NGI Archives | NGI All News Access

Two More Onshore E&Ps Taking IPO Route

Two private equity-based onshore independents are preparing to launch public offerings, with Colorado’s Vantage Energy Inc. setting terms to raise $601 million, and Texas-based Energy & Exploration Partners Inc. (ENXP) proposing a fundraising target of $400 million.

Vantage, based in Englewood, CO on Monday said it would offer 23.55 million total shares of stock priced at between $24.00 and $27.00/share through an initial public offering (IPO), according to a Form S-1 filing with the U.S. Securities and Exchange Commission (SEC). The common stock would be listed on the New York Stock Exchange (NYSE) under “VEI.”

At the midpoint of the proposed range, Vantage would command a market value of $1.9 billion. Vantage is financed by Quantum Energy Partners, Riverstone Holdings and Lime Rock Partners, which together would own two-thirds of a post-IPO stake in Vantage.

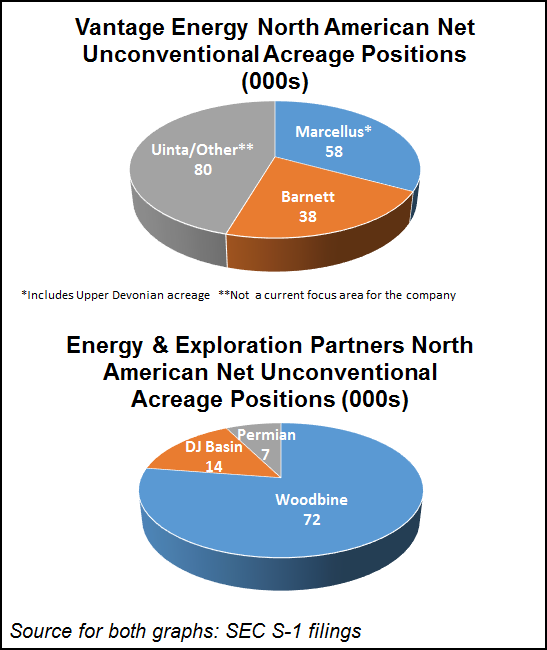

Vantage, founded in 2006, has three onshore developments, with a primary focus in the Marcellus Shale, where it has 48,000 net acres in Greene County, PA. It also has 37,000 net acres in the Barnett Shale, including more than 22,000 in the North Texas counties of Denton, Wise and Tarrant. More than 80,000 net acres also are in a project area in the Uinta Basin of Utah northeast of Price. Average total production at the end of 2013 was 150 MMcfe/d, versus 63 MMcfe/d at the end of 2012.

For the first half of 2014 (1H2014), most of Vantage’s revenue was derived from natural gas (73%), followed by natural gas liquids (15%) and oil (12%).

Revenue in 1H2014 rose 50% from the first half of 2013 to $41 million. Total production in the first six months increased to 8,600 MMcfe from 7,600 MMcfe. Average realized prices after hedges were 19% higher year/year on increasing output and higher prices across all segments. Vantage also more than doubled its debt in 1H2014 from a year ago to $237 million ($335 million after a corporate reorganization), which led to an interest expense of $8 million from $0 in the year-ago period

Vantage has been helmed by the same management team almost since it was formed in 2006. CEO Roger Biemans, who has run Vantage since the start, formerly was president of Encana Oil & Gas (USA) Inc. and had worked for predecessor Encana companies since 1982. CFO Thomas Tyree Jr., also an initial hire, previously served as CFO of Bill Barrett Corp. Vice President for Operations John J. Moran Jr. served until 2007 as drilling lead for Encana in Western Colorado.

For Energy & Exploration Partners, this would be its second attempt to go the public route. The producer in September 2012 filed with the SEC to launch an IPO to raise $275 million, but the filing was withdrawn in June.

At the end of July, the Fort Worth, TX-based operator owned a combined 93,000 net acres in the Permian Basin of West Texas, the Denver-Julesburg Basin in Wyoming, and the Upper Eagle Ford Shale, often referred to as the Eaglebine formation, in East Texas.

Highbridge Principal Strategies, a subsidiary of hedge fund Highbridge Capital Management, owns around 30% of Energy & Exploration, while Apollo Investment Corp. has a 19.2% stake. About $20 million of the net proceeds from the IPO would be used to repay a promissory note to Chesapeake Energy Corp., which sold Energy & Exploration land in the Eaglebine last year (see Shale Daily, April 16, 2013).

Once it launches, the company would be listed on the NYSE under “ENXP.” The number of shares expected to be offered was not disclosed, nor was the timing of the IPO.

Hunt Pettit founded Energy & Exploration Partners in 2006 after working as a landman and entrepreneur for years in Texas, Colorado and Wyoming. He also served as contract land manager for the Barnett shale from 2005 to 2008 for David H. Arrington Oil & Gas Inc. CFO Brian Nelson previously was the financial chief for Great Western Oil & Gas Co. LLC, while COO John Richards was executive vice president of ZaZa Energy until January 2013.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |