August Natural Gas Futures Tumble on Lower LNG Feed Gas Volumes

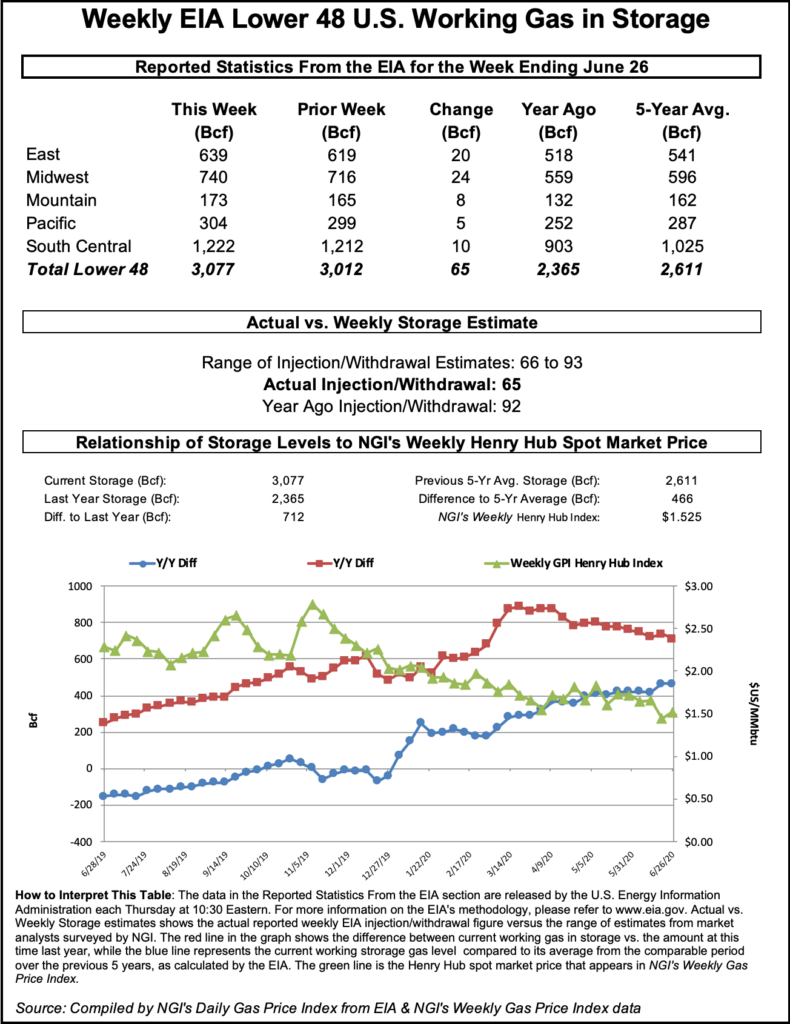

- BREAKING: U.S. EIA reports injection of 65 Bcf for the week ending June 26

- LNG feed gas demand was down notably Wednesday

- Forecasts continued to call for strong heat through mid-July

- Markets will next turn to Thursday’s storage report

Natural gas futures lost momentum Wednesday following two days of solid gains, after a disappointing drop in liquified natural gas (LNG) feed flows amplified concerns that supply/demand balances are largely dependent on extreme heat.

The August Nymex contract declined 8.0 cents day/day and settled at $1.671/MMBtu. September fell 6.8 cents to $1.721. The August contract had gained more than 20 cents over the two prior trading days on forecasts for robust heat.

NGI’s Spot Gas National Avg. dropped 9.5 cents to $1.490.

Genscape Inc. estimated early Wednesday that U.S. LNG feed gas demand was down to 3.1 Bcf/d, a 1.1 Bcf/d day/day decline. The firm cited “mounting cargo cancellations for this July and August,” referring to multiple media reports of dozens of cancellations in recent days.

Weak LNG feed gas demand and soft Lower 48 export levels are linked to the coronavirus-induced economic recession in the United States and abroad. The LNG outlook remains uncertain, given the ongoing virus outbreaks and their potential to stall economic recoveries and related energy demand. In the United States alone, more than 47,000 cases were identified on Tuesday, a record daily tally, according to Johns Hopkins University data. Officials in several states, including California, Georgia and Texas, also reported single-day highs.

Absent LNG as a catalyst, all eyes are on the weather, with high hopes that blistering summer heat will galvanize Americans to crank up air conditioners.

“If LNG holds at these low levels, that will represent a big hit to balances, meaning weather has to stay very strong to fill the void,” Bespoke Weather Services said.

In the near-term, analysts said, the long Fourth of July weekend likely will limit energy demand with fewer people indoors over the holiday break.

Still, Bespoke said there is reason for optimism. The forecaster sees “very strong demand into the first half of July,” with gas-weighted degree days “projected at record levels” over the next two weeks, setting up the third hottest July on record, “even if we move to normal for the entire back half of the month.”

NatGasWeather issued a similar outlook. The “coming 15-day pattern remains solidly hot and bullish…The focus remains how long this hot/bullish U.S. pattern will last, and we continue to expect through at least mid-July as upper high pressure dominates most of the country with highs of upper 80s to 100s besides the far northwest and northeast corners. The net result will be smaller than normal builds as power burns increase to a stout 41-44 Bcf/day-plus.”

Next up is Thursday’s storage report.

A larger-than-expected storage injection report for the week ended June 19 rattled markets and amplified entrenched supply/demand worries. The U.S. Energy Information Administration (EIA) reported an injection of 120 Bcf storage for that week, which surpassed even the high end of analysts’ projections and lifted inventories well above the five-year average. However, the covered week was defined largely by mild temperatures that have since climbed substantially higher.

Analysts anticipate a double-digit injection with the EIA’s next storage report, which would cover the week ended June 26, reflecting heat and stronger power burns.

A Bloomberg poll found injection estimates ranging from 68 Bcf to 85 Bcf, with a median of 78 Bcf. A Wall Street Journal survey produced estimates spanning 66 Bcf to 85 Bcf and an average of 79 Bcf. Estimates by analysts polled by Reuters ranged from 69 Bcf to 93 Bcf, with a median of 78 bcf. NGI estimated a 71 Bcf build.

The forecasts compare with a reported 92 Bcf injection in the same week a year earlier and a five-year average build of 65 Bcf.

Despite forecasts for a build much lower than the previous week, skepticism permeated markets Wednesday.

“After last week’s monster injection,” EBW Analytics Group said, the next storage report “is more difficult to predict. A wide range of outcomes is possible. Another bearish print, coupled with weak cash demand, could drive down” August futures.

Sputtering Spot Prices

Spot prices pulled back Wednesday across the Lower 48. Despite the forecasts for more heat, near-term prices were down on expectations for relatively weak cooling demand over the upcoming holiday weekend.

NatGasWeather said “very warm to hot conditions will rule the central and southern U.S. the rest of the week with highs of 80s and 90s and 100s in the Southwest.

“Cooler exceptions continue over the Northwest and New England due to stalled weather systems for locally lighter demand,” the firm said. However, “the pattern will remain very warm to hot over most of the U.S. for the Fourth of July weekend.”

In the West, SoCal Citygate lost 16.0 cents day/day to average to $1.505, while Kern Delivery dropped 15.0 cents to $1.395.

In the Midwest, Chicago Citygate slid 11.0 cents to $1.550, and in West Texas, El Paso Permian lost 13.5 to $1.215.

In the Northeast, E Hereford/Pittsburg was an exception, advancing 3.5 cents to $2.035.

In pipeline news, two-week maintenance work beginning Friday could disrupt up to 600 MMcf/d of flows in northeast British Columbia (BC) on the Westcoast system, Genscape Inc. said, although the actual impact may be more modest.

The firm said Westcoast plans work on the Fort St. John Mainline near Chetwynd, BC, requiring the capacity of the Station #1 Westbound point to go to zero for the duration of a project expected to culminate on July 16.

“This point has reported an average scheduled volume of 610 MMcf/d over the last 30 days,” Gensacape said. “But during similar past events this point has reported scheduled volumes up to 200 MMcf/d higher than posted caps. This is a result of the flow dynamics on this part of Westcoast’s system, allowing production receipts flowing onto the Fort St. John Mainline to be matched to deliveries off Westcoast onto TC Alberta at the Sunset Creek and Gordondale interconnects.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |