Markets | NGI All News Access | NGI The Weekly Gas Market Report

Alberta Seeing Benefits of North American NatGas Competition

Canadian and U.S. pipeliners have won an unexpected ally for their plans to expand the northbound freeway for natural gas from the eastern United States — the Alberta government.

Rather than try to turn back the clock to the fading era when Ontario and Quebec relied almost entirely on long-distance deliveries from west to east, the chief Canadian gas-supplier jurisdiction has decided to accept the new trading pattern.

The Alberta government told the National Energy Board (NEB) that the province does not — and cannot — oppose the agreement on building import facilities between TransCanada Corp. and the country’s three top distributors: Enbridge, Union (Spectra) and Gaz Metro.

“Alberta understands that if approved, the application will result in the construction of new pipeline infrastructure that will allow for increased supply diversity for Ontario, Quebec and Northeast U.S. natural gas markets,” said the province’s lawyers. “Alberta sees the benefits to residential, commercial and industrial consumers of this supply diversity, and is supportive of unimpeded market access and supply competition.”

The stance acknowledged that, with provincial government support, Alberta-based pipelines and producers are urging the NEB to approve numerous projects in the name of the same open-market goal sought by TransCanada, Enbridge, Union and Gaz Metro.

“Alberta has consistently supported increased market access on matters before the National Energy Board and considers increased market access as being in the broad Canadian public interest,” the provincial government stated. “Accordingly, Alberta supports the timely increase in supply access objectives of this application.

“North American commodity markets continue to evolve, and infrastructure build-out is critical in achieving the associated economic benefits to the North American economy.”

The regulatory position is consistent with the top priority that Alberta’s new Premier Jim Prentice has assigned by a public “mandate letter” to his freshly appointed energy minister Frank Oberle.

Job No. 1 for Oberle is: “Expand Alberta’s access to key global markets for energy commodities and products and work collaboratively with partners to develop strategies that address issues and barriers and understand social license challenges within key markets and jurisdictions.”

Prentice, a former senior minister in the federal Conservative cabinet and vice chairman of the Canadian Bank of Commerce, is a stalwart supporter of free trade in general and especially new pipelines for oil and gas to the west and east coasts of Canada.

During a provincial Conservative party leadership contest after Alison Redford resigned as premier, Prentice made encouraging global market access for Alberta production his top economic priority. The stance is rooted in growth of the provincial industry, competition from shale gas production in the United States, and the refusal so far of the Obama administration in Washington, DC, to approve TransCanada’s proposed Keystone XL oil pipeline.

Competition by expected U.S. gas exports has been as painful for Alberta as the end, represented by the Keystone project’s fate, of the Canadian industry’s ability to rely virtually entirely on oil exports to the U.S. to support supply projects and growth.

Since the onset of large-scale U.S. shale production in 2007, U.S. gas exports into Alberta’s former captive market of Central Canada have about quadrupled into a range of 1 Tcf/year. The agreement between TransCanada, Enbridge, Union and Gaz Metro has already led to a string of construction applications for pipeline additions in southwestern and eastern Ontario.

The trade competition, as an aspect of the North American supply glut and fallen prices, has contributed to a 90% drop in Alberta government gas royalties into an annual range of C$1 billion ($900 million) from a 2005 peak of C$8.3 billion ($7.5 billion).

The NEB hearings on the deal between TransCanada, Enbridge, Union and Gaz Metro focus on complex details of the toll regime that they have worked out to finance additions to import facilities. The sore spot is “discretionary” rights for TransCanada to charge as much for short delivery contracts as markets will bear during periods of peak demand for service on the eastern, Ontario and Quebec portions of its gas Mainline.

Strong potential for outbreaks of high cost jumps has emerged, especially during the severe cold snaps of the exceptionally 2013-2014 harsh heating season, said critics such as the Canadian Association of Petroleum Producers (CAPP) and Alberta Northeast Gas, a supply procurement agency for distributors in New York, New Jersey and New England. Short-term service tolls jumped as much as 5,500%, the case showed.

But like the Alberta government, CAPP accepts that North American gas trading patterns are changing permanently as a result of the shale supply revolution.

“The market is clearly shifting from long-haul [deliveries to Ontario and Quebec from Alberta] to U.S. supplies accessed by eastern short-haul [especially from Marcellus Shale production],” CAPP lawyer Lewis Manning told the NEB.

From the point of view of Alberta gas production, “These volumes are, to coin an expression, ‘gone, baby, gone,'” said Lewis.

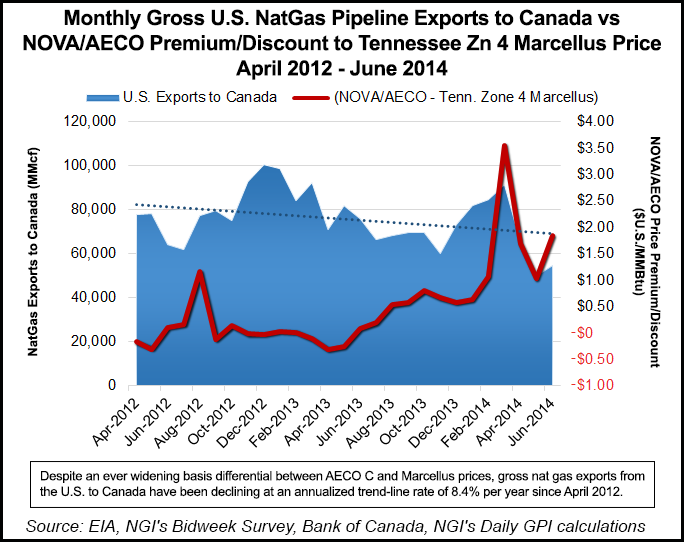

Despite an ever widening basis differential between AECO C and Marcellus Shale prices, gross natural gas exports from the United States to Canada have been declining at an annualized trend-line rate of 8.4% per year since April 2012. Part of that may be the result of the brutally cold winter of 2013/2014, which likely caused more domestic production to stay at home. The historically high storage withdrawals from this past winter have also likely prevented some U.S. volumes from flowing into Canada since March, in an effort to return storage levels to more normal levels going into this year’s heating season.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |