Dallas-based natural gas distributor Atmos Energy Corp. is earmarking $13-14 billion in planned spending over the next five years on system replacements, expansions and environmental upgrades, executives said on a recent conference call.

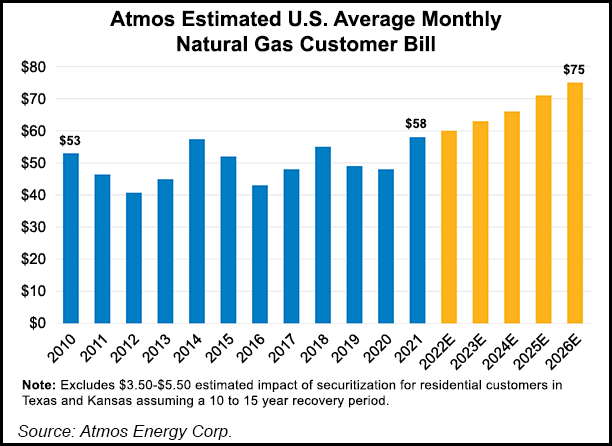

The Dallas-based natural gas-only distributor has more than three million customers in 1,400-plus communities across eight states, primarily in the South. The spending would support rate base growth of 11-13%/year through 2026, CFO Christopher Forsyth said.

The company invested $2 billion in fiscal year 2021, which ended in September. The funds principally were directed to replacing more than 930 miles of distribution pipe, 38,000 steel service lines and 175 miles of transmission pipeline. The company also installed about 230,000 wireless...