Shale Daily | E&P | NGI All News Access | Permian Basin

As Permian Output Upends Global Oil Markets, E&Ps Advised to Prepare

U.S. oil and natural gas independents need to position themselves to survive and thrive as the domestic markets are overhauled and excess onshore production is exported to global markets, according to an analysis.

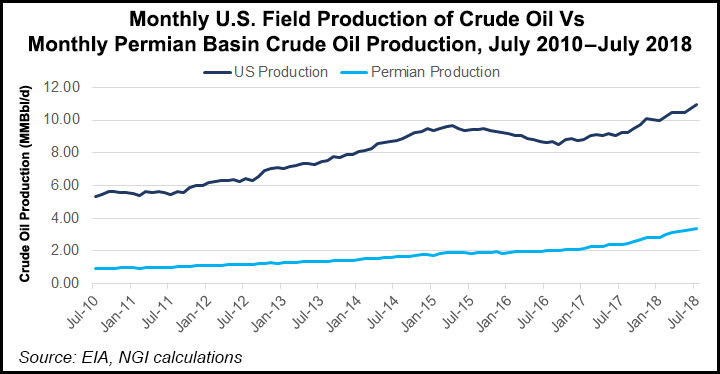

Unconventional oil output alone increased over a six-year period from 2008 to 2014 to about 4 million b/d, and by 2022, it is poised to add another 4 million b/d, mostly from the Permian Basin, said Bob Peterson, who authored the report for consultancy Arthur D. Little (ADL).

The United States this year has exported about 2 million b/d, almost all of the production from the Permian and mostly fueled by independent exploration and production (E&P) companies.

“Maintaining their leadership position will require a significant change in behavior and capabilities,” Peterson said of the E&Ps.

Complex issues now are on their plates that need to be resolved to ensure growth, including bringing on partners, maintaining price premiums, collaborating with infrastructure operators and ensuring there are enough capital investments.

Traditionally, independents have sold their oil at the wellhead “and move on to the next drilling campaign,” Peterson said. “It is a simple world, but a risky one as the U.S. becomes a major exporter and competition rises in global markets such as Latin America and the Pacific Rim.”

The “drill, sell direct at the wellhead, repeat” behavior, he said, has to change if independents want to maximize steady cash flow.

To command and maintain a price premium also is necessary, particularly when there is more production than capacity, as is the case today in the Permian.

“Under the traditional model of selling oil at the wellhead, independent producers have become accustomed to success without factoring in fluctuations in the global markets,” Peterson noted. “Those days are gone, as regional pricing spreads will certainly impact producers’ ability to stay predictably profitable.”

Independents may be able to stay ahead of the pricing scramble by establishing strategies to reduce discounts and realize premiums for their oil, such as developing export-shipping capacity as far as Brownsville, TX, on the Mexico border, to alleviate the growing bottlenecks in Houston and Corpus Christi.

According to a recent ADL study on Permian growth challenges, more than 41,000 wells at a total capital cost of $300 billion are planned over the next five years, which means “demands on infrastructure will be tremendous,” Peterson said.

“Trucking, roads, water usage, power consumption, and sand to fracture the wells, as well as community services such as housing, schools and hospitals, will all be necessary to sustain rapid development.”

ADL estimates that about 1 million b/d in production growth is at risk because of the inability of the local infrastructure to support daily operations.

In some expensive offshore basins, including West Africa and the Gulf of Mexico, operators often pool demand for noncompetitive services “such as lodging, supply boats, safety management and helicopter transportation to lower costs and improve the collective quality of service.”

The “independent” nature of U.S. onshore operators “is a strong cultural barrier to this type of collaboration,” Peterson said.

Pioneer Natural Resources Co., which has become a leader in community stakeholder management in the Permian, “has initiated an effort to potentially pool power generation for the mutual benefit of the operator community and the local towns and ranches. This is a good start to addressing the demand for common services, but much more will be required.”

Pioneer two years ago also agreed to a public-private partnership with officials in Midland, TX, in which the E&P agreed to upgrade the city’s wastewater treatment plant, and in turn, Midland is providing Pioneer with the plant’s reclaimed water to use in its Permian operations.

Building out the Permian will require collaboration but it also requires a lot of investment, according to Peterson.

“This is perhaps the greatest challenge in the basin. To provide potential solutions, operators have to think more creatively about funding structured projects.”

Practices, he said, “need to expand to areas such as water management, community infrastructure, roads and transportation to enable sustainable development.”

The Permian’s huge development will be a challenge unlike any encountered to date by the global oil industry, according to ADL’s analysis. The challenges require U.S. independents to “go against their nature by collaborating in key areas,” Peterson said.

“It requires establishing markets, building new partnerships to a level not yet seen in the sector, and giving up control of traditionally competitive capabilities in order to attract the necessary investment capital. Forward-thinking players will change the way they do business, giving rise to a new ecosystem that will be able to capitalize on current opportunities and create new avenues for growth.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |