LNG | Infrastructure | LNG Insight | Markets | NGI All News Access | NGI The Weekly Gas Market Report

Australian Natural Gas Auctions Said Competitive Even as Bigger Players Dominate

Spot prices in Eastern Australia’s domestic natural gas auctions generally are close to marginal supply prices even though three large firms dominate the markets, according to a market expert.

Regulated auctions with bids and offers set the daily prices for wholesale gas in four eastern Australian markets, with prices typically a netback to Asian liquefied natural gas (LNG) spot prices, said Rice University doctoral student Kelly Neill of the Center for Energy Studies at the Baker Institute for Public Policy.

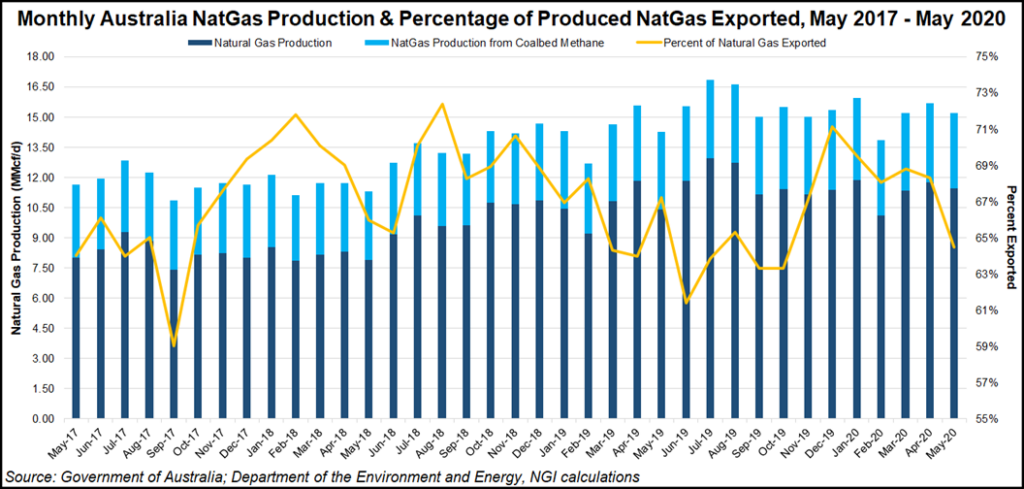

The wholesale prices follow spot LNG prices because the supply is mostly from coalbed methane and coalseam producing regions that were primarily developed to send feed gas to three export facilities in Queensland, Neill said. If the gas is not sold domestically, it presumably could be sold into the LNG spot market.

Neill, who focuses her studies on Australia’s wholesale domestic gas markets, made her comments during a Baker Institute webinar last week.

“My research is about the daily wholesale auctions, which can be thought of as spot prices for wholesale gas inside the city gates,” Neill told NGI after the presentation. “These are not the prices that retail customers pay, but the prices that auction participants pay to trade wholesale gas with each other.”

There are concerns that three larger vertically integrated companies — Origin Energy Ltd., EnergyAustralia Pty. Ltd. and AGL Energy Ltd. — have the power to move prices in their favor in the eastern market.

Neill said the three companies control about three-quarters of the supply in the eastern markets and have major retail arms in those markets, giving them strong positions as buyers and sellers. However, because they have dual positions as buyers and sellers, they often compete against each other in auctions. The price signals are comparable to more competitive markets that reflect marginal prices plus small profits, she said.

“It’s not necessarily the case that prices will be high even though there are three large players dominating the market, and that’s because on any particular day the large players might be either a net buyer or a net seller.”

Essentially, she said, the auctions “are the large companies competing to buy and sell amongst each other, and there’s some large buyers and there’s some large sellers as well, and what happens is that the overall impact on the price sort of balances out.”

Most of Australia’s LNG production capacity is along its northwestern coast, but the eastern and western domestic markets are separate because there are no pipelines that traverse the vast, sparsely populated areas between the markets.

Four gas hubs in eastern Australia hold mandatory auctions overseen by regulator Australian Energy Market Operator (AEMO) in the cities of Sydney, Adelaide and Brisbane, and the state of Victoria, the largest hub because it includes the cities of Melbourne and Canberra. There is also a voluntary hub at Wallumbilla, but it does not have much liquidity.

The auctions determine the prices at each hub through bids and offers. They are held to provide price signals as Australia has nothing close to a true liquid gas market, such as the Henry Hub in the United States, Neill said.

Companies must meet regulatory criteria to provide bids and offers in the auctions.The Victoria market has the largest number of approved participants at 15, while others have a handful, Neill said. In addition to the three larger firms, having a few smaller firms participating in auctions would not necessarily help price discovery. The smaller firms have less supply and fewer customers, and could be more susceptible to the market positions of the larger companies, Neill said. If there were enough smaller firms, it would overcome the influence of the larger firms, she said.

All four hubs tend to move together in line with spot LNG prices, but they do not have the same prices, she said.

Before the Queensland LNG export projects ramped up in 2014-16, much of eastern Australia’s gas demand was met by offshore production in the Bass Strait off the southeastern coast, “but that supply has been declining over time so our reliance on the gas coming from the LNG plants has increased,” she said.

Domestic Price Concerns

However, there are concerns that domestic users have been paying too much for their gas. The Australian Competition and Consumer Commission (ACCC) in January said in the 12-month period to April 2019, average price offers from Queensland producers “were broadly in line with expected 2020 LNG netback prices.”

But falling LNG prices since mid-2019 “have not been reflected in the averages of producer prices offered in Queensland,” the ACCC said. The ACCC said in some cases it reflected a fixed price component by some LNG producers in addition to a spot LNG-linked component. Plans are to study the matter further.

Prices offered by producers last year for 2020 domestic supply largely remained in the range of AU$9-10/gigajoule (GJ), the ACCC said, which under current exchange rates would be about $6.65-7.38/MMBtu. By last August, producer price offers were almost 25% higher than expected 2020 LNG netback prices, the agency added.

Neill said this doesn’t contradict her findings because the ACCC is “almost certainly talking about long-term contract prices.” The three larger firms in the auctions generally don’t produce gas and procure it via long-term contracts with producers. They also have contracts with pipeline operators to move the gas to the hubs. “So my research is indicating that the spot prices in the auctions are likely to be close to the marginal cost under these contracts.”

The ACCC data showed that the prices offered by producers are higher than the spot LNG netback by an amount that is slightly less than the cost of pipeline transportation from Queensland to the southern markets, she said. “I think that such a price is in line with what we should expect in a working market when the general direction of gas flow is from Queensland to the south.”

Neill said that the ACCC’s concerns about price offers being higher than the LNG netback in late 2019 are “fair enough, but I think that in general they are not too bad.”

The three larger companies’ commodity costs have increased as initial low-priced legacy supply contracts have expired, from an average cost of AU$4/GJ in 2015 to AU$6.50/GJ in 2018, the ACCC said. The average prices under contracts signed from early 2017 to August 2019 were AU$8.50-9/GJ. Low-priced legacy contracts will account for less than 20% of the three companies’ supplies by 2021, the agency said.

The three companies should be able to absorb the increases in their gas costs as those legacy contracts expire, the ACCC said. Last July, the agency analyzed the costs and margins of AGL, EnergyAustralia and Origin in supplying gas to the east coast “and found that the margins of these retailers between 2014 and 2018 period were well in excess of what we would expect,” it said.

Average margins for wholesale supplies were 19-23%, and for sales to the commercial and industrial sectors the margins grew in the period from 13% to 28%, the ACCC said.

Neill agreed that the profit margins “seem high,” but said those are for the three larger companies’ overall retail businesses and don’t represent prices for wholesale gas within city gates.

It is unclear to what extent the Covid-19 pandemic may have lowered eastern Australian domestic prices. Prices at the Victoria hub were about AU$5-6/GJ Tuesday, compared with about AU$8/GJ on the same day last year, according to an AEMO bulletin board.

Queensland producers currently have enough production to serve both the export and domestic markets this year, but adequately supplying the domestic market could be in doubt without additional infrastructure because of declining reserves, the ACCC said.

This year’s demand for long-term LNG export contracts in eastern Australia is expected to total 1,294 petajoules (PJ), or 1.364 Tcf. Eastern domestic demand is expected to total 537 PJ, the ACCC said, which would leave an additional uncommitted supply of 138 PJ available for either export or domestic use.

The three LNG plants in Queensland sell almost all their supplies under long-term deals with Asian customers, Neill said.

The domestic supply outlook for 2021-2031 “remains uncertain” and eastern markets could face a supply shortfall in the medium term unless there is additional development in southern Australia, more pipelines are built to bring gas from Queensland or the Northern Territory southward to major markets, or one or more LNG import terminals are developed, the ACCC said.

Queensland reserves were downgraded by more than 4,400 PJ from July 2017 to June 2019, it said. “Concerns about the adequacy of future gas supply are exacerbated by the blanket moratoria and regulatory restrictions in some states and territories which inhibit further gas exploration and development of new gas resources, especially in Victoria and New South Wales.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |