August Natural Gas Futures Recover Ground Amid Cooling Demand Expectations, Signs of LNG Improvement

August natural gas futures gathered momentum on Tuesday, buoyed by expectations for strong near-term cooling demand and new indications that U.S. exports could recover later in 2020. The August Nymex contract climbed 3.4 cents day/day and settled at $1.675/MMBtu. September gained 3.0 cents to $1.714.

NGI’s Spot Gas National Avg. lost a half-cent to $1.615.

NatGasWeather said while weather forecasts have trended cooler in recent days, it continues to expect robust heat across much of the Lower 48, driving air-conditioner demand and keeping cooling-degree day (CDD) levels above normal.

The latest data “held a hotter-than-normal pattern into early August,” the forecaster said. The coming pattern should drive “above-normal national CDDs due to widespread highs of upper 80s to 100s, besides the northwest and northeast corners.”

Additionally, traders surveyed by Bloomberg estimated that between 20 and 30 U.S. liquefied natural gas (LNG) export cargoes would not get loaded in September. That is down from 50 for July and an estimated 35-40 for August, indicating U.S. gas demand from leading consumers in Asia and Europe is gradually recovering. Gas prices on both continents are trading at a premium to the U.S. benchmark.

Some analysts remain skeptical that LNG will come back strong enough to fill the demand void that could develop when summer heat fades.

The “uplift from weather is a short-term salve for market looseness ahead of the shoulder season,” Energy Aspects said in note to clients. This “should also signal caution for price formation in the weeks ahead when national population-weighted CDD counts will not be enough to sponge away excess supply. This puts a significant onus on the LNG feed gas demand trajectory.”

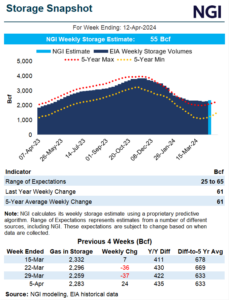

The latest U.S. Energy Information Administration (EIA) storage report showed a moderately bullish injection of 45 Bcf for the week ending July 10, but the injection nevertheless lifted inventories to 3,178 Bcf, up from the year-earlier level of 2,515 Bcf. If the balance of summer were to lose more heat intensity, containment could become an issue in the fall.

The wild card for both domestic and global energy demand is of course the coronavirus pandemic, which has in recent weeks worsened across heavily populated states in the Lower 48 and elsewhere globally. Analysts said these new outbreaks could stunt economic recoveries that had started to take root in May, when both U.S. employment and consumer spending data improved.

“A much-anticipated V-shaped recovery is but a pipe dream,” The Schork Report said. It noted that shipments via air, rail, trucks and pipelines all dipped in July, signaling a slowdown in economic activity that could threaten fuel demand and overall energy needs.

Notably positive on the pandemic front, coronavirus treatments under development by leading candidates that include University of Oxford researchers and AstraZeneca plc; Pfizer Inc. and German firm BioNTech SE; and CanSino Biologics in Chinca, each said this week their vaccines proved effective and safe in early trials, clearing the way for later-stage testing that could prove whether the shots are effective enough to bring to market.

The mid-term direction of domestic oil and gas production also remains an important unknown at this stage, though there are indications that substantial increases in associated gas output are not likely to maintain traction. Any spike in production before demand fully recovers would throw the two into greater imbalance.

“Associated natural gas production out of the Permian Basin rebounded sharply a few weeks ago, indicating production curtailments that went into effect in May in response to low crude oil prices” were coming back online, RBN Energy LLC analyst Sheetal Nasta said in a report.

However, the oil rig count has continued falling since, “and indications are that many of the wells drilled over the past few weeks have not been completed,” Nasta said. “The meager drilling and completion activity suggests that the natural declines of existing wells, which were temporarily exaggerated by the shut-ins, will now be felt — and felt for as long as rig counts remain depressed, not just in the Permian but also in other oil-focused basins.

“Daily gas production volumes in the Permian in the past 10 days or so already are slipping, despite shut-ins tapering,” Nasta said.

Cash Mixed

Spot prices generally held in a narrow range Tuesday, with gains across the Midwest and Southeast but losses in California, West Texas and other key regions.

The National Weather Service said while temperatures are expected to remain elevated this week, with highs in the 80s to the 100s across most of the country, large swaths of the central and eastern United States could see thunderstorms and briefly cooler air at midweek, adding a dose of uncertainty to near-term weather outlooks.

Decliners on Tuesday included El Paso Permian, down 4.5 cents day/day to average $1.385, and Algonquin Citygate, down 11.0 cents to $1.555. Dominion North fell 7.0 cents to $1.240, while SoCal Border Avg. lost 3.0 cents to $1.660.Gainers included Chicago Citygate, up 5.0 cents to $1.625, and Florida Gas Zone 3, ahead 5.5 cents to $1.755.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |