Hurricane Season Said to Potentially Test ‘Operational Limits’ of Natural Gas Storage, Infrastructure

Foreseeable risks from swelling natural gas inventories and an active hurricane season in the Atlantic Basin could bring more volatility to commodity prices in the coming months, a market expert said this week at an industry conference.

The looming threat of hurricanes, which forecasters are predicting to be more frequent this season, will be “an important story this summer,” said East Daley Analytics senior director Jack Weixel. He spoke during a panel discussion at the LDC Gas Forums Southeast in Florida.

“We all know hurricanes are no longer a production story; they are purely a demand story,” Weixel said. The storms could test the critical need for additional storage capacity, he noted, particularly in the South Central region.

Record-warm ocean surface temperatures fueled above-average activity during the 2023 Atlantic hurricane season. However, most of the storms steered clear of the U.S. energy complex on the Gulf Coast, with little impact on natural gas production or prices.

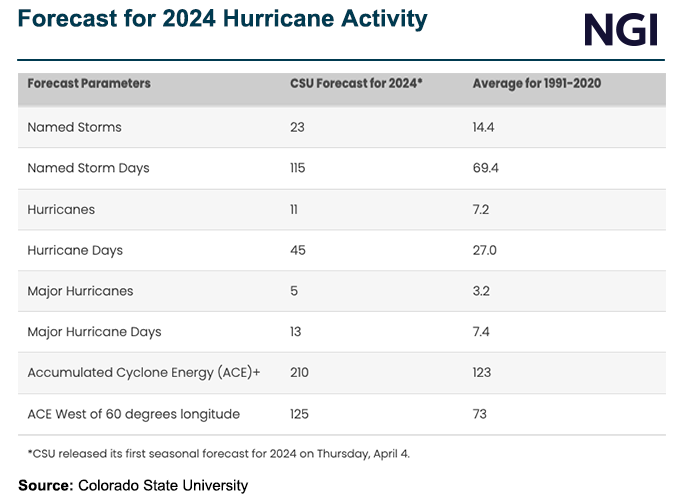

For the upcoming hurricane season from June 1 to Nov. 30, researchers at Colorado State University initially have forecast 23 named storms, 11 hurricanes and five major hurricanes. This is well above the seasonal average of 14 named storms, seven hurricanes and three major hurricanes. If the forecast were to be correct, it would place the 2024 season as the third most active hurricane season on record, behind 2005 with 28 and 2020 with 30.

For the South Central region in particular, there is about 150 Bcf of wiggle room in terms of storage, according to Weixel. Meanwhile, there is about 15 Bcf of LNG demand and 5-8 Bcf of industrial power demand that could be waylaid should a hurricane hit the region, he said.

“That gives you six and a half days to fix all your poles, get your power going again, and get the vessels moving in and out of ports before you basically operationally handicap South Central storage,” Weixel said. “That means shut-ins, that means production troubles, especially now with South Central storage being above the five-year average just like the rest of the country.”

When injecting natural gas becomes more difficult into the fall, a late-season hurricane could “come in and take away two or three days worth of demand,” Weixel said. That would test “the operational limits of the current storage and pipeline infrastructure complex” along the Gulf Coast.

Storage Capacity Shortage?

U.S. natural gas inventories are tracking far above historical levels following a mild 2023-2024 winter, with prices responding accordingly.

The Henry Hub spot natural gas price tumbled to a decade-plus low of $1.240/MMBtu on March 13, according to NGI’s Daily Historical Data. The national benchmark hub averaged $1.570 as of Thursday (April 18), but it remained below year-earlier levels of more than $2.220.

The U.S. Energy Information Administration (EIA) reported Thursday that total working gas supply had risen to 2,333 Bcf for the week ended April 12. That was 622 Bcf above the five-year average. On a regional basis, South Central stocks stood about 33% above the five-year average.

Though at near-record levels, Weixel said the storage surplus could be halved by August, and prices are expected to rise above $2.00, even if still trailing last summer’s levels. East Daley forecasts an average summer natural gas price of $2.240.

Even if the storage surplus ultimately shrinks, the threat of a South Central storage capacity shortage could worsen as more natural gas comes online to meet liquefied natural gas demand.

Noting the U.S. Department of Energy’s (DOE) temporary pause on reviewing applications to export LNG to nonfree trade agreement countries, Weixel said Venture Global LNG Inc.’s Calcasieu Pass 2 export project and the Commonwealth LNG facility were at risk being delayed.

Commonwealth and Calcasieu Pass 2 were pending non-FTA approval before the pause, so they are affected by the DOE’s decision, according to NGI’s Jacob Dick, senior editor, LNG. That said, Calcasieu Pass 2 has not received approval from the Federal Energy Regulatory Commission. Project developer Venture Global Inc. filed for a permit with federal regulators in December 2021.

With less natural gas feeding those facilities, more supply would be available in the open market and potentially need to find a home in storage.

While producers including EQT Corp. and Chesapeake Energy Corp. announced production cuts earlier this year, East Daley expects output to begin ramping back up later this year. The bulk of production would return in calendar 2025, Weixel said. However, “there’s still a lot of gas coming online.”

Emphasizing the need for additional South Central storage capacity, Weixel said storage capacity woes would be a reality “until more folks take developing flexible salt storage a little more seriously.”

BP plc’s Zach Inman, vice president, Southeast U.S. & Mexico Origination, shared the stage with Weixel and had similar views on the storage situation.

“We are 400 Bcf over year/year and roughly speaking, 600 Bcf over the five-year average,” Inman said.

Inman noted the EIA inventory forecast for the end of the injection season is close to 4.1 Tcf, “which, to my recollection, is either at or near a record.”

That’s of interest, he said, “because in nearly 20 years, the U.S. gas market has grown by almost a factor of two, while storage has really only grown by about 50%.

“That 50% is actually a little misleading because if you look at some of the recent entries into storage places, they are LNG folks, and a lot keep up with storage,” Inman said. “So they have a place to put gas when their facilities trip.

“That is, however, not the most efficient use of storage if you are looking at the perspective of peak day withdrawal.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2158-8023 |