NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Mexico Energy Reforms Offer Equal Amounts of Opportunity, Uncertainty, Say Experts

With its well-publicized national energy market reforms now in place, Mexico is going to offer big opportunities for the U.S. energy sector, but they are still wrapped in a bundle of uncertainties, a U.S. consultant and energy attorney told an industry audience Tuesday in Los Angeles.

“Mexico is not just in play, it’s the story,” said ICF International Vice President Greg Hopper.

He was joined by Akin Gump attorney Vladimir Fet to outline the landscape taking shape in the wake of the rapidly enacted opening of Mexico’s energy sector (see Daily GPI, Oct. 3). They spoke at the LDC Gas Forum Rockies & the West conference.

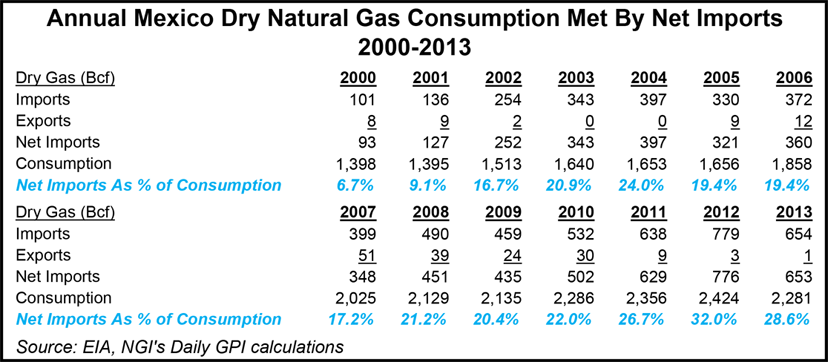

Hopper said ICF estimates that Mexico will be a similar sized energy market to Canada by 2020, accounting for roughly 12 Bcf/d of natural gas. However, Hopper said so far there aren’t any parallels between the long-standing Canada-U.S. energy relationship and that with Mexico. Both are “natural trading partners,” however.

Noting that there are still a lot of questions about the timing and volumes of future exports of U.S. gas to Mexico, Hopper said the potential electric generation-driven demand in Mexico — the main target for U.S. gas — is about 7.2 Bcf/d, and by 2020 there will be a wide range of projections. He thinks there is another 3 Bcf/d of power demand possible, and by 2027 up to 10 Bcf/d.

Hopper pointed out that a lot of the robust proposals for adding up to 10-11 Bcf/d of added capacity to carry supplies into Mexico are being hammered out without a clear assessment of whether demand is going to match that capacity.

“Either we have a lot of added supply and capacity to serve a proportionally smaller market, or we have a lot of new demand that is going to be there, such as the 10 Bcf/d of added power generation. The short answer to that is we don’t really know yet,” said Hopper.

He said it is too early for companies leading the effort in Mexico that are still working on their strategic plans and trying to understand new laws and rules to support the reforms.

Both Hopper and Fet also said that it is still not clear what the changes in Mexico mean for the United States in the long-term. In the near-term, Hopper thinks that Texas’ Permian Basin and Eagle Ford Shale will be the source of added gas to Mexico, but longer term that would probably change, as would the principal entry points for gas into Mexico switching from the Eagle Ford in South Texas to the Permian’s sources in West Texas.

The initial added gas transmission pipeline infrastructure already under construction in Mexico is concentrated in the northwest region of the country, and that calls for an even more westerly entry point. According to Hopper, there are already about a dozen entry points on the U.S.-Mexico border, and a greater number on the U.S.-Canada border.

Aside from the attractive numbers on future markets and potential energy demand, Fet gave an outline of the business environment and culture in Mexico based on his work representing various U.S. interests there. He underscored the importance of advisers with extensive experience in Mexico.

“With smart planning today in Mexico, you can minimize your tax rate very significantly,” he said. “Of course, you do need to employ people who know how to get this done, tax advisers and attorneys, as well as local counsel. The other essential is a joint venture agreement with a local partner.”

Another area requiring a lot of local expertise pertains to land rights, said Fet, noting that there are both private and communal land ownership.

“When you are dealing with a project on which some of the parcels are located on communal-owned land, it is very important to understand who legitimately in the community has the authority to sign documents, and basically who has control of the land. That is not always clear.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |