NGI Data | NGI All News Access

Widespread, Deep Weekly Northeast NatGas Losses Can’t Keep The Overall Market Down

The Northeast proved to be something of a contrarian in trading for the week ended Sept. 19 as the region, true to its non-conformist colors, dropped 27 cents to average $2.52 with fall-like temperatures dominant. All other regions of the country managed gains of about a nickel. Nationally the NGI Weekly Spot Gas Average rose 3 cents to $3.73.

Of the actively traded points Tennessee Zone 6 200 L went against the Northeast regional grain in posting the greatest individual gain of 24 cents to average $3.19, and Transco Zone 6 non-NY North saw the week’s largest loss, dropping 36 cents to $2.26.

South Louisiana, East Texas, and the Midwest managed gains of 4 cents apiece to average $3.90, $3.91, and $4.03, respectively.

The Mid-Continent, Rocky Mountains, and South Texas all rose by a nickel to average $3.83, $3.85, and $3.87, respectively.

California points were up by an average 6 cents to $4.29.

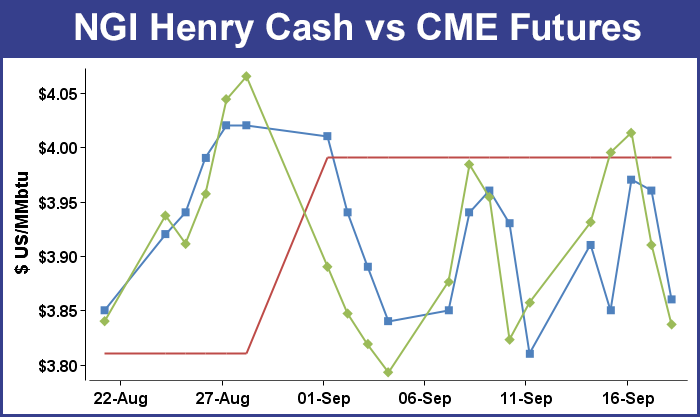

October futures on the week gained 2 cents to $3.857, and although futures markets are known for their ability to discount currently known information and factor it immediately into price, Thursday’s release of storage data found a market unready for an injection report that by all accounts should have been widely expected and factored into the market.

Traders were still expecting a hefty build, but the 90 Bcf build reported by the Energy Information Administration for the week ending Sept. 12 came in right in line with what the market was thinking. Prices, nonetheless, tanked. “I’m hearing a pretty big number, about 90 Bcf,” said a New York floor trader Wednesday. “The range is anywhere from 82 Bcf to 101 Bcf, and that’s a significant number considering last year was only 48 Bcf and the five-year average is 71 Bcf. I think if the number comes in anywhere near there, I think we’ll see this market come off. I’m thinking if it comes in that way we’ll see a settle under $4, and then we are back in our [$3.75-4.00] range.”

Others were also looking for an injection in the 90 Bcf area. Analysts at United ICAP forecast an 89 Bcf build, and Ritterbusch and Associates expected an increase of 95 Bcf. A Reuters poll of 29 industry cognoscenti revealed an average 90 Bcf with a range of 81-96 Bcf.

The New York floor trader couldn’t have been more prescient. Once the 90 Bcf figure was released, October futures fell to a low of $3.897 and by 10:45 October was trading at $3.917, down 10.6 cents from Wednesday’s settlement. October finished the day 10.3 cents lower at $3.910.

Tim Evans of Citi Futures Perspective said “there’s no particular shock or surprise. However, the build was still bearish compared with the 71 Bcf five-year average level and leaves the door open to larger storage injections in the weeks ahead, as air-conditioning demand fades further.”

Inventories now stand at 2,891 Bcf and are 401 Bcf less than last year and 444 Bcf below the 5-year average. In the East Region 58 Bcf were injected and the West Region saw inventories up by 7 Bcf. Inventories in the Producing Region rose by 25 Bcf.

Analysts interpreted Thursday’s market response to the number as characteristic of a market environment in which sellers are poised to strike at the drop of a hat. “[Thursday’s] outsized response to a storage miss of only 1 Bcf highlights an extremely heavy trading environment in which large speculative entities appeared poised to re-establish short holdings on even a bullish injection miss of miniscule proportions,” said Jim Ritterbusch of Ritterbusch and Associates.

“Regardless, [Thursday’s] 90 Bcf supply build narrowed the surplus against average levels by almost 20 Bcf. Additionally, our fundamental model in which the deficit against five-year averages will be reduced by about 1% per week into November still appears intact as the shortfall against the averages fell to 13% with [Thursday’s] number. Additionally, the market is being forced to look ahead to next week when another injection at least as large as today’s increase could again develop in the process of cutting the shortfall by another sizable chunk.

“At least two more strong storage increases lie ahead and will be available to contain occasional price rallies,” Ritterbusch added. “But while our expected price decline to the $3.75 level was reinforced by today’s 2.5% selloff, we are tweaking our market view in the direction of a sideways/wide-swinging trade through the rest of this fall, basically a continuation of the chart picture that has been established during the past couple of months. So while we still possess high confidence that nearby futures will achieve our targeted $3.75 area, we will also be looking to reverse into a bullish stance on this implied additional 15 cent price decline.”

Technical analysts see a retest of late-July lows as close to a done deal. “Failure yet again,” said Brian LaRose, an analyst with United ICAP after the market closed Thursday. “With natgas turning lower from the $4.028-4.029-4.040-4.051 zone Thursday, it very much looks like a corrective ABC advance off the $3.761 low has ended. Assuming $4.101 to $3.761 was Wave a, $3.761 to $4.040 was Wave b, a Wave c would target $3.700. [We] see only one way to avoid a retest of the $3.724 low, carve out an immediate bottom from the $3.883 vicinity.”

Three-day deals for physical gas over the weekend and Monday went begging in Friday’s trading as traders realigned quotes with Thursday’s screen drop and factored in a mild shoulder-season temperature regime.

Points were solidly in the red across the board, and most locations posted losses deep into double-digits. Gulf Coast, California, Mid-Atlantic and New England points were down hard, and the overall market decline was seen at 29 cents. Futures continued slip-sliding away and October settled 7.3 cents lower at $3.837, and November was off 7.2 cents at $3.903. October crude oil fell 66 cents to $92.41/bbl.

Weekend and Monday gas in Southern California fell sharply as temperatures continued sliding from Los Angeles’ record temperature of 103 degrees seen on Tuesday and were expected to just reach seasonal norms. AccuWeather.com forecast that the high Friday in Los Angeles of 82 was expected to ease to 81 Saturday before climbing back to 86 Monday. The normal high in Los Angeles mid-September is 83. To the north, Santa Barbara’s Friday maximum of 75 was anticipated to hold Saturday before reaching 78 on Monday. The seasonal high in Santa Barbara is 74. San Diego’s 79 high Friday was seen easing to 78 Saturday before rebounding to 79 Monday. The normal high in San Diego is 76.

“After a period of very warm and record-tying temperatures, highs are expected to become fairly typical by week’s end in Los Angeles,” said AccuWeather.com meteorologists. “It’s going to get gradually better as we get through the rest of the week,” said AccuWeather.com’s Ken Clark.

“After beginning the week in the upper-90s, highs will drop to the low 80s by Friday. Normal high temperatures for this time of year in the Los Angeles region are in the low 80s. The same system that’s pushing Tropical Rainstorm Odile’s moisture towards Arizona and Texas will help bring the cooler weather to Southern California. However, the moisture from Odile will stay primarily to the south and east.”

Weekend and Monday gas at Malin fell 10 cents to $3.88, and packages at the PG&E Citygates shed 17 cents to $4.39. Gas at the SoCal Citygates was off 26 cents to $4.20, and parcels at SoCal Border points fell 23 cents to $4.00. Gas on El Paso S Mainline tumbled 29 cents to $4.01.

Not to be outdone, eastern points put up losses of their own. Gas for weekend and Monday delivery to New York City on Transco Zone 6 shed 41 cents to $1.70, and parcels on Tetco M-3 skidded 34 cents to $1.73.

On Millennium, three-day parcels fell 30 cents to $1.78, and deliveries to Iroquois Waddington fell 11 cents to $3.11. Gas on Tennessee Zone 6 200 L dropped 35 cents to $3.05.

Gas at the Algonquin Citygates posted an anomalous 48-cent gain to $2.94 as pipeline restrictions kicked in.

Algonquin Gas Transmission (AGT) said, “Due to the previously posted maintenance required on its 24-inch Line between the Cromwell Compressor Station (Cromwell) and Burrillville Compressor Station, AGT has restricted interruptible and approximately 87% of secondary out of path nominations that exceed entitlement sourced from points west of its Cromwell Compressor Station for delivery to points east of Cromwell. No increases in nominations sourced from points west of Cromwell for delivery to points east of Cromwell, except for Primary Firm No-Notice nominations, will be accepted.”

Genscape reported that this will require AGT to isolate the line and limit capacity by 174 MMcf/d, down to 675 MMcf/d, starting on Sept. 20.

Gulf locations also fell more than a dime for weekend and Monday delivery. Gas at the Henry Hub was seen 10 cents lower at $3.86, and parcels on Transco Zone 3 came in 13 cents lower at $3.85. On Tennessee 500 L, gas changed hands at $3.82, down 12 cents, and on Columbia Gulf Mainline weekend and Monday gas was quoted at $3.82, down 13 cents.

Inventories now stand at 2,891 Bcf and are 401 Bcf less than last year and 444 Bcf below the 5-year average. In the East Region 58 Bcf were injected and the West Region saw inventories up by 7 Bcf. Inventories in the Producing Region rose by 25 Bcf.

Analysts interpreted Thursday’s market response to the number as characteristic of a market environment in which sellers are poised to strike at the drop of a hat. “[Thursday’s] outsized response to a storage miss of only 1 Bcf highlights an extremely heavy trading environment in which large speculative entities appeared poised to re-establish short holdings on even a bullish injection miss of miniscule proportions,” said Jim Ritterbusch of Ritterbusch and Associates.

“Regardless, [Thursday’s] 90 Bcf supply build narrowed the surplus against average levels by almost 20 Bcf. Additionally, our fundamental model in which the deficit against five-year averages will be reduced by about 1% per week into November still appears intact as the shortfall against the averages fell to 13% with [Thursday’s] number. Additionally, the market is being forced to look ahead to next week when another injection at least as large as today’s increase could again develop in the process of cutting the shortfall by another sizable chunk.

“At least two more strong storage increases lie ahead and will be available to contain occasional price rallies,” Ritterbusch added. “But while our expected price decline to the $3.75 level was reinforced by today’s 2.5% selloff, we are tweaking our market view in the direction of a sideways/wide-swinging trade through the rest of this fall, basically a continuation of the chart picture that has been established during the past couple of months. So while we still possess high confidence that nearby futures will achieve our targeted $3.75 area, we will also be looking to reverse into a bullish stance on this implied additional 15 cent price decline.”

Technical analysts see a retest of late-July lows as close to a done deal. “Failure yet again,” said Brian LaRose, an analyst with United ICAP after the market closed Thursday. “With natgas turning lower from the $4.028-4.029-4.040-4.051 zone Thursday, it very much looks like a corrective ABC advance off the $3.761 low has ended. Assuming $4.101 to $3.761 was Wave a, $3.761 to $4.040 was Wave b, a Wave c would target $3.700. [We] see only one way to avoid a retest of the $3.724 low, carve out an immediate bottom from the $3.883 vicinity.”

Three-day deals for physical gas over the weekend and Monday went begging in Friday’s trading as traders realigned quotes with Thursday’s screen drop and factored in a mild shoulder-season temperature regime.

Points were solidly in the red across the board, and most locations posted losses deep into double-digits. Gulf Coast, California, Mid-Atlantic and New England points were down hard, and the overall market decline was seen at 29 cents. Futures continued slip-sliding away and October settled 7.3 cents lower at $3.837, and November was off 7.2 cents at $3.903. October crude oil fell 66 cents to $92.41/bbl.

Weekend and Monday gas in Southern California fell sharply as temperatures continued sliding from Los Angeles’ record temperature of 103 degrees seen on Tuesday and were expected to just reach seasonal norms. AccuWeather.com forecast that the high Friday in Los Angeles of 82 was expected to ease to 81 Saturday before climbing back to 86 Monday. The normal high in Los Angeles mid-September is 83. To the north, Santa Barbara’s Friday maximum of 75 was anticipated to hold Saturday before reaching 78 on Monday. The seasonal high in Santa Barbara is 74. San Diego’s 79 high Friday was seen easing to 78 Saturday before rebounding to 79 Monday. The normal high in San Diego is 76.

“After a period of very warm and record-tying temperatures, highs are expected to become fairly typical by week’s end in Los Angeles,” said AccuWeather.com meteorologists. “It’s going to get gradually better as we get through the rest of the week,” said AccuWeather.com’s Ken Clark.

“After beginning the week in the upper-90s, highs will drop to the low 80s by Friday. Normal high temperatures for this time of year in the Los Angeles region are in the low 80s. The same system that’s pushing Tropical Rainstorm Odile’s moisture towards Arizona and Texas will help bring the cooler weather to Southern California. However, the moisture from Odile will stay primarily to the south and east.”

Weekend and Monday gas at Malin fell 10 cents to $3.88, and packages at the PG&E Citygates shed 17 cents to $4.39. Gas at the SoCal Citygates was off 26 cents to $4.20, and parcels at SoCal Border points fell 23 cents to $4.00. Gas on El Paso S Mainline tumbled 29 cents to $4.01.

Not to be outdone, eastern points put up losses of their own. Gas for weekend and Monday delivery to New York City on Transco Zone 6 shed 41 cents to $1.70, and parcels on Tetco M-3 skidded 34 cents to $1.73.

On Millennium, three-day parcels fell 30 cents to $1.78, and deliveries to Iroquois Waddington fell 11 cents to $3.11. Gas on Tennessee Zone 6 200 L dropped 35 cents to $3.05.

Gas at the Algonquin Citygates posted an anomalous 48-cent gain to $2.94 as pipeline restrictions kicked in.

Algonquin Gas Transmission (AGT) said, “Due to the previously posted maintenance required on its 24-inch Line between the Cromwell Compressor Station (Cromwell) and Burrillville Compressor Station, AGT has restricted interruptible and approximately 87% of secondary out of path nominations that exceed entitlement sourced from points west of its Cromwell Compressor Station for delivery to points east of Cromwell. No increases in nominations sourced from points west of Cromwell for delivery to points east of Cromwell, except for Primary Firm No-Notice nominations, will be accepted.”

Genscape reported that this will require AGT to isolate the line and limit capacity by 174 MMcf/d, down to 675 MMcf/d, starting on Sept. 20.

Gulf locations also fell more than a dime for weekend and Monday delivery. Gas at the Henry Hub was seen 10 cents lower at $3.86, and parcels on Transco Zone 3 came in 13 cents lower at $3.85. On Tennessee 500 L, gas changed hands at $3.82, down 12 cents, and on Columbia Gulf Mainline weekend and Monday gas was quoted at $3.82, down 13 cents.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |