagle Ford Shale.”

Perth-based Amadeus owns long-life, proved and producing oil and gas fields and exploration leaseholds in 21 counties and parishes in Louisiana, Oklahoma and Texas.

Lonestar’s portfolio is largely concentrated in the Eagle Ford crude oil and condensate window. The properties comprise a 51% working interest (WI) in the currently producing Beall Ranch property, as well as the development-ready Asherton and Gonzo properties, both of which are held on a 100% WI basis, Amadeus said.

Lonestar’s other producing asset is Woodlands Estate in the Barnett Shale (75% WI). Lonestar also holds a 65% WI in 32,625 net acres in a prospective part of the Williston Basin, where it has tested light oil from vertical completions in the Bakken and Three Forks formations. Lonestar has more than 5,000 acres prospective for the Eagle Ford in Dimmit, La Salle, and Wilson counties, TX.

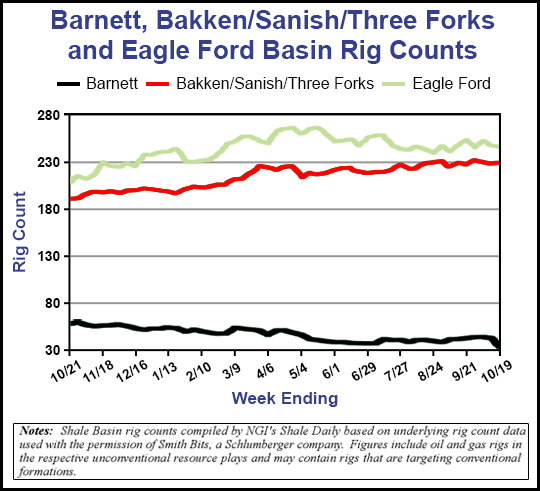

The Eagle Ford and Bakken/Sanish Three Forks are the most active shale plays in the United States, with a combined 473 unconventional rigs in operation last week, according to NGI‘s Shale Daily Unconventional Rig Count. There were 243 rigs in the Eagle Ford, up from 209 a year ago, and 230 in the Bakken, up from 192 last year. The Barnett operates on a smaller scale, with 36 rigs in the play last week, down 38% from 58 rigs last year.

Pro-forma combined proved (1P) reserves as of June 30 are 12.7 million boe and pro-forma combined proved and probable (2P) reserves are 18.4 million boe, with 65% of pro-forma 2P reserves being crude oil, condensate and natural gas liquids. Pro-forma combined average production was 2,887 boe/d for the three months ended Sept. 30 and is expected to increase to 3,300-3,800 boe/d as of Dec. 31.

As of June 30, Lonestar had 1P reserves of 8.1 million boe, comprising 59% liquids, and 2P reserves of 11.8 million boe, comprising 57% liquids. Lonestar is currently producing oil and gas at a rate of 2,011 boe/d.

Current Lonestar CEO Frank D. Bracken III would assume the role of managing director after completion of the deal. “We believe that the combined company creates a well capitalized platform upon which Lonestar plans to substantially accelerate its business plan, which calls for the acquisition and development of operated leasehold in our primary focus area, the Eagle Ford Shale,” Bracken said.

Amadeus will issue 460 million new ordinary shares to the current owners of Ecofin Energy, including Ecofin Water & Power Opportunities plc and a number of senior executives of Lonestar. A further 40 million shares will be issued to the current owners of Ecofin Energy within 18 months of deal completion subject to conditions.

Earlier this year Lonestar sought but failed to combine with Eagle Ford player Eureka Energy Ltd. of Australia (see Shale Daily, June 14; June 11).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |