U.S. dry natural gas production should average 96.9 Bcf/d in April and 97.4 Bcf/d for full-year 2022, which would reflect a 3.8 Bcf/d increase over 2021 levels, according to updated forecasting from the Energy Information Administration (EIA).

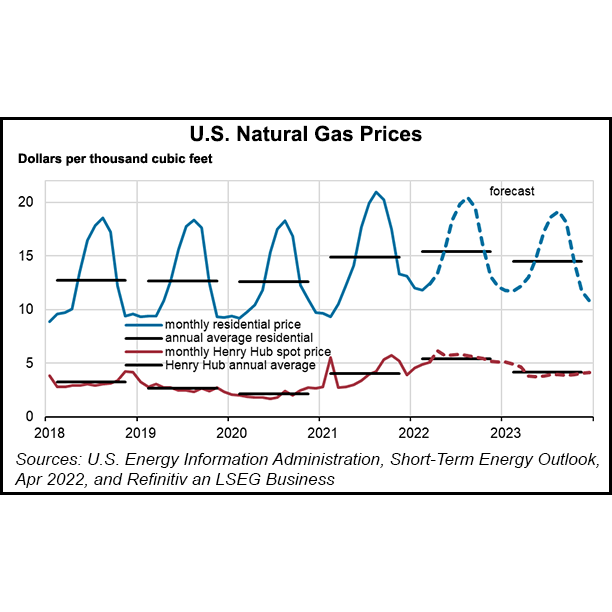

As the market has keyed in on supply adequacy fears and sent prices soaring well above $6.500/MMBtu this month, domestic production trends have taken on increased significance in setting the tone for prices.

In its latest Short-Term Energy Outlook (STEO), EIA estimated domestic output of 96.2 Bcf/d in March, up 1.2 Bcf/d from February levels.

“Similar to January and February, production in March was lower than in December because of brief periods of freezing temperatures in certain production regions and, in part, because of...