E&P | NGI All News Access | NGI The Weekly Gas Market Report

Declining Crude Prices May Cause Pause in Onshore Boom, Say Analysts

Stagnant natural gas prices led exploration and production (E&P) companies to move their drillbits to more lucrative liquids. Now, declining crude prices may cause a pause in some of the booming onshore areas as well, analysts believe.

If cash flow and margins are squeezed, that could put a damper on some of the higher priced and longer-term projects, at least until prices recover to their loftier levels. West Texas Intermediate (WTI) fell below $90.00/bbl on Oct. 2 for the first time in 17 months, and crude oil prices in the Bakken Shale have been several dollars lower on transportation bottlenecks.

Those lower prices have in turn scuttled the high-flying energy sectors. Through most of June, the energy sector had risen overall by close to 13% on the S&P 500; it has since fallen by about as much. Integrated oil and gas company stock prices have dropped about 10% since then, while E&Ps have reversed by more than 15%.

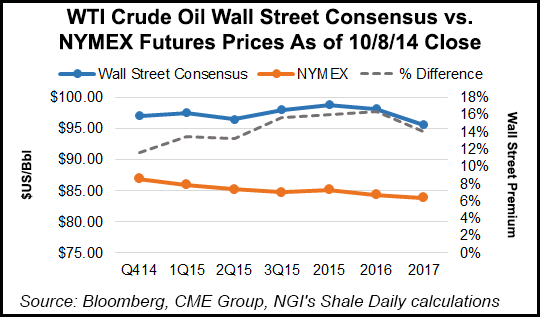

Barclays Capital on Thursday cut its WTI forecast for 4Q2014 to $85.00/bbl from $98.00; the full-year 2014 price was revised downward to an average of $96.00 from $99.00 In 2015, analysts now see WTI prices averaging $89.00/bbl, versus a previous forecast of $100.

Analysts also trimmed Brent prices for 4Q2014 to $93.00/bbl from $106.00, and for 2015, they expect average prices now to be $96.00 versus $107.00.

“The recent weakness in oil and gas prices “will result in a slew of 2015 spending questions during upcoming quarterly conference calls,” said analysts with Tudor, Pickering, Holt & Co. (TPH).

“At what price would cash flow end up flat in 2015, causing leverage to expand? Will E&Ps revise budgets given weakness in strip pricing?”

It’s too early to hit the panic button on activity yet, said analysts, “but clearly, the fall in oil may affect acceleration plans if it remains weak (think three-six months). Concurrently, operators are starting to face pressure on service costs just as revenues are heading lower, hindering netbacks further.”

Leverage remains the key issue for industry because some operators would be unwilling to add more debt to finance large programs in a falling commodity price environment, according to TPH.

“Further, many of our small cap coverage already runs high leverage profiles and are depending on strong commodity prices to grow into debt loads. Ultimately, we think the small cap (12% total industry activity) and private universe (40% total activity) would first have activity impacted if weak strip prices sustain. Currently, our small caps are trading at debt/cash flow multiples of 3.3 times versus large/mid cap peers at 1.4 times.”

Wunderlich Securities Inc.’s Jason Wangler said OFS activity so far hasn’t skipped a beat, and the shale oil and liquids regions still are running hard.

“Believe it or not, the actual activity levels in the oil patch remain strong and frankly unaffected from the recent declines in oil price,” he said. “Natural gas markets remain muted given the price but oil/liquids plays are still running strong as evidenced…in the rig count. We feel this shows the OFS companies continue to generate high utilizations that should grow revenues, earnings per share…in 3Q2014 and beyond, assuming oil and natural gas remain at these levels or press higher.”

What’s driving a lot of the activity, he said, is the need for infrastructure, which should lead to “ample announcements and workflow for companies with oil and gas construction capabilities.”

Wells Fargo Securities energy analysts said the 3Q2014 Form 13-F reports to the Securities and Exchange Commission, which contain all equity assets under management of at least $100 million in value are beginning to arrive for the E&P sector. Overall, the initial look indicates that energy allocations are down around 50 basis points quarter/quarter, the second largest decline after industrials, financials and healthcare.

Of the companies that Wells Fargo covers, overall positions that declined quarter/quarter included Apache Corp., Anadarko Petroleum Corp., Devon Energy Corp. and Cabot Oil & Gas Corp. The top additions included Chesapeake Energy Corp., Range Resources Corp. and EOG Resources Inc.

“For reference, the S&P 500 E&P index fell 12% during the quarter,” the Wells Fargo analysts said. “The relationship held in September, which saw the steepest sell-offs in the quarter…Obviously 13F’s are just a snapshot, so we don’t know what happened intraquarter

and don’t want to read too much into investors buying shares that have fallen the hardest. From our conversations with clients, investors are not likely to step back into the group with force until commodities find some stable ground.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |