Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Oneok to Invest $480-680M on Gas Processing Plants

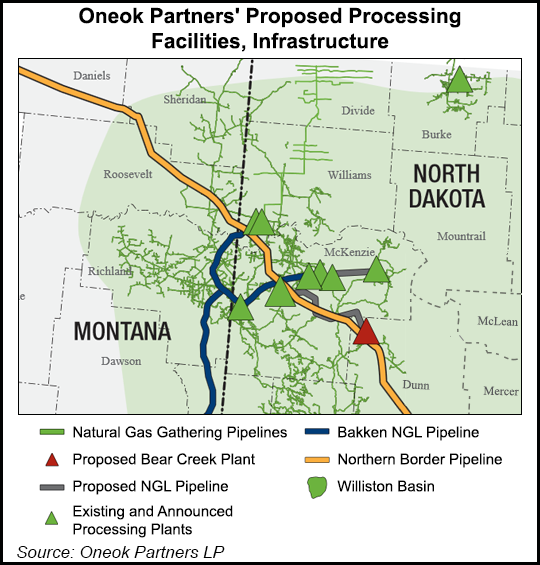

Oneok Partners LP plans to invest $480-680 million between now and the end of 3Q2016 to build two natural gas processing facilities and associated infrastructure in North Dakota and Wyoming, the partnership said Monday.

Tulsa-based Oneok said it plans to build its 80 MMcf/d Bear Creek processing facility in northwest Dunn County, ND, and its 100 MMcf/d Bronco processing plant in southern Campbell County, WY. Bear Creek would serve the Bakken Shale in the Williston Basin, while Bronco would serve the Turner, Frontier, Sussex and Niobrara shale formations in the Powder River Basin.

Oneok CEO Terry Spencer said the partnership has announced $1.5-1.9 billion in capital growth projects this year, a continuation of its $7.5-8.2 billion capital growth program planned through 2016.

“The Bear Creek and Bronco plants will increase our natural gas processing capacity across our operating footprint by 180 MMcf/d and add additional natural gas and natural gas liquids volumes on our systems,” Spencer said. “These projects further demonstrate the value of the partnership’s integrated operations that allows us to better serve area producers.”

According to Oneok, construction of the Bear Creek facility and its associated infrastructure will cost $265-365 million and be completed in 2Q2016. The costs were broken down to include $130-190 million for the processing plant, and $135-185 million for the infrastructure.

Spencer said the Bear Creek plant would be built near the partnership’s “existing natural gas gathering, compression and residue takeaway infrastructure in Dunn County and will alleviate pipeline inefficiencies in an area challenged by geographical constraints and severe terrain.” He added that Bear Creek would also allow Oneok “to respond more quickly to accommodate our customers’ growing crude oil and natural gas production on acreage dedicated to us in the area.

“The construction of this facility, along with previously announced capital growth projects, shows our continued commitment to building critical natural gas infrastructure in North Dakota in an effort to meet the industry goal of reducing natural gas flaring to 5-10% of total production by 4Q2020” (see Shale Daily, Nov. 21, 2013).

Oneok said that once the Bear Creek facility and other projects are completed by 3Q2016, it expects its gas processing capacity in the Williston Basin will increase to about 1.2 Bcf/d. The other projects include the three new gas processing plants in McKenzie County, ND — Garden Creek III (100 MMcf/d capacity), Lonesome Creek (200 MMcf/d) and Demicks Lake (200 MMcf/d) — plus additional compression (100 MMcf/d) at its existing and planned Garden Creek and Stateline processing plants (see Shale Daily, Aug. 29).

Meanwhile, Oneok said construction of the Bronco facility and associated infrastructure are expected to cost $215-305 million and be completed during 3Q2016. The costs include $130-190 million for the processing plant; $45-60 million for construction of a 65-mile, 10-inch diameter natural gas liquids (NGL) pipeline connecting Bronco to Oneok’s Bakken NGL Pipeline lateral, currently under construction; and $40-55 million for building the associated infrastructure.

“The Bronco plant will expand the partnership’s natural gas gathering and processing and NGL gathering infrastructure in Campbell and Converse Counties, WY, and is supported by long-term dedications of more than 130,000 net acres,” Spencer said. “Last year, the partnership acquired the 50 MMcf/d Sage Creek plant, and the Bronco plant will provide [us] with additional natural gas processing capacity in a region poised for significant growth in natural gas and NGL production volumes” (see Shale Daily, Aug. 28, 2013).

Oneok said the $7.5-8.2 billion earmarked for capital projects would go toward “acquisitions and infrastructure growth projects related to natural gas gathering and processing and NGLs” through 2016. Broken down, the total includes $4.2-4.8 billion for gathering and processing projects, plus another $3.3-3.4 billion for NGL projects.

“In aggregate, these projects are expected to generate adjusted EBITDA [earnings before interest, taxes, depreciation and amortization] multiples of five to seven times,” Oneok said. “The incremental earnings from these projects are expected to increase distributable cash flow and value to unitholders in the form of higher distributions.”

Oneok said the partnership will continue to hold a $3-4 billion backlog of unannounced growth projects. That includes what will follow completion of the Bear Creek and Bronco plants, as well as work at its Demicks Lake and Knox facilities (see Shale Daily, July 31).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |