S&P Lowers Southwest Gas Ratings on Recent Purchase

Standard & Poor’s Ratings Services (S&P) gave a thumbs-down Thursday to Las Vegas, NV-based Southwest Gas Corp.’s ratings based on the natural gas-only utility’s purchase of some Canadian pipeline construction companies for more than $200 million.

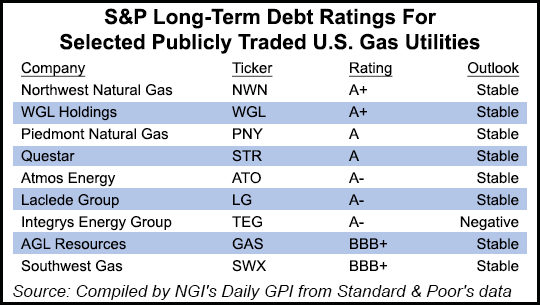

While dropping Southwest’s business risk profile from “excellent” to “strong,” S&P kept the outlook “stable” but lowered the utility’s credit and senior unsecured debt ratings to triple “B-” (“BBB-”) from “A-.”

S&P also said it removed Southwest from its “CreditWatch — negative” status, where it was placed early last month following the acquisition by the Southwest construction unit, NPL Construction Co. (NPL), of the Canadian-based Link-Line Group of Companies, Link-Line Contractors Ltd., W.S. Nicholls Construction Inc., W.S. Nicholls Industries Inc. and a 50% equity interest in W.S. Nicholls Western Construction Ltd.

Southwest said the deal involved $185 million in cash, less assumed debt subject to working capital adjustment in the privately held construction companies, all operating in Canada.

“These acquisitions will expand NPL’s customer base, geographic scope and technical service offerings,” said Jeffrey Shaw, Southwest CEO and the Chairman of NPL. “We seek to grow NPL both organically and through strategic transactions.”

S&P said the Link-Line buy “increases the relative size of [Southwest’s] higher-risk construction businesses.” The rating agency projects the expanded construction unit will consistently remain more than 20% of the consolidated Southwest holdings.

“The larger and higher-risk construction business weakens the company’s business risk profile to ‘strong’ from ‘excellent.’”

Staying with a strong risk profile rating underscores what S&P called Southwest’s “mostly low-risk” regulated gas utility business spread over Nevada, Arizona and a small stretch of California.

S&P said Southwest’s utility operations enjoy geographic and regulatory diversity, while its construction business is centered on pipe replacement work for other regulated utilities operating under multi-year contracts.

“These strengths are somewhat offset by potential margin erosion from higher-than-expected costs and potentially reduced utility capital budgets,” the ratings agency said. Southwest’s ratings could be lowered further by an additional weakening of the business risks or what S&P called less-than-effective management of the risk profile.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |