Mexico | E&P | NGI All News Access

As OPEC Cuts Take Force, Mexico Oil Production Falls in May

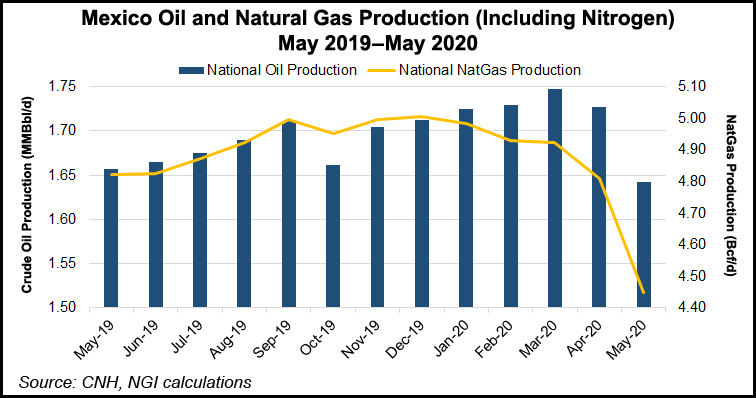

Mexico’s oil production fell to 1.64 million b/d in May compared to 1.66 million b/d in the year-ago period, according to new data provided by the country’s upstream watchdog Comisión Nacional de Hidrocarburos (CNH).

Gas production in May was 3.61 Bcf/d, down from 3.82 Bcf/d last May.

The figures are the first to reflect committed oil production cuts by Mexico for May and June under the curtailment agreement between the Organization of the Petroleum Exporting Countries and its allies, aka OPEC-plus, to balance an oversupplied oil market in the wake of Covid-19 demand destruction.

In related news, Mexican President Andrés Manuel López Obrador said Monday that he would make his first visit overseas during his more than 18 months in office to the United States to visit U.S. President Donald Trump.

While the trip is officially to mark the start of the United States Mexico Canada Agreement (USMCA), the revamped North American Free Trade Agreement (NAFTA), which took effect on July 1, López Obrador told press he also wants to thank the U.S. president for help during the pandemic including in the OPEC-plus negotiations.

During the tense oil talks in early April, Mexico delayed the deal when it refused to commit to a requested 400,000 b/d in production cuts. President Trump said via Twitter that he would assist Mexico by offering an additional 250,000 b/d in U.S. cuts, and in the end Mexico said it would slash May and June production by 100,000 b/d.

Mexico has since refused to join other OPEC-plus nations in extending the supply curtailment beyond June.

Up until May, Mexico had shown a degree of stability in its oil and gas production, with five straight months of production above the 1.7 million b/d mark. Associated gas accounts for about 75% of natural gas output in Mexico and natural gas showed similar gains.

Still, the numbers are far from the president’s pledge to up oil output to 2.7 million b/d and natural gas to 5 Bcf/d by the time he leaves office in 2024.

The International Energy Agency (IEA) said this month that Mexico oil production is likely to stay flat through 2021, with the natural decline of legacy fields operated by national oil company Petróleos Mexicanos (Pemex) offsetting any production gains at the firm’s so-called priority fields.

Pemex produces the vast majority of oil and gas in the country and accounted for 1.59 million b/d of the 1.64 million b/d produced in May.

Last year, Pemex said it would give priority to 20 fields as part of its strategy to boost oil and gas production in the country, where output has declined annually for more than a decade.

As part of this push, CNH approved more than $16 billion for hydrocarbon development plans in 17 Pemex fields. Through the drilling of 119 new wells, the fields were projected to increase national oil production by 307,000 b/d and gas production by 893 MMcf/d by 2022.

But in the first quarter, the 17 fields combined saw production of 22,000 b/d and 64.9 MMcf/d. Oil production was only 12% of its stated target for the period, and gas production 15%, according to CNH. The remaining three fields of the 20 priority fields have yet to gain approval from the CNH.

IHS Markit analysts Marcos Lepore and Renata Machado said last week in a note that “Pemex has been facing numerous problems in drilling its so-called priority fields in shallow water. The exploratory campaigns in these areas are still on hold and show negligible levels of advance compared with those initially estimated.”

They added that “in early June, the company suspended contracts for numerous logistical vessels.”

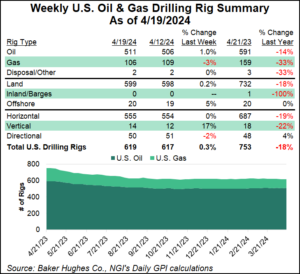

Still, Mexico was one of the few countries to add rigs in both April and May as most oil producing countries cut back given the low price environment and uncertain market conditions.

The IEA forecasts global oil production will decrease by 7.2 million b/d in 2020, before recovering by 1.8 million b/d in 2021, assuming full compliance by OPEC-plus members regarding production cuts.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |