Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

Weak Power Prices Drop Physical NatGas Values; Bearish Storage Data Tumbles Futures

Physical natural gas prices for Friday delivery fell hard in Thursday’s trading as cascading power loads and prices along with a more mild temperature outlook gave buyers little incentive to seek incremental supplies.

Northeast locations were hit the hardest, with double-digit drops pervasive from New England to the Mid-Atlantic, but most points dropped anywhere from a nickel to a dime. Overall, the market fell 3 cents.

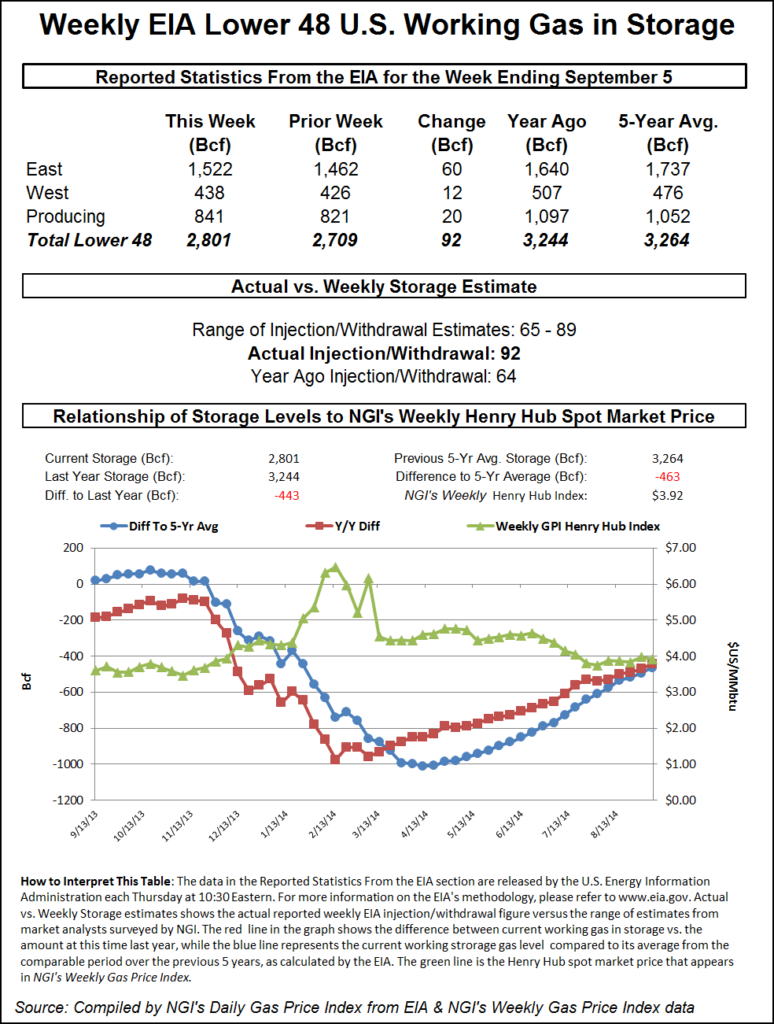

Free-falling futures quotes didn’t help the bullish cause as the Energy Information Administration (EIA) reported a build of 92 Bcf, anywhere from 5 to 10 Bcf greater than what the market was looking for. Futures dropped sharply, with the spot October contract giving up 13.1 cents to $3.823 and November dropping 13.2 cents to $3.873. October crude oil managed to recover a portion of recent losses and added $1.16 to $92.83/bbl.

In the Northeast, power prices and power loads were both seen working lower heading into the weekend. IntercontinentalExchange reported that peak power for Friday delivery at ISO New England’s Massachusetts Hub fell $13.17 to $31.61/MWh, and at the PJM Interconnect’s West Hub peak Friday power dropped $17.22 to $35.38/MWh.

Power loads were also lower. ISO New England forecast peak power Thursday of 17,850 MW would drop to 15,700 MW Friday and 14,600 MW Saturday. The New York ISO predicted that peak Thursday power requirements of 23,828 MW would fall to 21,147 MW Friday and 17,843 MW Saturday.

If that weren’t enough to keep a buyer out of the market, forecast temperatures in major population centers were expected to decline to below-normal Friday and Saturday. Wunderground.com predicted that Boston’s Thursday high of 79 degrees would ease to 70 Friday and 67 Saturday, 7 degrees below the seasonal norm. New York City’s 81 Thursday high was seen falling to 76 Friday and 72 by Saturday. The normal high in New York is 77. Baltimore’s peak of 85 Thursday was forecast to fall to 78 Friday and slide further to 70 on Saturday. The normal mid-September high in Baltimore is 80.

The National Weather Service in the Baltimore-Washington, DC, area said, “a cold front will approach the area from the west [Thursday] before passing through the area tonight. The front will stall out to the south Friday…but it will return north as a warm front Friday night into Saturday. A reinforcing cold front will pass through the area Saturday night and high pressure will return for Sunday. Another cold front may pass through the area early next week.”

Gas bound for New York City on Transco Zone 6 plunged 53 cents to $2.53, and parcels on Tetco M-3 shed 49 cents to $2.50.

Appalachia and Marcellus points were hit almost as hard. Gas for Friday delivery on Millennium fell 38 cents to $2.43, and gas on Transco Leidy was off 37 cents to $2.36. Parcels on Dominion South fell 41 cents to $2.39.

Typically volatile New England points did not escape unscathed. Gas at the Algonquin Citygates was quoted at $2.78, down 47 cents, and deliveries to Iroquois Waddington shed 16 cents to $3.72. Gas on Tennessee Zone 6 200 L retreated 31 cents to $2.83.

The heavy selling on the East Coast was not as prevalent out west. Gas at Malin came in 8 cents lower at $3.87, and deliveries at the PG&E Citygates slipped 6 cents to $4.44. Gas at the SoCal Border changed hands 7 cents lower as well at $4.10, and deliveries to SoCal Citygates fell 2 cents to $4.43.

The reported injection of 92 Bcf caught some traders by surprise. October futures fell to a low of $3.822 soon after the number was released and by 10:45 a.m. EDT October was trading at $3.832, down 12.2 cents from Wednesday’s settlement.

“The earlier morning losses seemed to signal the market’s version of preemptive strike at what was anticipated to be another oversized injection,” said Teri Viswanath, director of commodity market strategy at BNP Paribas. “With last week’s storage release coming in higher than market consensus, it appeared that traders were placing early wagers on the off chance that lightning might strike twice. While this bet seemed ill-advised at the time, given the string of undersized injections in August, it certainly paid off today — with the Oct ’14 futures contract retreating $0.116 [post report] from yesterday’s settle at $3.838/MMBtu.

“Historically, the highest seasonal stock builds occur at the point where cumulative heating degree days begin to outpace cooling degree days,” she added. “The updated commercial weather forecasts suggest that this transition period might occur as early as the week of Sept. 26th. Accordingly, with inventory restocking beginning to re-accelerate in response to declining weather demand, we expect the front of the futures curve to retest the season-to-date lows.”

August futures posted the recent spot contract low of $3.723 July 29.

The shoulder season has now begun in earnest, and storage injections that some have estimated might reach 100 Bcf or more may be ready to pounce. It was not to be — not this week at least. This time around, analysts were looking for an upper-80s Bcf build. Nonetheless, the contraction in the deficit is nothing to sneeze at. Last year, 64 Bcf was injected, and the five-year pace stands at 60 Bcf.

Jim Ritterbusch of Ritterbusch and Associates was looking for an increase of 87 Bcf, and Citi Futures Perspective came in with a low 70 Bcf estimate. A Reuters survey of 27 traders and analysts revealed an injection of 82 Bcf with a range of 65-89 Bcf.

Phillip Golden, director of risk and product management at EMEX, noted that the report was certainly bearish when compared to market expectations of 82-84 Bcf and historical norms. “This very bearish storage report has resulted in a significant fall in the market, reversing a large portion of the price increases from earlier in the week,” he said, adding that EMEX still believes that the best buying opportunities are likely to occur between now and the end of October. “Today’s market fall represents one of those opportunities.”

Not only did the build outpace projections, it also set records for this time of the year. “This week’s injection is the largest for the twenty-third week of the injection season,” Golden said. “The second largest injection we have seen was 69 [Bcf] back in 2009.”

To refill storage to the levels expected by EIA, Golden said the industry would need injection numbers of 78 Bcf/week going forward. To get to the high of 2012, industry would need the remaining builds to average 138 Bcf/week.

“If we were to revert back to historical averages, we would end this injection season at just under 3,400 Bcf, which would be a very nice recovery from this past winter,” he said.

A New York floor trader added, “We were looking for 82 Bcf, so this number was significantly higher, but we had also heard as high as 88 Bcf to 90 Bcf. We are still in the $3.75 to $4 trading range, and I think the market is a little more antsy to the upside. We’ll have to see. These are significant builds.”

Analysts are mulling whether the hefty build was due to the Labor Day holiday or underlying higher production. “The 92 Bcf net injection for last week was at the top end of the range of market expectations and 31 Bcf more than the five-year average for the date, a clearly bearish outcome,” said Tim Evans of Citi Futures Perspective. “As it’s unclear how much demand may have been lost due to the Labor Day holiday, it’s hard to know how much the build represents a possible increase in underlying supply that would carry over into future flows.”

Inventories now stand at 2,801 Bcf and are 443 Bcf less than last year and 463 Bcf below the five-year average. In the East Region 60 Bcf was injected, and the West Region saw inventories up by 12 Bcf. Inventories in the Producing Region rose by 20 Bcf.

Market technicians following Elliott Wave and retracement didn’t see the market’s 18-cent advance Monday and Tuesday followed by Wednesday’s 3-cent setback as sufficient to generate much more in the way of market gains. “To begin to unravel the bearish case for another leg down to another new low on the year, spot natgas must now break above $4.050 and the 12-month strip must now break above the 4.020 level,” said Walter Zimmermann of United ICAP in closing comments Wednesday to clients. “The inability to take out these key resistance levels does not prove that the trend is still down, but it does keep the bearish case alive.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |